Bitcoin (BTC) worth volatility has skyrocketed over the previous two months, suggesting the market might return to options-driven worth motion that causes giant strikes in each instructions.

Since Bitcoin ETFs have been accredited within the U.S., Bitcoin’s implied volatility has by no means exceeded 80%, stated Jeff Park, a market analyst and advisor at funding agency Bitwise.

Nonetheless, the chart shared by Park exhibits that Bitcoin’s volatility has regularly returned to round 60 as of this writing.

Historic BTC volatility ranges present a big spike forward of Bitcoin exchange-traded funds being accredited within the US market in 2024. supply: jeff park

Park cited Bitcoin’s explosive worth motion in January 2021 and the start of the 2021 bull market, which took BTC to a brand new all-time excessive and cycle excessive of $69,000 in November of the identical 12 months, because the final main options-driven meltup. he stated:

“Finally, it’s choice positioning, not mere spot flows, that can create the decisive transfer that can propel Bitcoin to new highs. For the primary time in virtually two years, the volatility floor could also be flickering, an early signal that Bitcoin could as soon as once more develop into options-driven.”

This evaluation refutes the speculation that the presence of ETFs and institutional traders completely smoothed out Bitcoin’s worth fluctuations, shifting the market construction to mirror a extra mature asset class, strengthened by passive inflows from funding autos.

Associated: ‘Volatility is your pal’: Eric Trump is not bothered by Bitcoin or crypto carnage

Volatility rises amid market carnage, elevating issues of extended financial downturn

In line with Binance CEO Richard Teng, the rise in volatility within the BTC market is in line with ranges throughout all asset lessons.

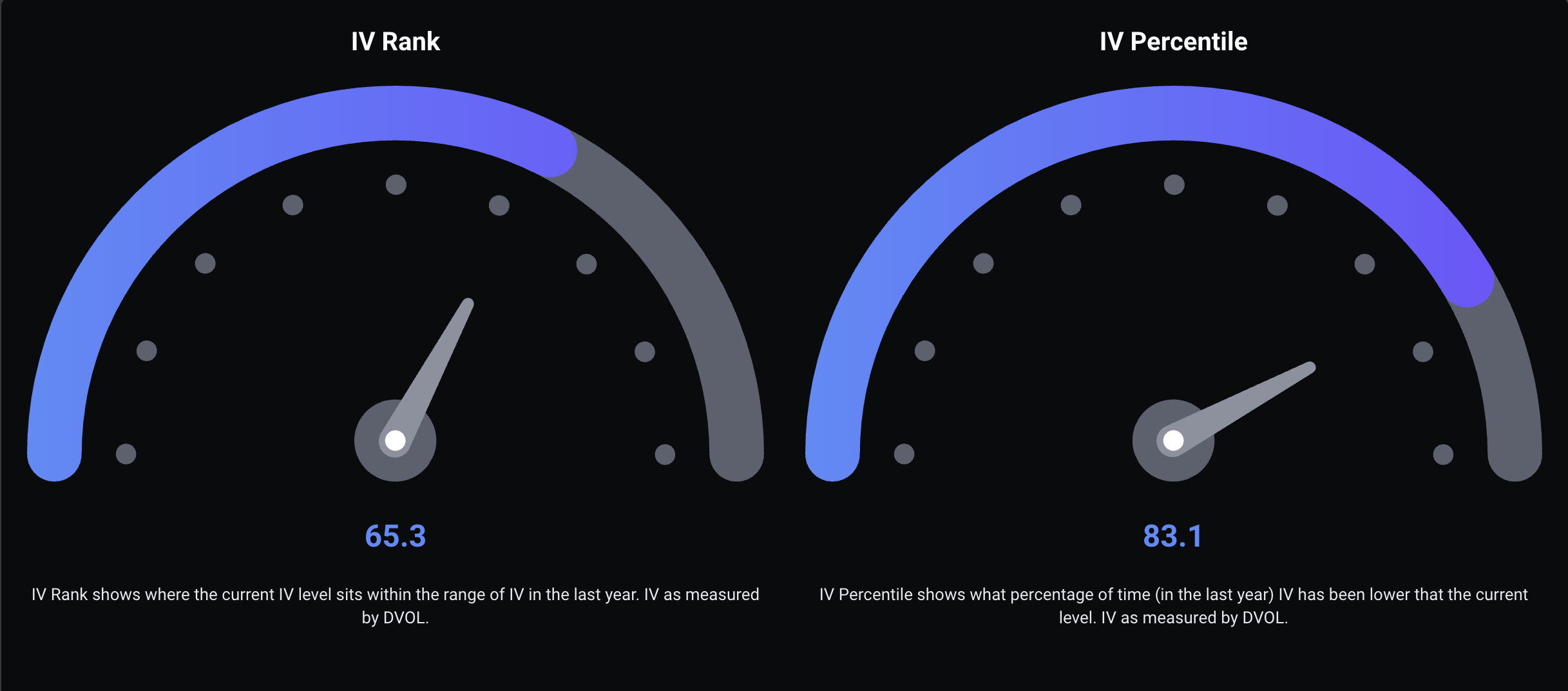

Rank and percentile of Bitcoin’s implied volatility in comparison with historic ranges. sauce: can be ridiculed

Bitcoin crashed beneath $85,000 on Thursday, sparking fears that it might fall additional within the coming weeks and begin one other Bitcoin bear market.

Analysts have supplied a number of theories as to the reason for the financial downturn, together with the liquidation of extremely leveraged positions in derivatives markets, long-term BTC holders cashing out, and macroeconomic pressures.

Analysts at crypto trade Bitfinex say Bitcoin’s continued decline is because of short-term elements, suggesting a “tactical rebalancing” moderately than a flight of institutional traders or an absence of demand.

Analysts stated this doesn’t derail Bitcoin’s long-term fundamentals, worth progress, or institutional adoption traits.

journal: Bitcoin “one other large push” to $150,000, ETH stress will increase: commerce secrets and techniques