With cryptocurrency stagnation, Bitcoin (BTC) volatility meltdown continues, with costs slowing between $110,000 and $120,000.

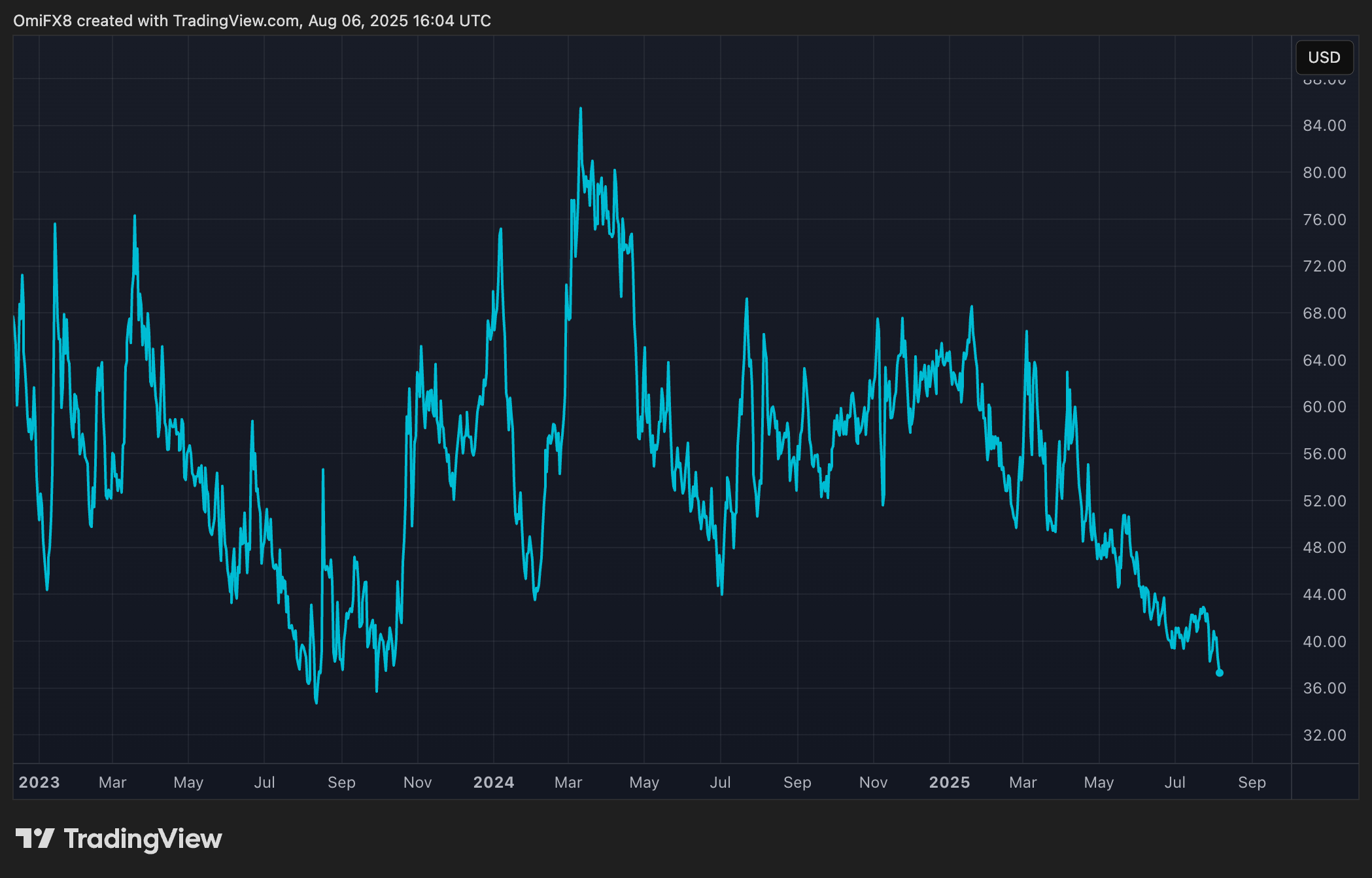

In response to Knowledge Supply TradingView, Cryptocurrency’s 30-day implicit volatility fell to 36.5% per 12 months late on Wednesday, reaching a stage the place BTC was under $30,000 in October 2023, as represented by Volmex’s BVIV index.

The brand new multi-year lows of implicit volatility recommend that choices merchants will not be but in a rush to hedge, regardless of US financial information elevating considerations about stagflation. Demand for choices, a contract used to hedge or revenue towards value fluctuations, is a significant component within the implicit volatility of an asset.

Volmex’s 30-day BTC is Volatility Index, BVIV. (TradingView)

The identical will be mentioned for the inventory that the VIX Index reversed Friday’s spike from 17 to 21. The VIX measures the 30-day implicit volatility of the S&P 500.

BTC displays inventory market volatility patterns

BTC’s implicit volatility has been in a months-long downtrend, transferring in the other way of cryptocurrency costs, exceeding $70,000 to $110,000 since November.

Adverse correlations point out a deep change in Bitcoin’s market dynamics. Traditionally, BTC volatility and its spot costs have moved in tandem, with volatility rising in each bull and bear markets.

This variation in spot volatility correlation is due partly to the rising recognition of structured merchandise, together with writing (promoting) cash of the cash of the cash name choice, analysts informed Coindesk.

This new dynamic means that Bitcoin is more and more a mirroring sample on Wall Road.

Learn: Bitcoin’s “low volatility” rally from $70,000 to $118K: The story of the transition from Wild West to Wall Road-like dynamics