The market remains to be recovering from Thursday’s bomb industrial inflation knowledge, however institutional curiosity in Bitcoin remains to be alive and effectively.

BTC flat, however institutional traders stay bullish

Bitcoin fell beneath $117K on Friday. It is because it was stunned by wholesale inflation knowledge from the Bureau of Wholesale Statistics (BLS), which was projected greater than anticipated on Thursday. Nonetheless, the short-term worth dip for cryptocurrency has not prevented institutional traders just like the Norwegian Authorities Pension Fund World (GPFG) from chasing their Bitcoin publicity, which is almost $2 trillion.

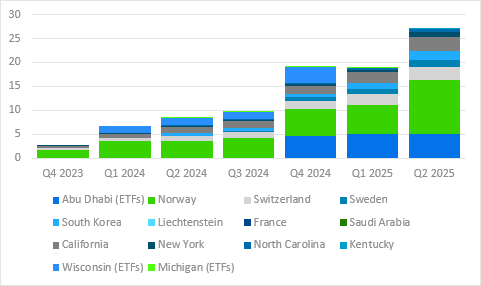

Mammoth-sized sovereign wealth funds have change into keen on digital property by 2020, however reasonably than shopping for Bitcoin instantly, they are going to purchase shares in corporations comparable to Technique (NASDAQ: MSTR) for oblique publicity. By the top of 2024, GPFG had greater than $500 million in MSTR and had invested in different crypto corporations, comparable to Coinbase.

(The MSTR positions in public pension schemes besides Michigan and Wisconsin use ETFs for Bitcoin publicity/commonplace chartered research)

And now, the London-based Normal Chartered Financial institution says its thirteenth Fed submitting with the Securities and Change Fee (SEC) signifies the GPFG managed by Norges Financial institution Funding Administration (NBIM), a division throughout the nation’s central financial institution.

“We ran the same old 13F submitting spreadsheet for BTC ETF, MSTR and Metaplanet,” writes Geoffrey Kendrick, Head of Digital Asset Analysis at Normal Chartered. “Probably the most attention-grabbing element was this time the Norges purchases from MSTR and Metaplanet. Within the second quarter, we elevated BTC-equivalent exposures from 6,200 to 11,400 BTC (a rise of 83%).”

Kendrick says in his analysis notes Norges is sort of solely exposing MSTR to Bitcoin, however the fund additionally has a job at Metaplanet, the place a Japanese lodge developer has changed into a Bitcoin finance firm. “This location is sort of completely within the MSTR, however we have added a small (200 BTC equal) place to the metaplanet,” explains Kendrick.

Market Metric Overview

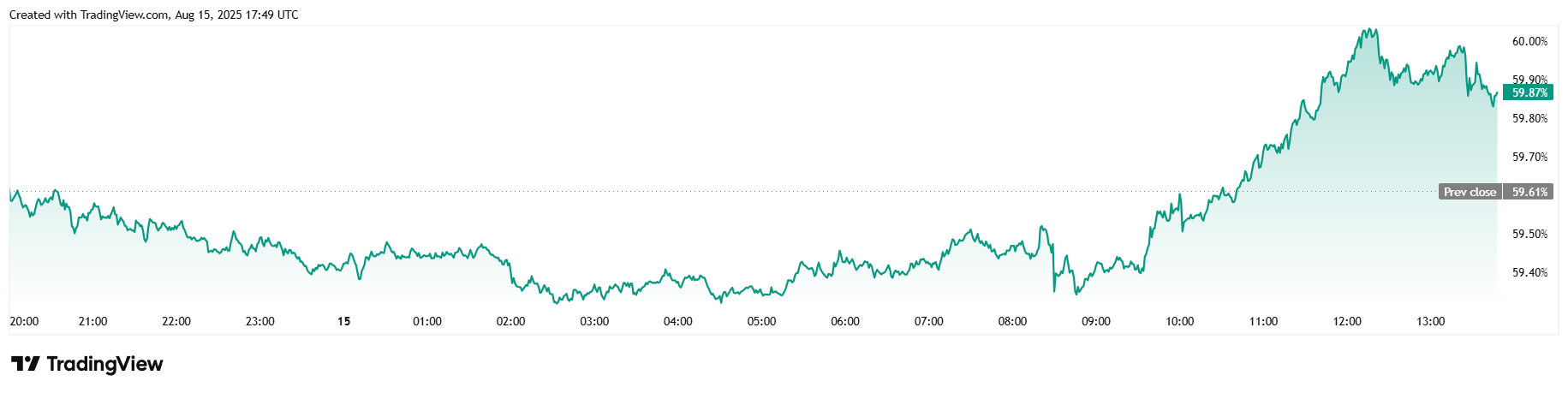

Bitcoin was buying and selling at $117,251.98 on the time of writing, down 0.46% from Thursday. Nonetheless, every week, in accordance with CoinmarketCap, cryptocurrency remains to be growing by Smidgen at 0.84%. BTC has been buying and selling between $116,864.57 and $119,332.31 over the previous 24 hours.

(BTC Value/Commerce View)

Buying and selling quantity has dropped considerably since yesterday, easing to $7.406 billion, down 31.39%. Like costs, the market capitalization is sort of flat, immersing 0.28% to $2.33 trillion within the final 24 hours. Curiously, regardless of the unfastened worth motion, Bitcoin’s dominance rose to 59.87%, an enchancment of 0.43% from Thursday. This reveals that Altcoins are farther aside than the dominant cryptocurrency within the present market.

(BTC dominance/commerce view)

Coinglass reveals a 1.67% decline in 24 hours at $81.72 billion in whole public curiosity on Bitcoin futures at reporting. BTC liquidation on Friday was considerably decrease than Thursday’s numbers. The lengthy liquidation was $50.45 million and the quick liquidation was $6.54 million.