As of December 27, 2025, Bitcoin’s value is extraordinarily excessive at $87,382, with a market capitalization of $1.74 trillion and a 24-hour buying and selling quantity of $30.6 billion. Main digital shares fluctuated in a slender intraday vary between $86,673 and $88,965, however the market confirmed indicators of tightening forward of a possible breakout. Metrics that span a number of time frames, from hourly noise to every day drama, paint an image much less of certainty and extra of monitoring a fuse earlier than it ignites.

Bitcoin chart outlook

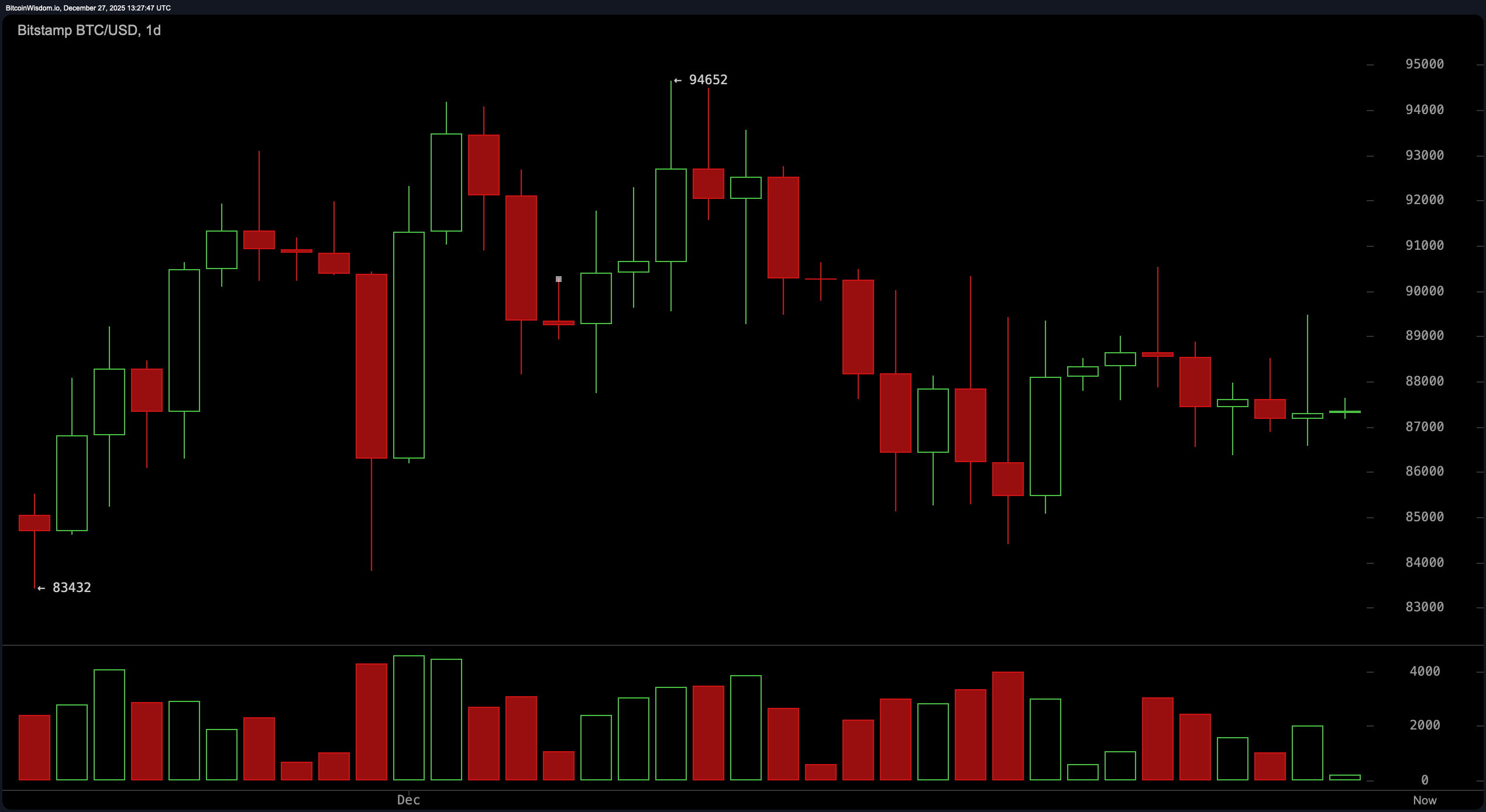

On the every day chart, Bitcoin seems to be forming a lobe of stitched highs and lows. It is a basic descending construction that means bearish sentiment, though it has not but seen a dramatic rally. After breaking above round $94,652, the value slowly declined to the $87,000-$88,000 zone and is now quietly growing.

However the actual whisper here’s a decline in buying and selling volumes. A lower in buying strain is usually a relaxation interval earlier than the following act. Merchants could be sensible to observe for a restoration on the $90,000 stage, particularly with some quantity fireworks, earlier than the bulls declare a return to the stage.

BTC/USD 1-day chart through Bitstamp for December 27, 2025.

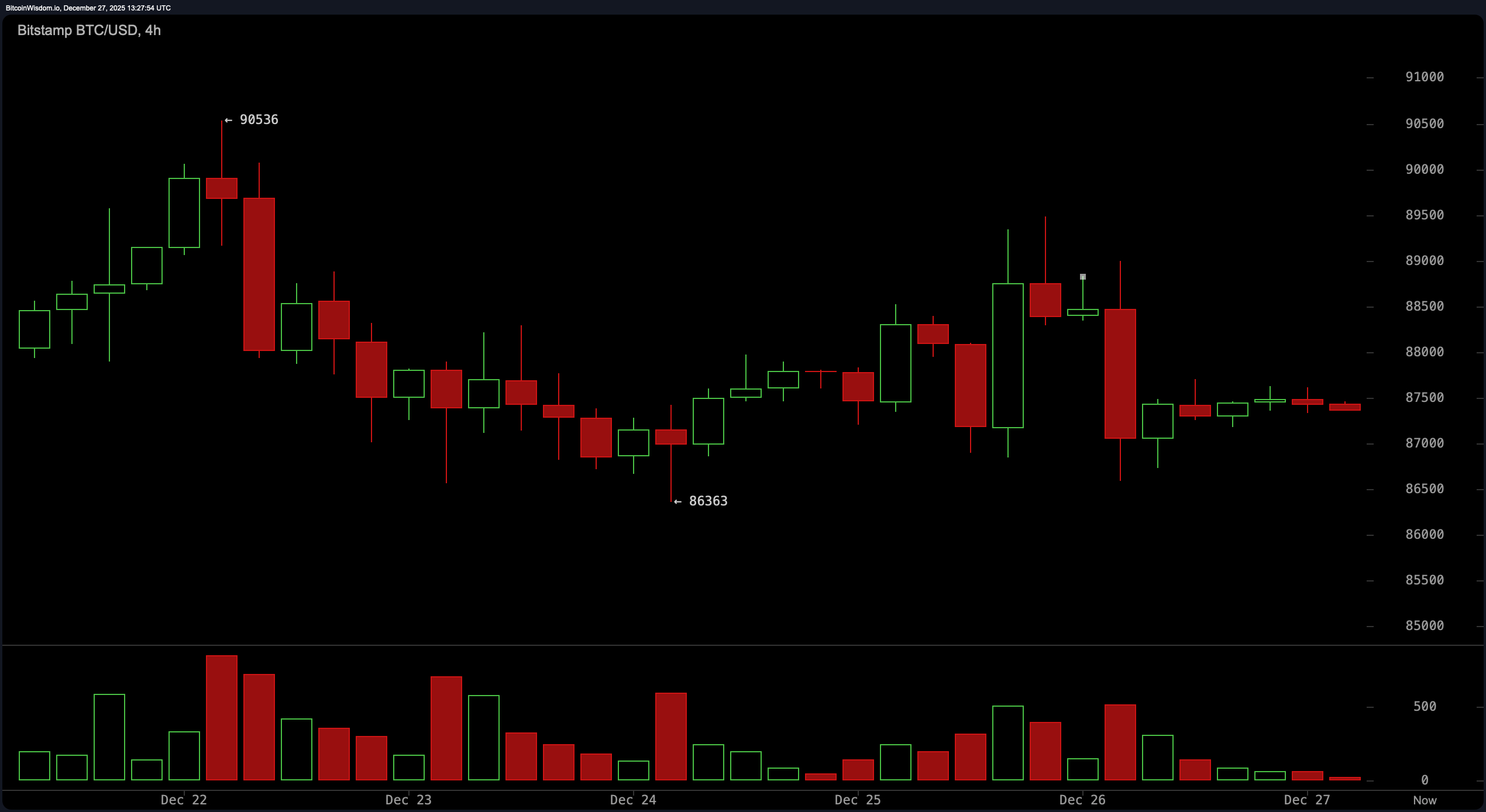

On the 4-hour chart, the temper for Bitcoin is a little more weary. The rejection of $90,536 was carried out laborious and quick, escorted by a bunch of crimson candles. Clearly, somebody had introduced that they might not be attending the rally. The help at $86,363 has up to now stood agency like a bouncer on the entrance to the $86,000 membership, however the consolidation beneath the resistance exhibits that sellers are nonetheless loud within the room. What’s noteworthy is that whereas buying and selling volumes are reducing throughout uptrends, there’s extra noise throughout downtrends. It is a basic case of bearish strain disguised as a sideways market.

BTC/USD 4-hour chart through Bitstamp on December 27, 2025.

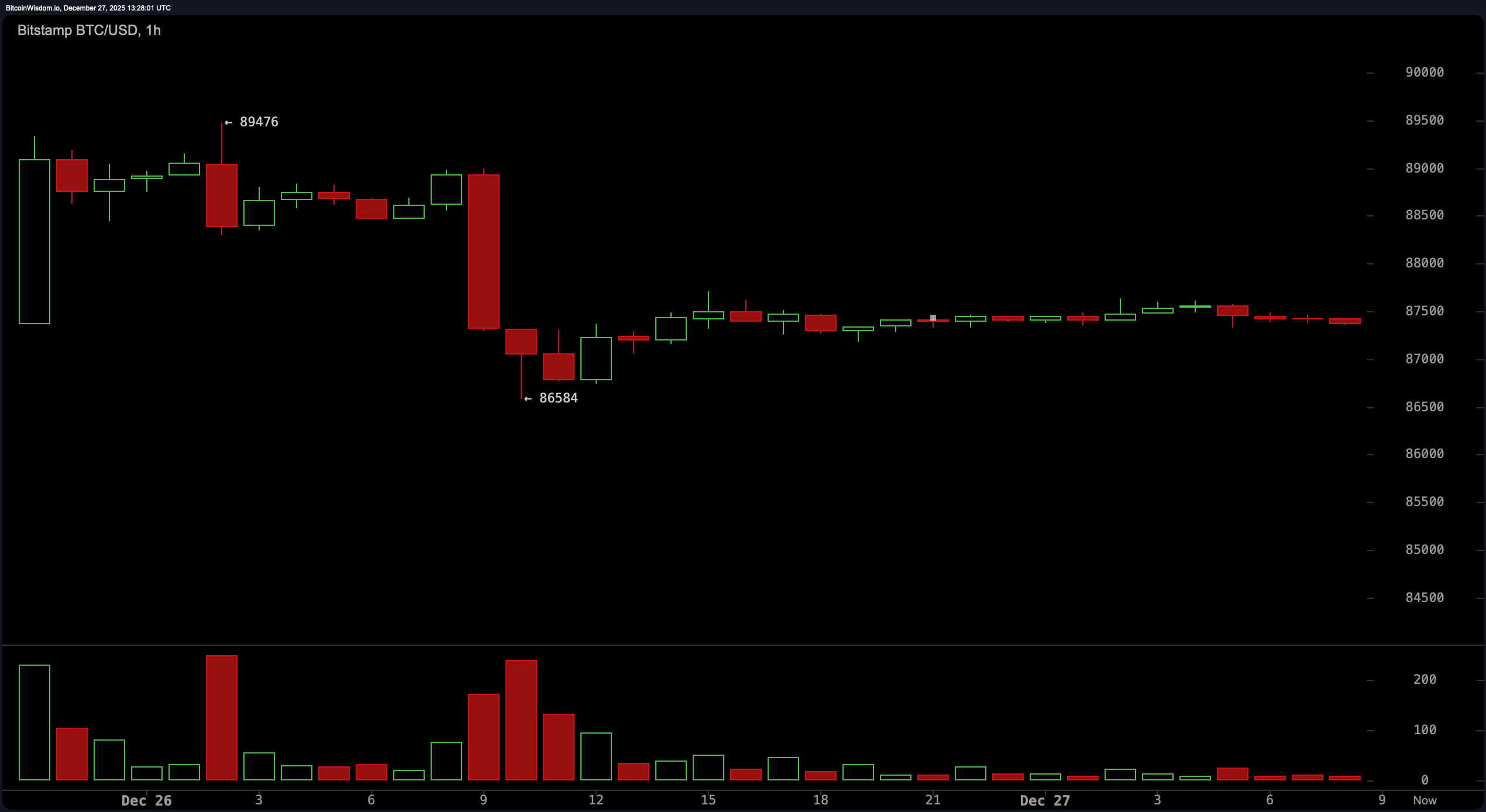

Zooming in on the hourly chart is like stepping right into a crypto fog. The sharp drop from about $89,400 to $86,500 spooked the tape, nevertheless it was adopted by value fluctuations that might greatest be described as… politely indecisive. The vary is slender between $87,000 and $87,500, however what concerning the quantity? It is nearly a whisper. This may very well be a typical accumulation zone in preparation for a breakout above $88,000. Alternatively, it may very well be a sly bearish flag that exits for an additional leg down if $86,000 collapses.

BTC/USD 1 hour chart through Bitstamp for December 27, 2025.

Oscillators aren’t precisely striving for readability both, however they’re nice if you happen to get pleasure from ambiguity with a dose of warning. The Relative Energy Index (RSI), Stochastics, Commodity Channel Index (CCI), Common Directionality Index (ADX), and Superior Oscillator are all flashing the last word inconclusive standing: Impartial. Solely momentum and shifting common convergence divergence (MACD) are nodding barely upward. If the market had been a cocktail celebration, these two could be the one ones holding espresso photographs whereas everybody else was clutching water.

What about shifting averages (MA)? They’re giving a grasp class in collective skepticism. All short-term and long-term shifting averages from Exponential Transferring Common (EMA) 10 to Easy Transferring Common (SMA) 200 are trending above the present value and are bearish. It is like the entire shifting common household bought collectively and determined that Bitcoin wanted a timeout. Whether or not the value can break by way of the $88,000-$88,500 resistance will decide whether or not it’s merely resting or planning its subsequent moonshot. Till then, my recommendation is easy. Watch your quantity, respect your chops, and do not forget that breakouts aren’t RSVPs, they’re crashing the celebration.

Bullish verdict:

If Bitcoin can decisively transfer above the $88,500 threshold with significant quantity, this setup would favor a near-term revisit to the $90,000-$91,000 resistance zone. Whereas the Momentum (10) and Transferring Common Convergence Divergence (MACD) indicators are flashing inexperienced, different indicators are dozing, so a slender however clear window for continued upside exists. For bulls, it is not a matter of power, however timing and perception.

Bear verdict:

Failure to maintain above the $86,000 help dangers confirming the bear flag sample recognized on the hourly chart, with a possible draw back goal round $83,500-$84,000. Transferring averages are shifting above value in unison, and quantity is favoring promoting over rebounding, suggesting that the trail of least resistance should be trending south. The bear might not be barking but, however he is undoubtedly circling.

Regularly requested questions ❓

- What’s the value of Bitcoin as we speak? Bitcoin is buying and selling at $87,382 as of December 27, 2025.

- Is Bitcoin going up or down now? Bitcoin continues to consolidate in a slender vary with combined technical alerts.

- What are the essential ranges to look out for in Bitcoin?Take a look at the upside potential of $88,500 and the draw back potential of $86,000.

- Why is Bitcoin quantity so low as we speak?It is the vacation season and it is fully regular. Low quantity suggests the market is both indecisive or poised for an even bigger transfer.