Bitcoin’s spot worth fell greater than 5% in opposition to the US greenback on Tuesday, wiping out greater than $7,000 in worth for the reason that first commerce of the day. This decline has hit the miners instantly behind the hashing energy, with revenues dropping to ranges not seen since April 8, 2025, and leaving many rigs operating to outlive.

Falling Bitcoin hash worth places stress on mining margins

As of two:30 p.m. ET, Bitcoin is buying and selling wildly, falling 5% in opposition to the U.S. greenback and fluctuating between $100,175 and $107,302 per coin. Bitcoin has fallen under the $100,000 degree on some exchanges, resembling Bitstamp.

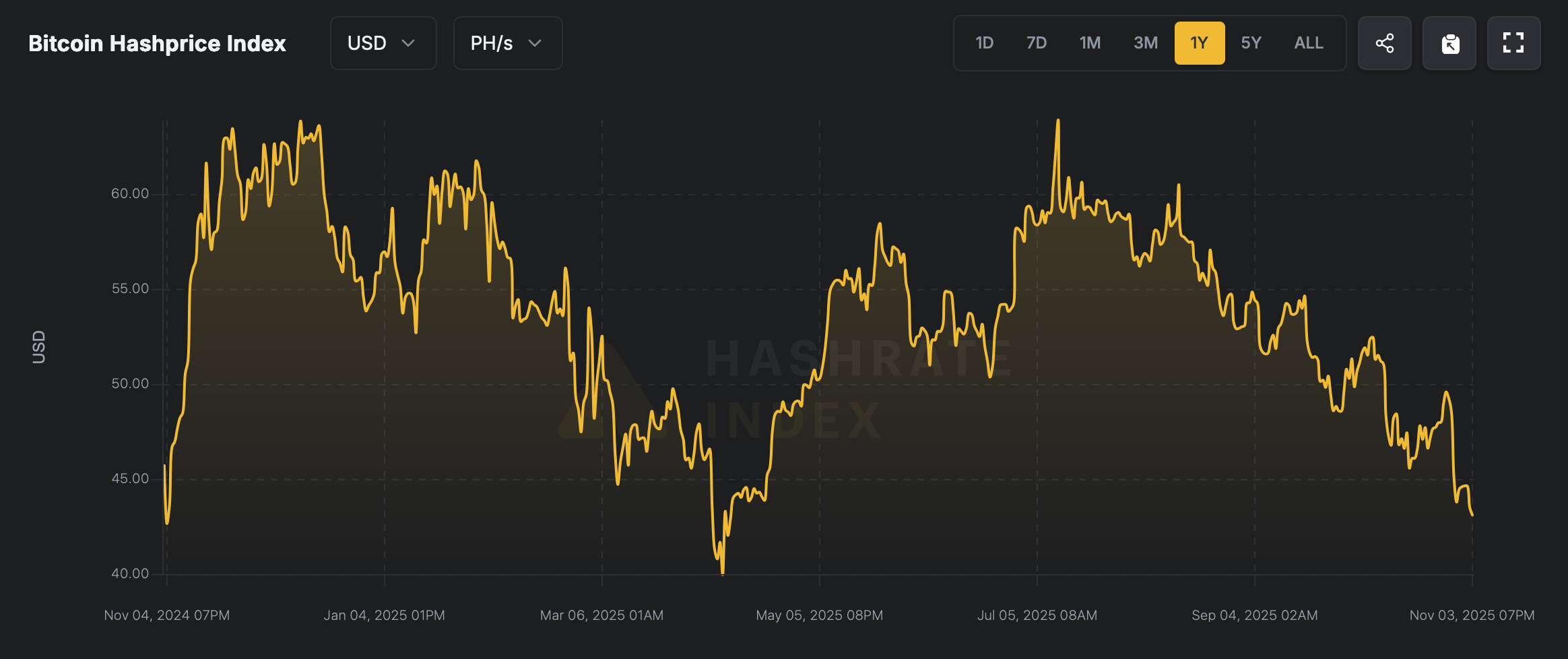

In accordance with knowledge from hashrateindex.com, the Bitcoin hash worth (present charge of SHA256 hash charge of 1 petahash per second (PH/s)) is presently $40.85. It was at a more healthy worth of $49.61 per PH/s simply 8 days in the past, and miners are positively feeling the distinction by 17.66%.

Bitcoin hash worth on November 4, 2025, in response to hashrateindex.com.

It isn’t been a dream week for Bitcoin miners who’ve seen their worth soften away, however the downturn started in July. Again on July 11, 116 days in the past, the hash worth was $63.92 per PH/sec. Quick ahead to November 4, 2025, and miners will earn 36.09% much less for a similar hashing energy. Although hash costs have fallen, Bitcoin’s community stays a critical powerhouse, exceeding zettahashes, or greater than 1,000 exahashes per second (EH/s).

On the time of writing, roughly 1,111.99 EH/s has secured the chain, and it’s progressing easily. Block spacing continues to be across the 10-minute candy spot, and to date the problem forecast for November twelfth suggests little change. If costs proceed to fall whereas difficulties stay excessive, miners, particularly these working older rigs or paying excessive power payments, may face a profitability disaster.

The mixture of falling hash costs and fixed hash charges may pressure smaller operations to close down their machines and consolidate energy amongst industrial-sized farms. Alternatively, if tensions ease attributable to a rebound within the Bitcoin worth or an adjustment in issue, the tide may change. Cheaper power, extra environment friendly {hardware}, or new market optimism may assist miners breathe once more, however for now, it is a ready recreation within the high-voltage enterprise.