Bitcoin’s current rally has revived the bull-buy narrative, however the knowledge tells a extra sophisticated story. Bitcoin costs fell almost 15%, briefly touching the $60,000 zone, earlier than rebounding greater than 11% and sending merchants again into lengthy positions.

At first look, this bounce appears encouraging. Nonetheless, bearish chart patterns, rising leverage, and weak spot demand recommend the market is probably not out of the woods but. The newest rally now faces intense scrutiny, with a 25% decline nonetheless attainable.

Bear Flags, Rising Leverage, and Decrease Alternate Provide Recommend Dangerous Optimism

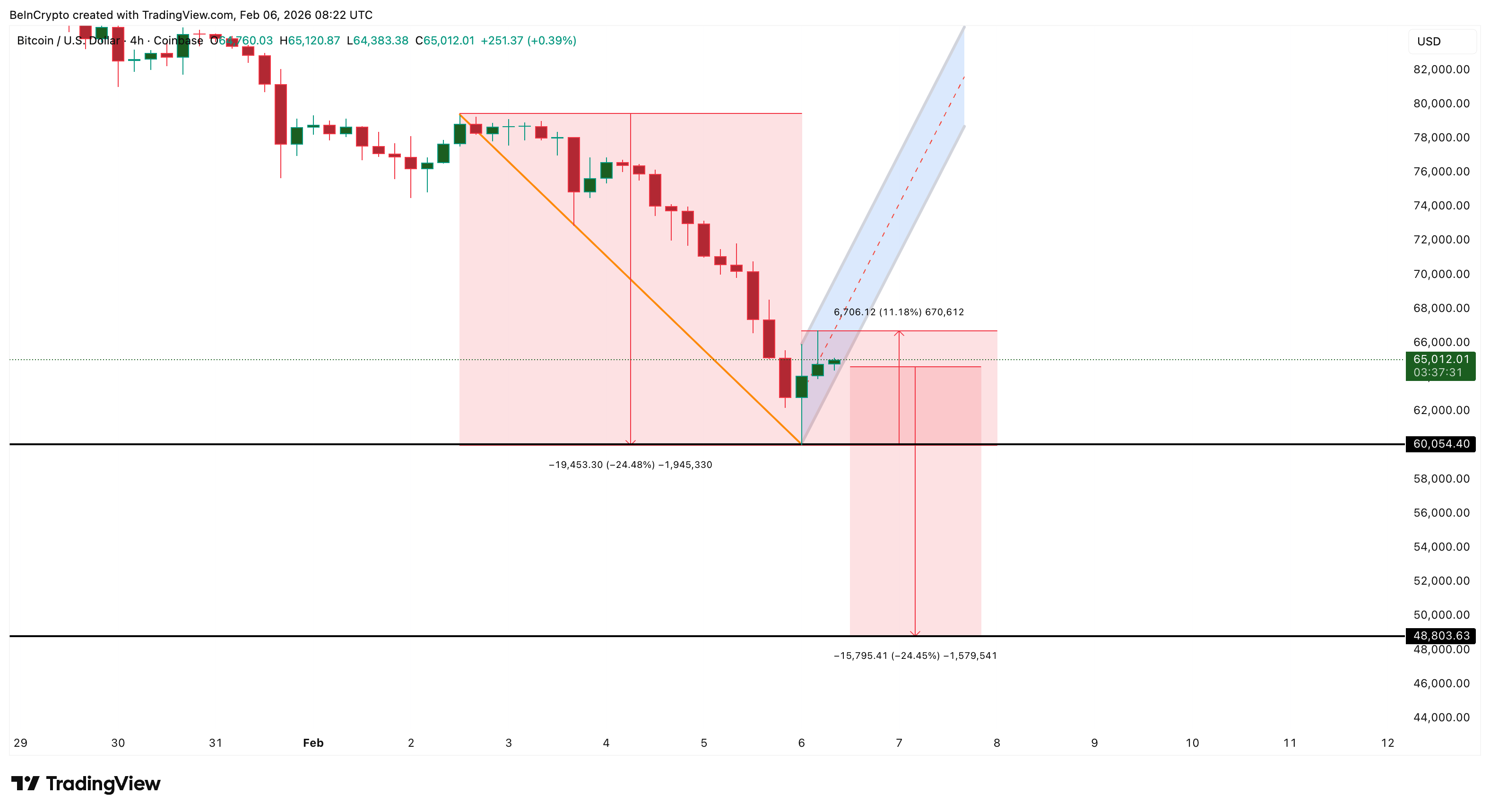

Bitcoin’s short-term danger is already seen on the 4-hour chart.

After plummeting in the direction of $60,000, Bitcoin worth has shaped a rebound construction and is now resembling a bear flag sample. This setting usually seems when the value has dropped considerably after which pauses earlier than falling additional. Upon breaking the decrease trendline, the sample signifies a virtually 25% draw back transfer concentrating on the $48,000-$49,000 zone.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

$BTC construction”>

$BTC construction”>

bearish $BTC Construction: TradingView

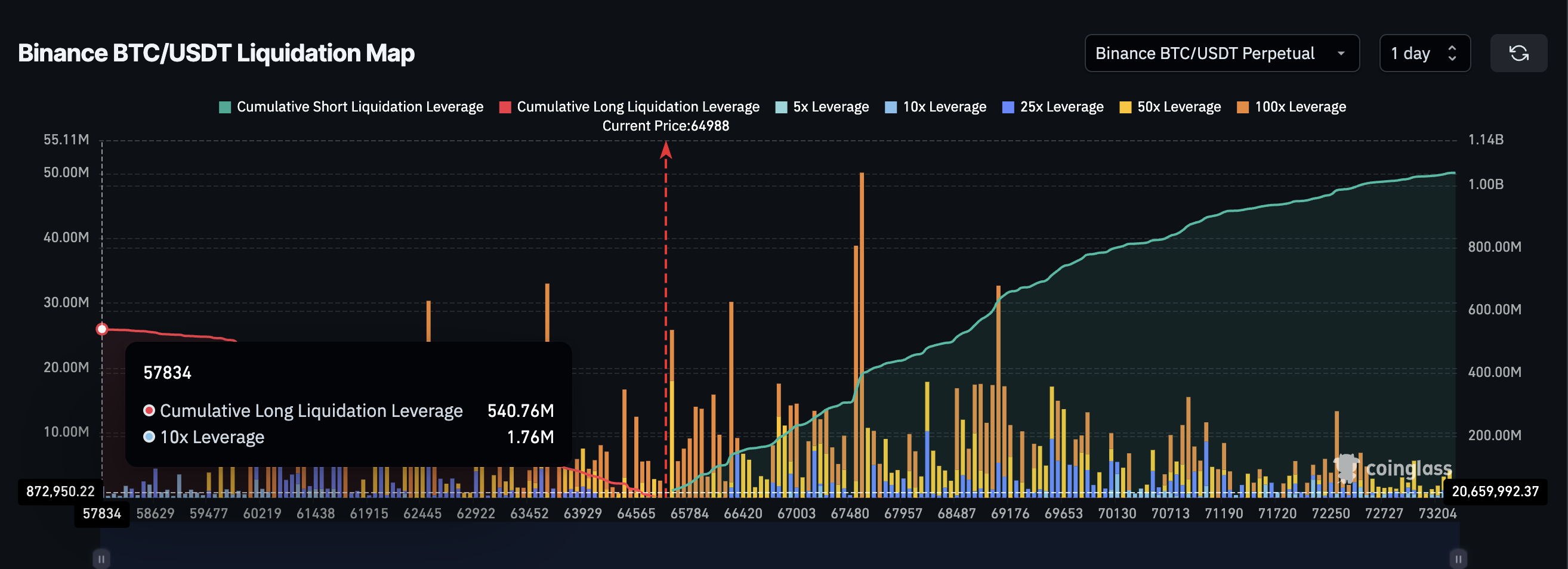

Regardless of this technical warning, leverage is rising once more.

Following the 11.18% rally, over $540 million of latest lengthy positions have been created on Binance alone. This exhibits that merchants are as soon as once more leveraging closely, betting that the underside has already hit. Comparable actions preceded large-scale liquidations throughout previous financial downturns.

Lengthy leverage is again: coin glass

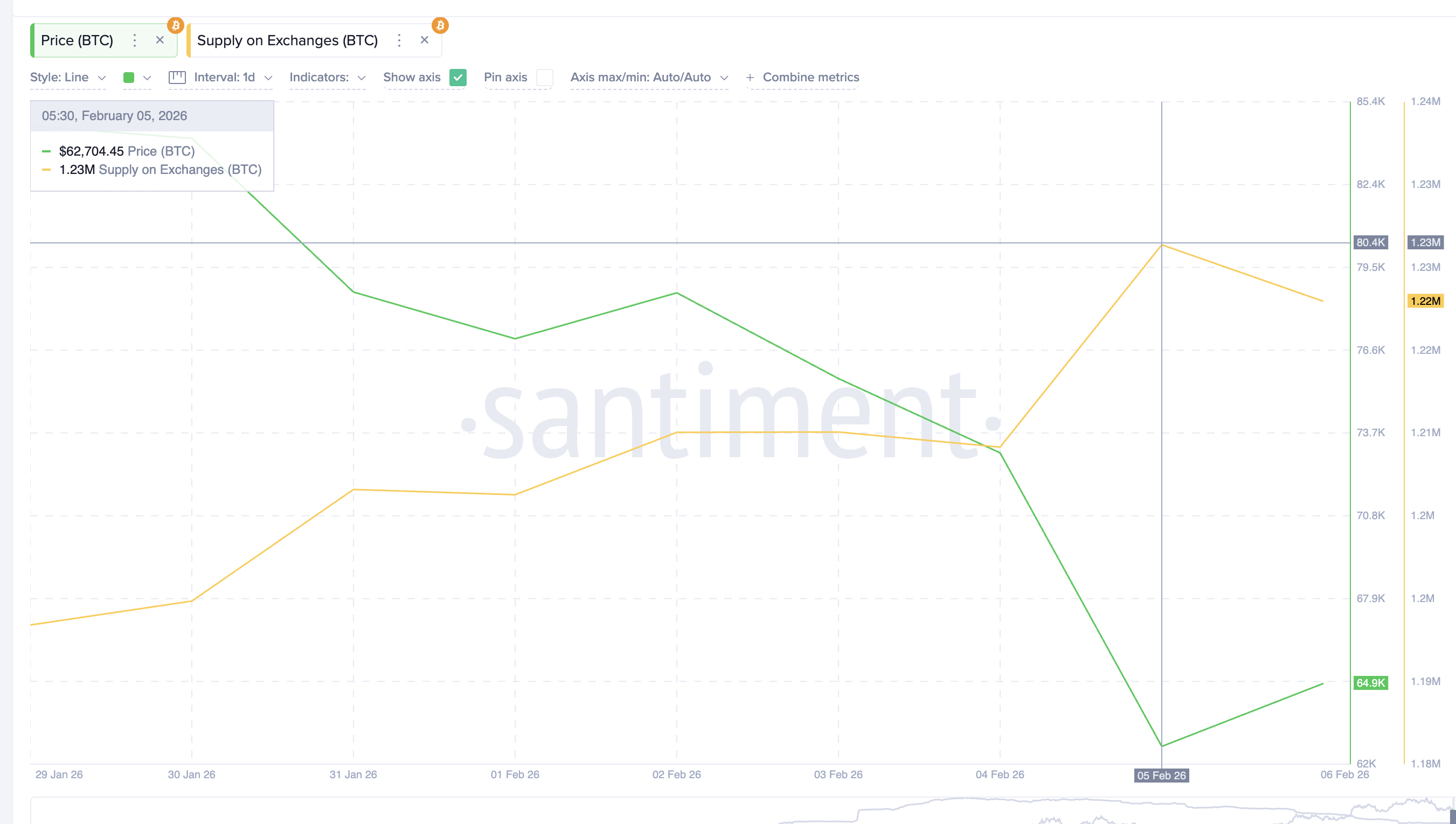

On the identical time, spot market traits replicate a rising buy-on-the-moment mentality.

Bitcoin provide on exchanges decreased from roughly 1.23 million $BTC As much as 1.22 million individuals $BTC This decline means that merchants are withdrawing the coin, maybe for short-term holding, in hopes of an increase in worth.

$BTC Provide drop: Santimento

Sentiment amongst celebrities and social media has additionally change into extra optimistic, with the tone of “shopping for on the spur of the second” rising stronger.

Purchased $2,000,000 BTC for 67,000.

Please bookmark this.

— Andrew Tate (@Cobratate) February 5, 2026

Taken collectively, these indicators can point out a false sense of confidence.

A weak chart sample, rising leverage, and early bullish shopping for are forming on the identical time. Rising optimism earlier than structural vulnerabilities are resolved typically will increase slightly than diminishing draw back dangers.

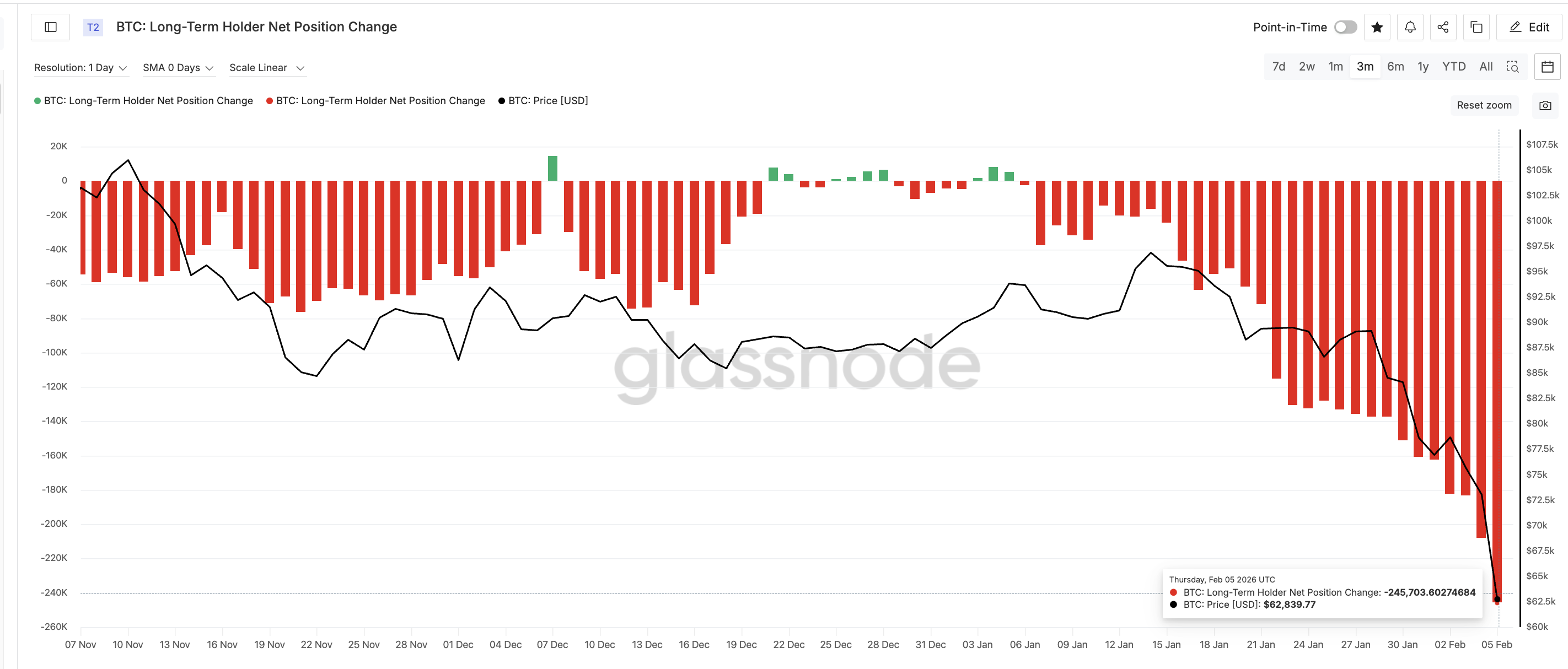

Lengthy-term holders proceed to promote as realized worth assist attracts consideration

Whereas short-term merchants are turning bullish, essentially the most secure long-term holders are transferring in the other way.

Lengthy-term holder web place change, which tracks 30-day provide shifts for buyers who’ve held for greater than a 12 months, has remained considerably destructive since early January. On January sixth, the indicator confirmed round 2,300 web quick positions. $BTC. By February 5, that quantity had worsened to about 246,000. $BTC.

Lengthy Time period Holder Sale: Glassnode

This represents a virtually 10,500% enhance in long-term deliveries in only one month. Merely put, most faith-based buyers are nonetheless lowering their publicity.

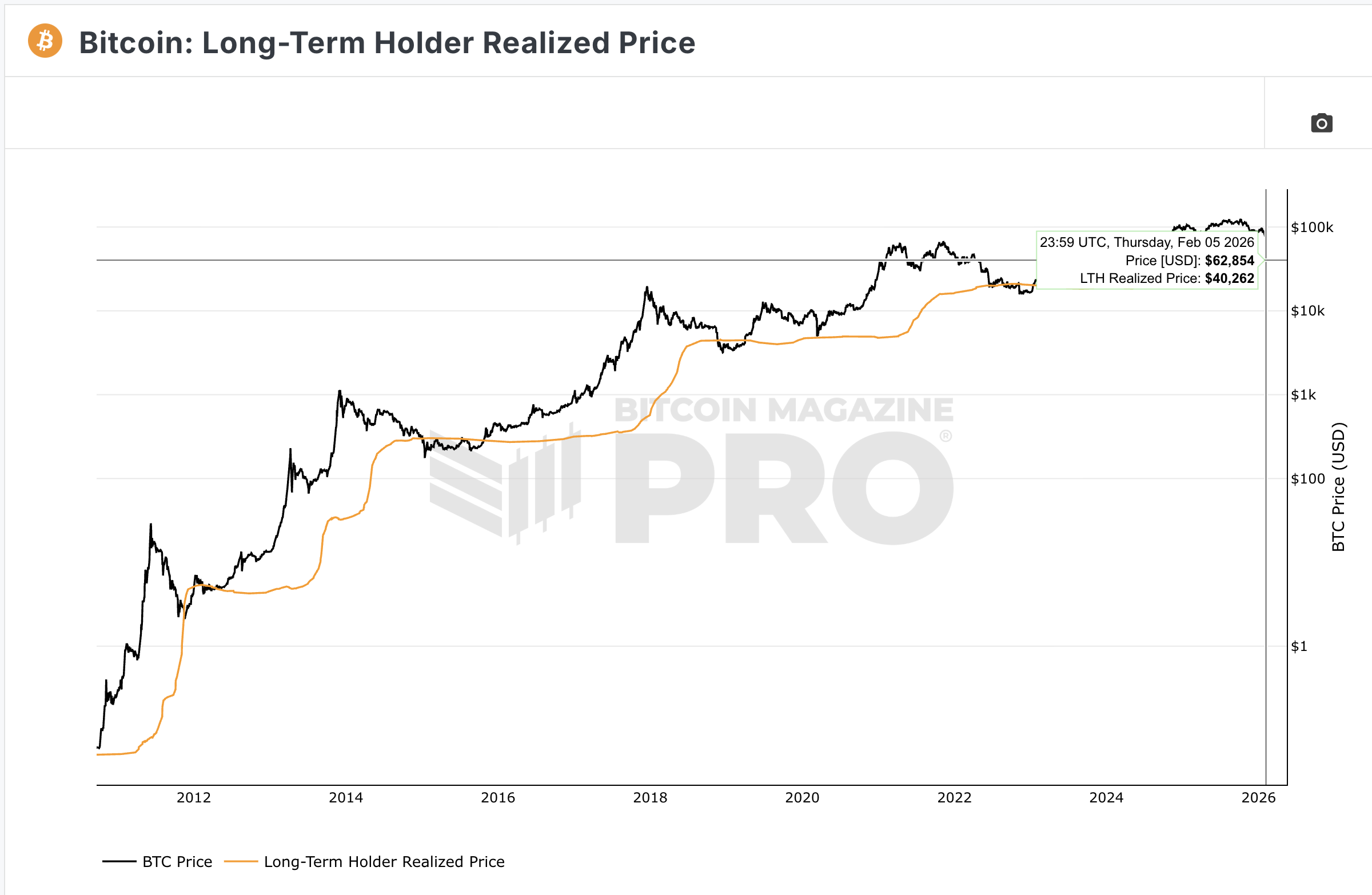

This transfer is much more regarding when mixed with the realized worth for long-term holders.

The realized worth represents the common acquisition value of a coin held by long-term buyers. Traditionally, when Bitcoin approaches or falls beneath this degree, it indicators extreme stress available in the market. In previous cycles, giant features started solely after costs stabilized round this zone. However not immediately.

At present, the realized worth for long-term holders is round $40,260.

Fundamental assist degree: Bitcoin Journal

As Bitcoin approaches this degree, extra long-term buyers will method breakeven. When costs fall beneath that, many individuals undergo losses and capitulation typically accelerates. This dynamic continued into late 2022, earlier than the ultimate backside of the bear market shaped.

Thus far, that reset hasn’t occurred.

Lengthy-term holders proceed to promote with out accumulating. Their realized costs have gotten necessary draw back magnets. This implies that the market has not totally accomplished the deleveraging and redistribution part.

Key Bitcoin worth ranges present why $48,000 and $40,000 are subsequent necessary

All technical and on-chain indicators are at present concentrated round just a few key worth zones.

On the draw back, the primary main assist is positioned close to $53,350. Failure right here would expose the $48,800 space, which is in keeping with the bear flag goal and the earlier consolidation zone.

If the value falls beneath $48,800, consideration will shift to the realized worth for long-term holders round $40,260.

This zone represents the deepest tectonic assist within the present cycle. A transfer into this area would sign widespread capitulation amongst long-term buyers and make sure a deeper bearish development.

Bitcoin Value Evaluation: TradingView

In a worst-case state of affairs, extended weak point might even open the door to $37,180 based mostly on long-term forecasts and historic assist clusters.

On the constructive aspect, Bitcoin must recuperate $69,510 on a 4-hour closing worth foundation to regain near-term confidence. A transfer above $73,320 is required to invalidate the bearish sample.

Till that occurs, the rally stays susceptible.

The present rally lacks structural assist, as leverage has been restructured, long-term holders are nonetheless promoting, and key assist ranges are approaching. Beneath these circumstances, a buy-on-the-beat technique should still be uncovered to a pointy reversal slightly than a sustained bull market.

The publish Bitcoin ‘purchase on the spurt’ saga faces powerful questions as one more 25% danger enhance appeared first on BeInCrypto.