Bitcoin’s four-day drop to $104,000 triggered what analysts name a “defensive rotation” amongst crypto traders, however on-chain knowledge suggests the correction was a wholesome reset slightly than the beginning of a broader market crash.

Bitcoin (BTC) skilled a four-day sell-off final week, dropping from $115,000 final Tuesday to a four-month low of $104,000 by Friday, a degree final seen in June, in line with TradingView knowledge.

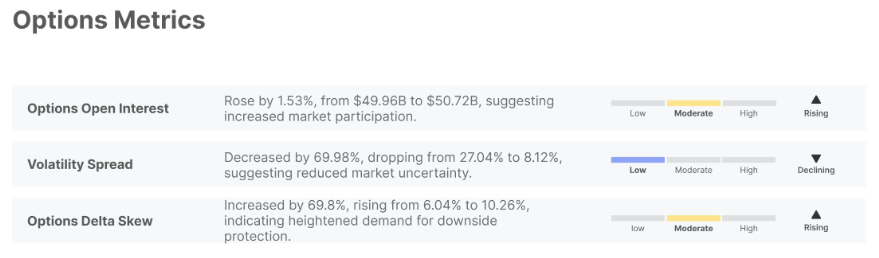

Analysts stated that regardless of the steep decline, the correction helped eradicate overleverage and inspired traders to shift from profit-seeking to capital preservation. Blockchain analytics agency Glassnode stated in a report on Tuesday that the availability of short-term Bitcoin holders is growing, suggesting that “speculative funds” are taking a bigger share of the market.

BTC/USD, 1-day chart, supply: Cointelegraph/TradingView

“On-chain, the availability share of short-term holders continues to rise, suggesting that speculative capital is changing into extra dominant,” Glassnord stated, including:

“This mixture of alerts signifies that the market is shifting into safety mode, with merchants prioritizing capital preservation over directional bets.”

Bitcoin weekly choices indicator modifications. Supply: Glassnode

In the meantime, Bitcoin open curiosity has fallen by about 30%, suggesting the crypto market is “a lot much less weak to a brand new liquidation cascade,” Glassnode stated in an X publish on Tuesday.

Associated: Elon Musk promotes Bitcoin as energy-based and immune to inflation, in contrast to “faux fiat currencies”

Bitcoin’s rise to $200,000 brings “troublesome instances” for “paper-handed” traders: Samson Mo

Glassnode’s report comes at a time of heightened uncertainty concerning the continuation of the crypto market cycle.

“This $1 million to $2 million vary is a tricky time for these with weak beliefs in HODL Bitcoin,” Jan3 CEO Samson Mo stated in an X publish on Monday, including:

“Uncertainty is excessive, partly as a result of the ‘cycles’ we have seen prior to now usually are not occurring, and different property corresponding to gold are rallying.”

Mow predicted that Bitcoin “will add zero quickly,” however cautioned that “paper-handed” traders with low conviction shouldn’t be shaken off by a brief correction.

Supply: Samsung mow

Associated: DeFi soars as $11 billion Bitcoin whale sparks ‘Uptober’ hopes: redefining finance

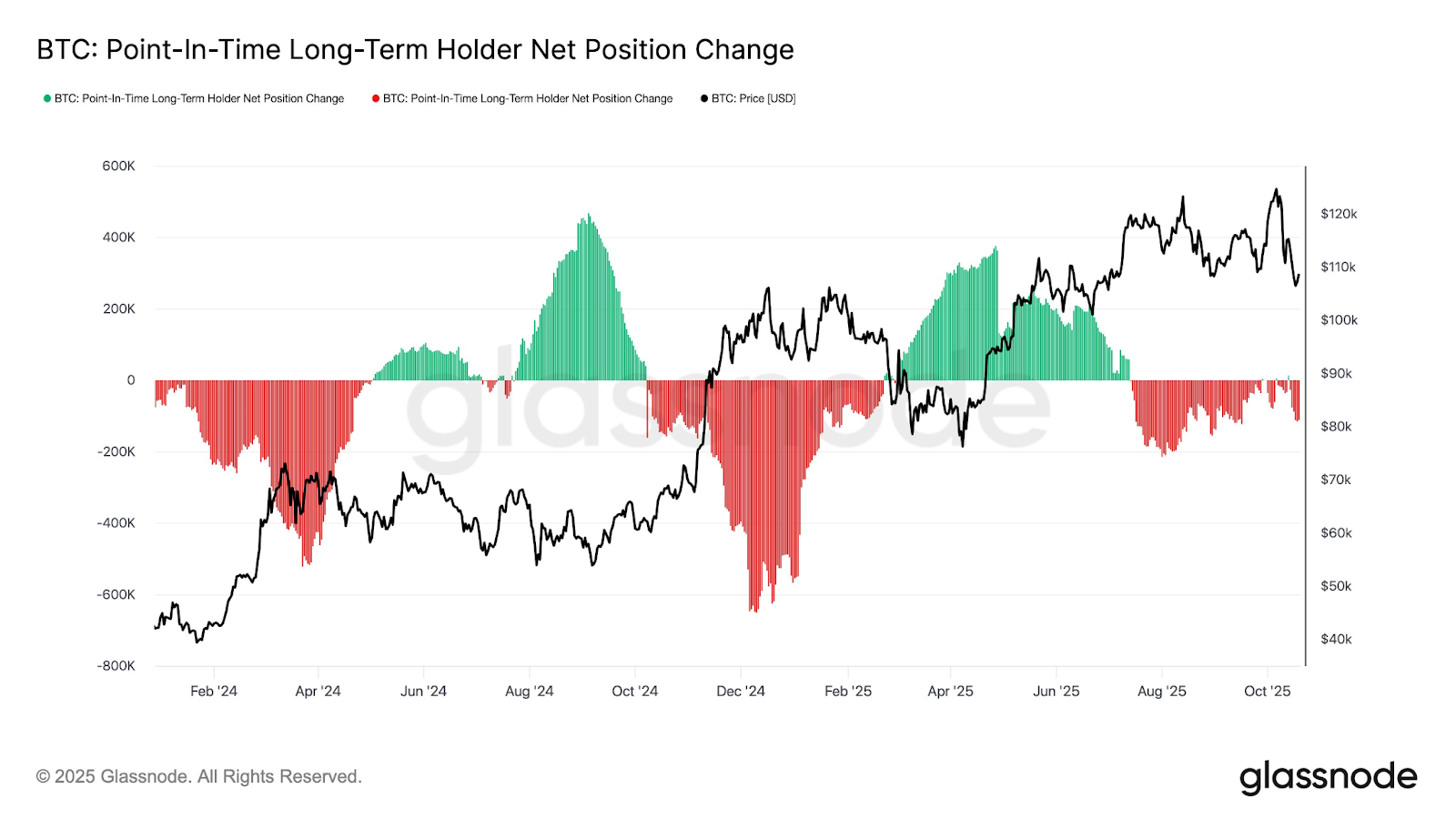

In the meantime, long-term Bitcoin holders proceed to promote to institutional traders, in line with Glassnode analyst Chris Beamish.

Supply: Chris bearish

Digital property (DATs) and exchange-traded funds (ETFs) are absorbing an “unbelievable quantity” of long-term holders’ provide, however till this group stops promoting, Bitcoin’s upside will stay restricted, analysts wrote in a publish on Monday.

However Bitcoin ETFs have additionally been damage by the political turmoil surrounding President Donald Trump’s risk of recent tariffs towards China.

Bitcoin ETFs recorded $40 million value of web outflows on Monday, marking the fourth consecutive day of promoting, Cointelegraph reported.

journal: Bitcoin is “fascinating web cash” in instances of disaster: Tezos co-founder