Bitcoin buying and selling charges have plunged to their lowest ranges for greater than a decade as social sentiments concerning the Federal Reserve’s rate of interest cuts reached a fever pitch and raised questions on market sustainability.

abstract

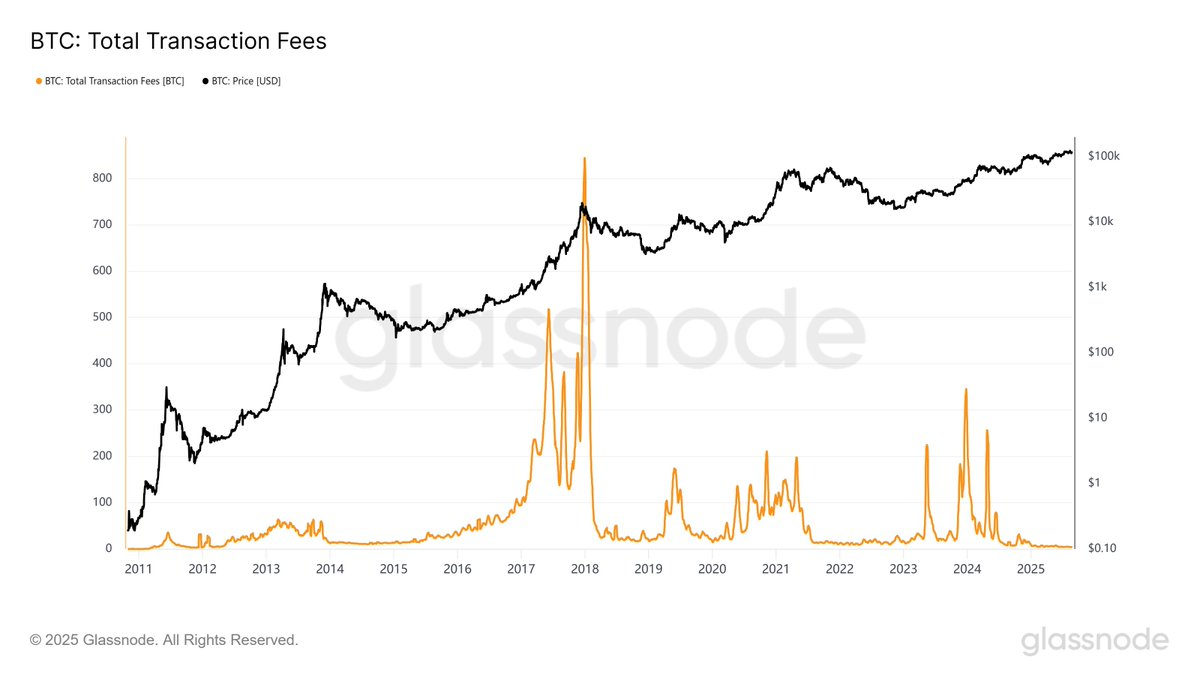

- Bitcoin charges drop to the bottom stage on day by day common of three.5 BTC since 2011

- Fed price minimize hype hits 11 months excessive and echoes the highest of the euphoria market of the previous

- Trade BTC balances 70k from June, indicating potential gross sales stress

In keeping with GlassNode information, day by day buying and selling charges for the Bitcoin (BTC) community (14-day SMA) have not too long ago dropped to three.5 BTC. That is the bottom stage because the second half of 2011.

The primary driver behind the current market energy was given a speech by Chairman Jerome Powell at Jackson Gap. There, he prompt potential price reductions, saying, “a balancing danger modifications might justify coverage changes.”

GlassNode information

Social feelings attain harmful territory for bulls

There was a surge in mentions of key phrases equivalent to “FED”, “price”, and “minimize” throughout social media platforms. Santimento information reveals this surge is the very best within the final 11 months.

This large spike within the dialogue of a single bullish narrative signifies that it might be traditionally too euphoric.

When social feelings round a selected catalyst attain excessive ranges, it usually coincides with the highest of native costs.

You would possibly prefer it too: Crypto VC Funding: Digift secures $11 million, with Irys Baggage $10 million

GlassNode evaluation is about organising a Bitcoin holder. The dense provide clusters accrued between $113,000 and $120,000 since early July belong to buyers who’ve been in lower than three months.

At the moment, the SOPRs by age of those short-term holders at present vary from 0.96 to 1.01. This information reveals a gentle discount in recognition.

Trade influx attracts worrying photos of Bitcoin

One of many traits is the rise in provide for Bitcoin exchanges. Since early June, the quantity of BTC held on the change has elevated by about 70,000 cash.

This means that it reverses the long-term pattern of cash shifting into chilly storage, indicating a spot the place extra holders promote.

Bitcoin Trade Stream Evaluation: Santimento

Traditionally, the rising change steadiness has preceded gross sales stress as buyers transfer cash to the platform in preparation for liquidation.

Bitcoin’s on-chain well being metrics present a impartial to coutary picture with day by day cooling of addresses and transaction volumes from current highs.

The long-term MVRV ratio is positioned at 18.5%, which is a barely dangerous zone for brand spanking new investments.

learn extra: NFT gross sales fell 25% to $134 million, whereas Cryptopunks fell 59%