Bitcoin ($BTC) An in a single day drop to $60,233 after which some restoration to $65,443 has left many of the largest pure-play Bitcoin firms with their holdings severely underneath water, with complete unrealized losses approaching $10 billion for eight entities that collectively management greater than $850,000 in Bitcoin. $BTC.

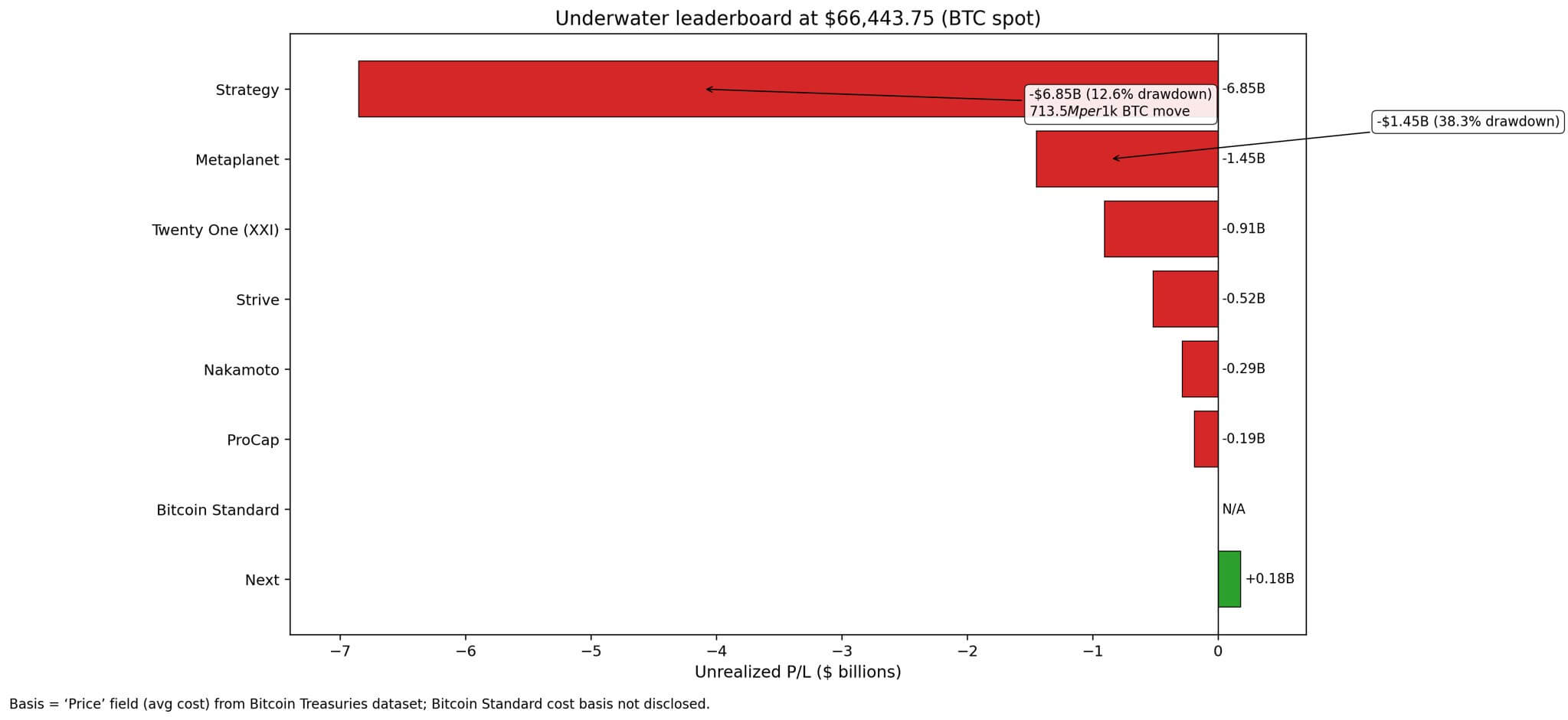

The calculations are most intense on the high. Technique (previously MicroStrategy) holds 713,502 $BTC On a mean value foundation, it could be $76,047 per coin, leading to an unrealized lack of $6.85 billion at present costs.

This represents a 12.6% drawdown for the Treasury, which is value $47.4 billion in bodily phrases, however given the corporate’s dimension, each $1,000 motion in Bitcoin’s worth interprets right into a $713.5 million change in its paper place.

Japanese Resort Firm Metaplanet Turns Bitcoin Accumulator, Shops $1.45 Billion Below 35,102 Seabeds $BTC They have been acquired for a mean of $107,716. The 38.3% unrealized loss displays timing threat related to purchases close to file highs in late 2024 and early 2025.

Twenty One Capital studies paper lack of $906.7 million on 43,514 sheets $BTC It was bought for $87,280.37 and remained 23.9% underwater. Values thought-about are primarily based on a submitting with the Securities and Alternate Fee on July 29, 2025.

This dataset is sourced from Bitcoin authorities bonds and solely tracks firms whose enterprise fashions revolve solely round Bitcoin accumulation.

Coinbase, Tesla, and different firms with diversified companies can’t qualify, making this a purely belief-versus-cost-based check.

Seven of the eight names analyzed are at present underwater. The one exception is Subsequent, which bought 5,833 models. $BTC It’s now $35,670.09, with 86.3% ($179.5 million) unrealized achieve remaining.

Dangers of mNAV compression

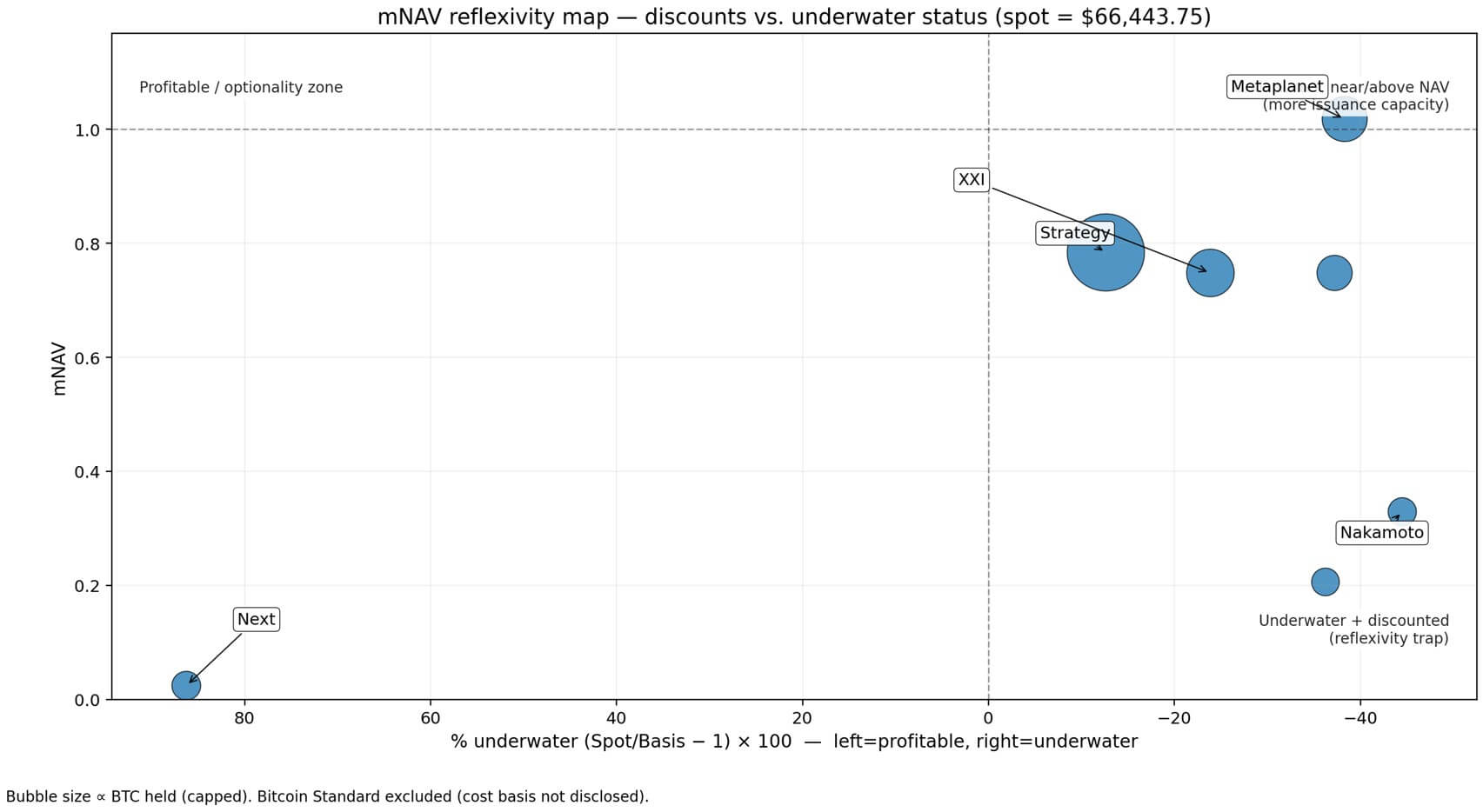

The market to internet asset worth ratio provides a reflexive dimension to the ache. Metaplanet is buying and selling at an mNAV of 1.018, which is principally consistent with that benchmark. $BTC However, Technique Inc.’s a number of of 0.784 signifies that the market values the corporate’s inventory at a 21.6% low cost to Bitcoin Treasury.

Mr. Nakamoto, 5,398 individuals $BTC 0.329 mNAV is buying and selling at a 67% low cost, representing an unrealized lack of 44.5%, regardless of holding the coin at $119,729.

This divergence is essential as a result of underwater treasuries typically require both premium mNAV multiples or dilutive fairness financing to proceed accumulating. In a drawdown, the market usually calls for the other. This implies widening the low cost vary and rising the hurdle charge for brand new capital.

Corporations that proceed to make income, akin to Subsequent, retain choices. They will maintain, understand income to fund operations, or deploy income defensively.

When 40% of shares are underwater, you face a special calculation. Holding is a compelled wager that Bitcoin will rebound earlier than the funding window closes.

elevated harm

The present worth of $65,443 is 51% under Bitcoin’s October 2025 peak of $126,000, a part of a broader crypto market drawdown that has worn out almost $2 trillion in worth.

Earlier this week, the $2.5 billion Bitcoin liquidation accelerated deleveraging, with the Monetary Occasions noting that prediction market odds for an consequence under $60,000 have been rising.

Stifel’s technical mannequin flags $38,000 as a cycle-style breakout goal primarily based on trendline help.

If Bitcoin continues to fall under $60,000 and declines 9% from present ranges, Technique’s losses might be $4.6 billion, Metaplanet’s losses might be $226 million, Twenty One Capital’s losses might be $280 million, and the losses might be even greater.

At $50,000, these numbers would balloon to $11.73 billion, $577 million, and $715 million, respectively.

A drop to $38,000 would end in an extra $20.29 billion in losses, on high of the $6.85 billion already misplaced to Technique alone.

effort, possession 13,132 $BTC On a base of $105,850, if Bitcoin reached $38,000, the $517.5 million recurring loss would widen by $373.5 million.

5,000 for professional caps $BTCbuy for $104,219.34 would deepen the $188.9 million underwater place by an extra $142 million.

Even Subsequent, which remains to be worthwhile at present costs, would hand over $165.9 million of its $179.5 million paper revenue if Bitcoin falls to $38,000, simply above break-even.

ETF outflows and modifications in distribution

This drawdown coincides with structural modifications in Bitcoin circulation.

The U.S. Spot Bitcoin ETF, which has been actively accumulating by 2024 and early 2025, has seen internet outflows in current weeks as institutional buyers pivot to safer property.

This reversal of developments will remove the foremost purchaser teams that beforehand absorbed provide pressures, leaving finance firms because the dominant diamond-hand group.

However “Diamond Arms” is a narrative, not a fundraising technique. Corporations that develop property by convertible debt or fairness financing face rising prices and shrinking mNAV premiums.

Metaplanet’s a number of is 1.018x, and Metaplanet’s capability to subject shares is sort of the identical. $BTC Assortment.

The technique’s 0.784 signifies that each $1 raised by fairness prices $1.27 in Bitcoin worth on a look-through foundation.

Nakamoto’s a number of of 0.329 turns the fairness increase right into a 3:1 dilution tax.

reflective lure

The hazard lies not solely in mark-to-market losses, but additionally in suggestions loops.

Water China bonds compress mNAV multiples, enhance the price of new capital, sluggish accumulation, and weigh on fairness sentiment, additional compressing multiples.

Corporations with excessive value bases purchased into that power. If Bitcoin continues to fall, they may have reached the highest of the cycle.

Twenty One Capital’s foundation disclosed in an SEC submitting is $87,280.37, 24% above present worth however 13% under the technique’s common of $76,047. It turns into a matter of timing, not confidence.

ProCap has an estimated foundation of $104,219.34 and Try has an estimated foundation of $105,850, each throughout the identical late 2024 buy window. All three firms are at present 36-37% underwater, that means Bitcoin would wish to rise above $91,000, a rise of 37% from present ranges, to interrupt even.

What about $38,000?

If Mr. Stifel’s $38,000 objective is realized, the full loss on these eight bonds could be greater than $25 billion in incremental losses from present ranges.

This technique alone would end in a $20.29 billion hit on high of the present paper lack of $6.85 billion, for a complete unrealized lack of $27.14 billion. Metaplanet’s complete worth might be nearer to $2.5 billion, whereas Twenty One Capital might be value nearer to $2.2 billion.

At that worth, even Subsequent will not break even and its $179.5 million cushion will disappear. Total cohorts are underwater and there’s no selection however to carry on and watch for a restoration by which markets are more and more pricing in uncertainty.

Pure Bitcoin Vaults bets that conviction and scale equal compound curiosity.

As Bitcoin rises, leverage amplifies income, widening mNAV multiples and turning shares into name choices. $BTC Monetary arbitrage is inbuilt. When Bitcoin falls, the identical leverage turns paper losses into funding constraints and a number of compressions into reflexive traps.

The present worth of $65,443 doesn’t erase the paper. As an alternative, do a stress check.

Technique’s $6.85 billion unrealized loss represents 12.6% of that quantity. $BTC This worth is suitable even when Bitcoin rebounds. If not, the issue is: Who decides at what worth underwater turns into unsustainable and when a conviction turns into give up?

To this point, the market, by mNAV, has delivered a verdict of premiums for high-yield bonds, reductions for underground bonds, and deep reductions for bonds with no clear exit ramp.

Paper loss leaderboards will not be static. Each $1,000 transfer in Bitcoin rebalances, and the following leg determines whether or not these bonds are worth traps or cycle survivors.