Bitcoin hit a brand new all-time excessive at $123,218 on Monday, July 14th. The most important cryptocurrency worn out its earnings and surpassed the $118,000 degree on the time of writing. Bitcoin’s latest actions have motivated BTC holders from Satoshi period to maneuver BTC to their OTC desks, presumably making earnings.

If BTC continues to increase earnings and maintains upward momentum, Bitcoin (BTC) may collect in the direction of a goal of over $150,000.

desk of contents

Bitcoin is the very best new hit ever

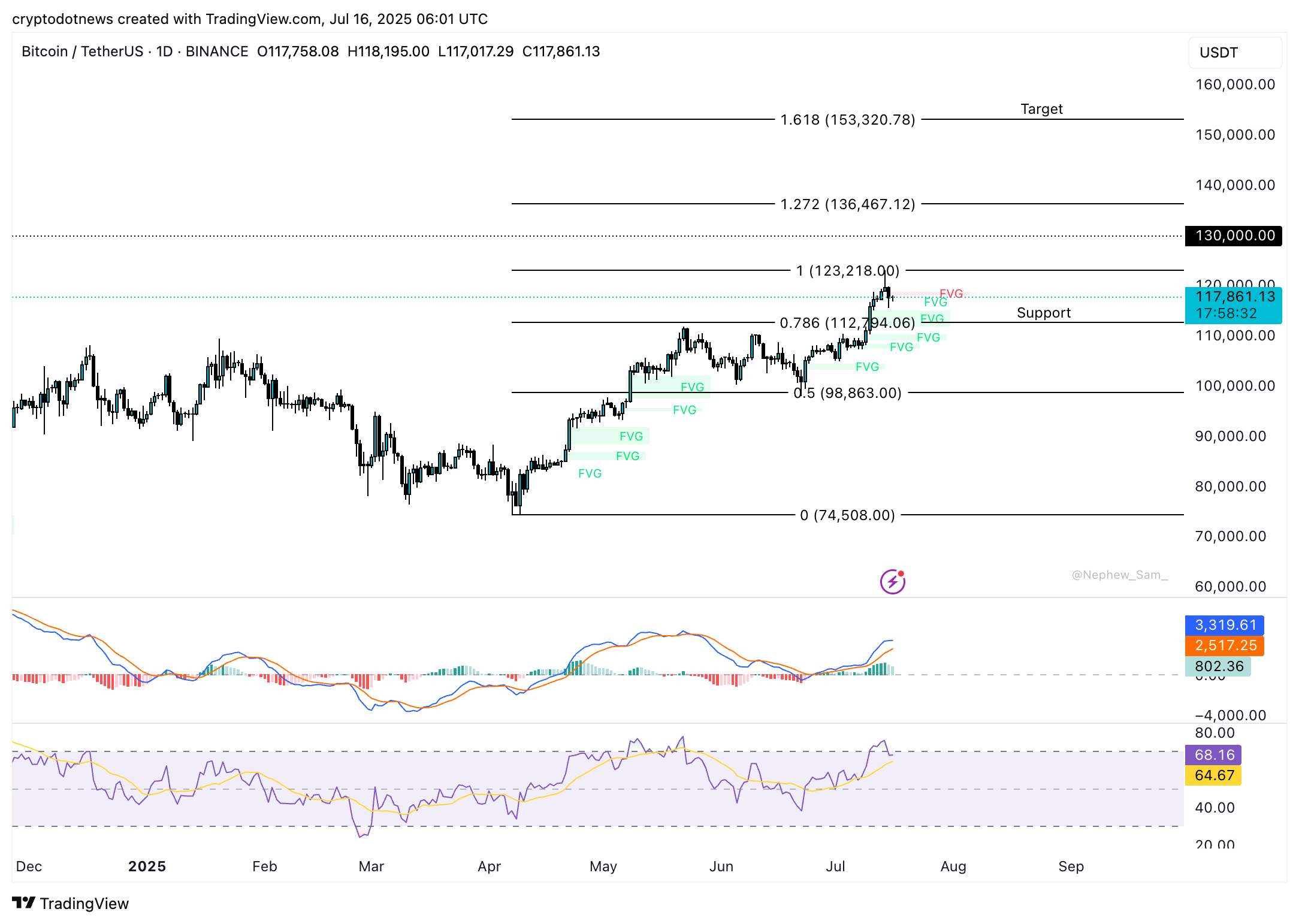

Bitcoin peaked at $123,218 on Monday, July 14th. The most important cryptocurrency fell, erasing new earnings to above $118,000 on Thursday. Bitcoin was capable of acquire liquidity with help at $112,794 on the 78.6% Fibonacci retracement degree of the rally from its April low to its peak in July.

Two essential momentum indicators on the BTC/USDT worth chart present that additional earnings are doable with Bitcoin. The RSI reads 68 and is tilted upwards, and the MACD flushes the inexperienced histogram bar above the impartial line. There’s a optimistic elementary momentum within the worth of Bitcoin.

Fibonacci has a goal of 127.2% at $136,467 and 161.8% at $153,320, and when Bitcoin sees every day Candlesticks exceed $130,000, it is available in.

The $150,000 objective is psychologically essential, with a big milestone for Bitcoin after $100,000 and a $120,000 degree.

BTC/USDT Every day Value Chart | Supply: crypto.information

Bitcoin has achieved the best new energy ever. Gemini’s Winklevoss Brothers’ $11 million Bitcoin purchases in 2013 went to $11 billion in 2025. A 1000x improve in Winklevoss Brothers’ investments helps optimistic sentiment amongst merchants.

In response to The Worry & Greed Index, a sentiment survey for market members, merchants are “grasping” this week.

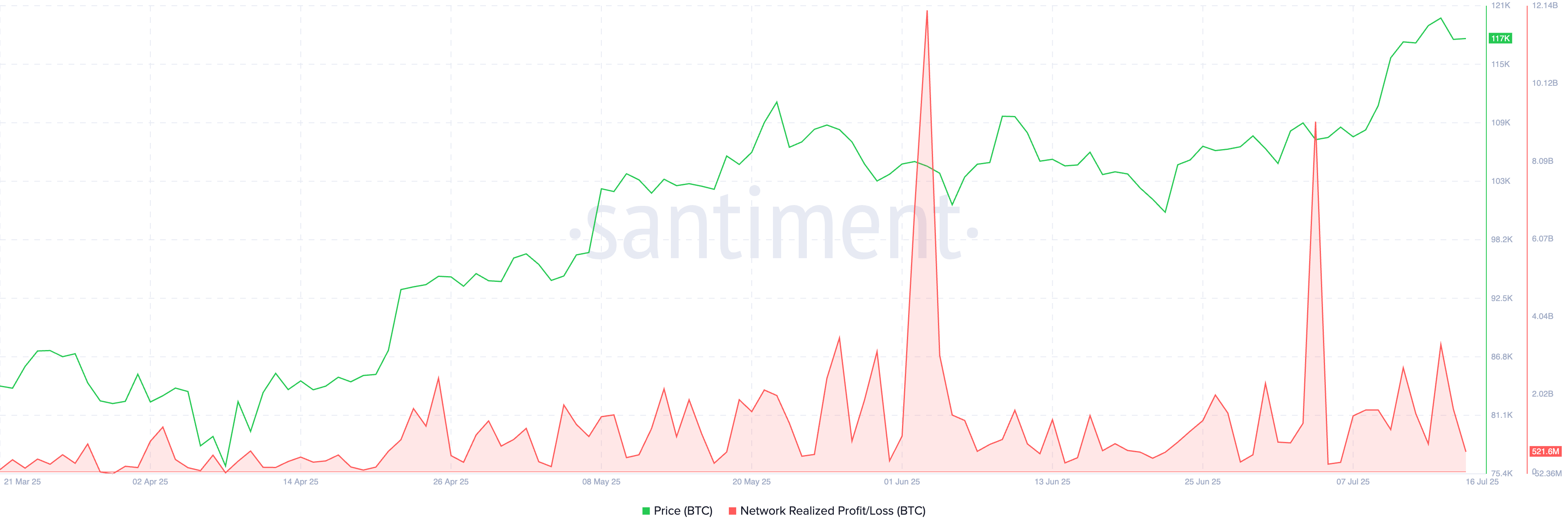

Bullish sentiment faces earnings from merchants. Over the previous 100 days, BTC holders have persistently benefited from their Bitcoin holdings. Santiment information reveals revenue/loss metrics which have achieved giant and constant optimistic spikes within the community between April and July 2025.

Bitcoin Community Realised Revenue/Loss | Supply: Santiment

You would possibly prefer it too: Spot Bitcoin and Ethereum ETF appeal to $200 billion and topped all asset courses since April

BTC Eyes Rally prices $150,000

Bitcoin’s latest revenue and worth discoveries have given us confidence to each establishments and retailers ready to deploy capital. Silicon Valley big Peter Tiel positioned a giant guess on the BTC mining firm and despatched inventory in a single day. Thiel has introduced a 9% stake in Bitmine.

The announcement supported a bullish paper on cryptocurrency. As BTC is situated to make additional earnings, there may very well be gatherings of over $150,000.

On the time of writing, Bitcoin slipped to the $114,000 degree and examined help. The Bulls defend Bitcoin help ranges, and the retest of resistance is prone to be $116,000, $120,000 and $123,000.

A break past three resistance permits Bitcoin to enter worth discovery and rally in the direction of its $150,000 objective.

Vikram Subburaj, CEO of Giottus, the alternate platform, commented on Bitcoin’s worth motion and future targets. Subburaj informed crypto.information:

“The important thing points for Bitcoin are: The place are they heading? $135,000 is the following key resistance in response to the FIB enlargement. If macro liquidity stays in favor and ETF flu persists, this development section is predicted to develop to over $150,000.

Trump’s Crypto Week

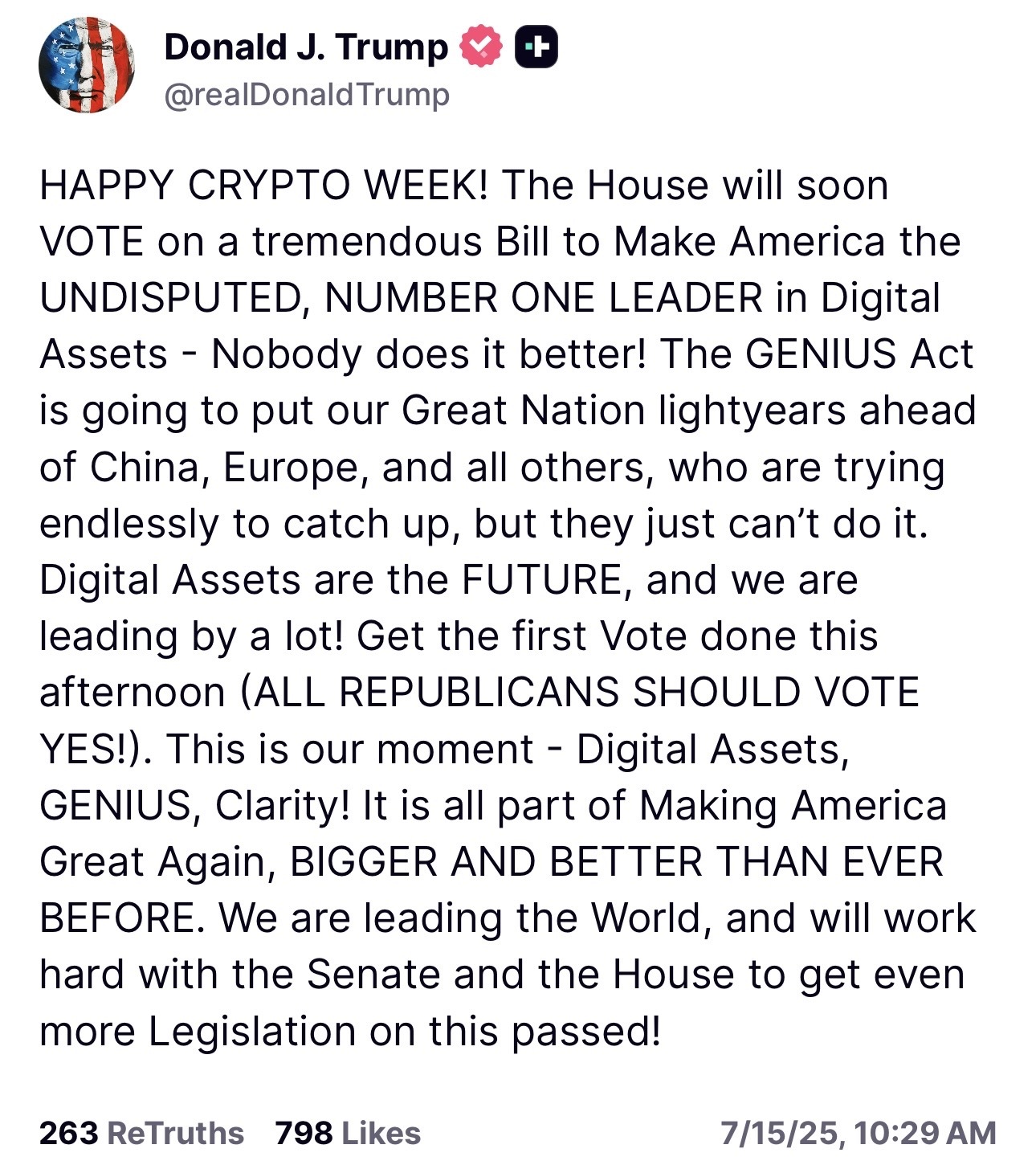

US President Donald Trump launched Crypto Week with an announcement on social media platform Truthsocial. Trump assured market members that the Home would quickly vote for a invoice that would make America an uncontroversial chief in digital belongings.

Trump mentioned he’ll work with the Home and Senate to go extra legal guidelines.

Donald Trump’s Reality Social Put up | Supply: x

The stubcoin regulation has stagnated, and disagreements have blocked the invoice from transferring ahead beforehand. It stays to be seen how the three crypto-related invoices will likely be handed and whether or not managers are taking extra steps to deal with the crypto market construction.

You would possibly prefer it too: Peter Thiel acquires 9.1% stake in Tom Lee’s Ethereum Treasury Firm

On-Chain Evaluation

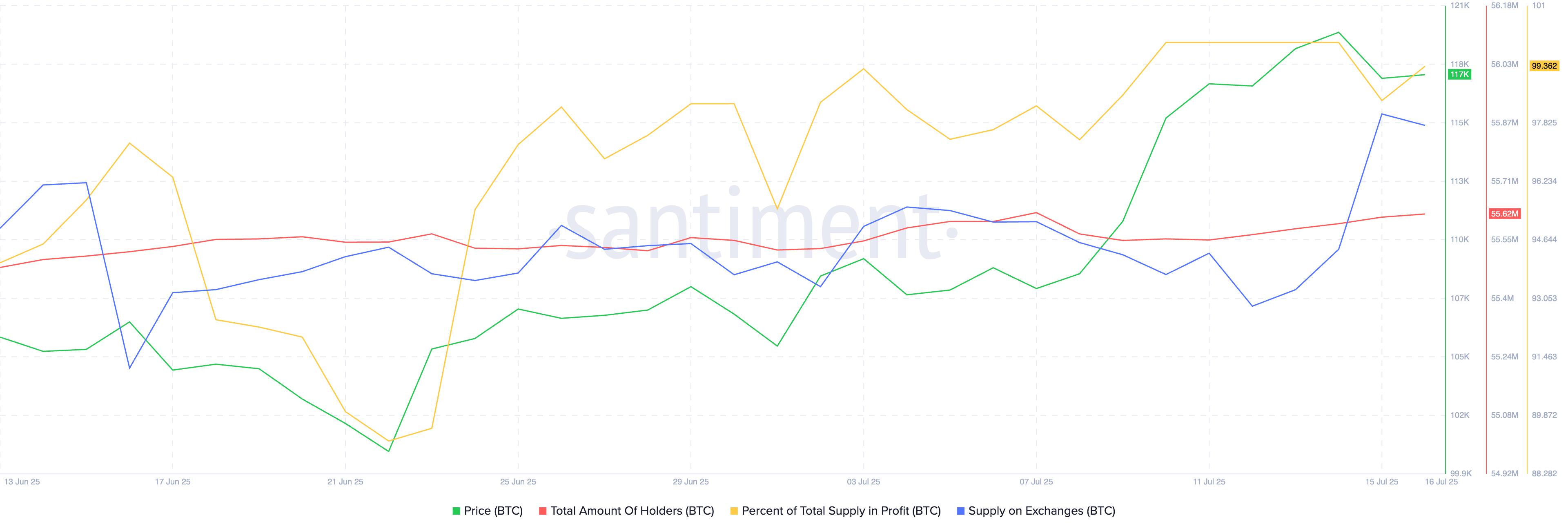

Santiment information reveals that the full variety of Bitcoin holders elevated final week. Nevertheless, the share of alternate provide decreased after the preliminary spike. Because the proportion of BTC provide of earnings elevated, the provision of exchanges was soaked. This might imply that BTC is being pulled out of exchanges for holdings somewhat than making earnings.

The revenue monitoring metrics present that they don’t present a serious surge over the previous week. Because of this merchants in alternate can take up gross sales strain and help Bitcoin worth will increase.

Bitcoin on Chain Evaluation | Supply: Santiment

On-chain evaluation reveals that whereas Bitcoin retailers are profiting and redistributing their holdings, giants and enormous pockets buyers accumulate via worth rallies. The technique purchased virtually each bitcoin worth dip and added 4,000 BTC, which averages over $111,000 per token. The Giants persistently scooped up Bitcoin within the 2025 Bull Run.

Skilled commentary

Andrejs Balans, danger supervisor for YouHodler, an EU-based FinTech platform, informed crypto.information in In The Interview.

“The Bitcoin market is sort of mature and this evolution has decreased volatility in comparison with previous cycles resulting from improved liquidity and participation by skilled buying and selling corporations.

Following the large revenue this yr, many long-term holders have realized earnings, which will increase market provide. With out contemporary demand persisting, this gross sales strain may preserve the value vary somewhat than encourage a crucial breakout. ”

“We’re wanting ahead to seeing you on this planet,” mentioned Jamie Elkaleh, Chief Advertising and marketing Officer at Bitget Pockets.

“Presently, the establishments are firmly driving Bitcoin development, signaling long-term belief with infiltrating past ETFs and a sustained accumulation of gamers like BlackRock and MicroStrategy. Brief-term pullbacks appear unlikely. Recursive gatherings, not but structural change.”

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.