Blockchain analytics platform Glassnode has shared some key insights concerning Bitcoin liquidity ranges amidst a somewhat unstable market interval. Notably, the main cryptocurrency has struggled to keep up its “uptober” kind after its worth soared to $126,000, adopted by a big correction under $105,000. Since then, Bitcoin has proven some restoration exercise, however has but to interrupt above the $115,000 resistance, holding its complete month-to-month acquire to 0.47%.

Bitcoin liquidity rises, testing energy of demand

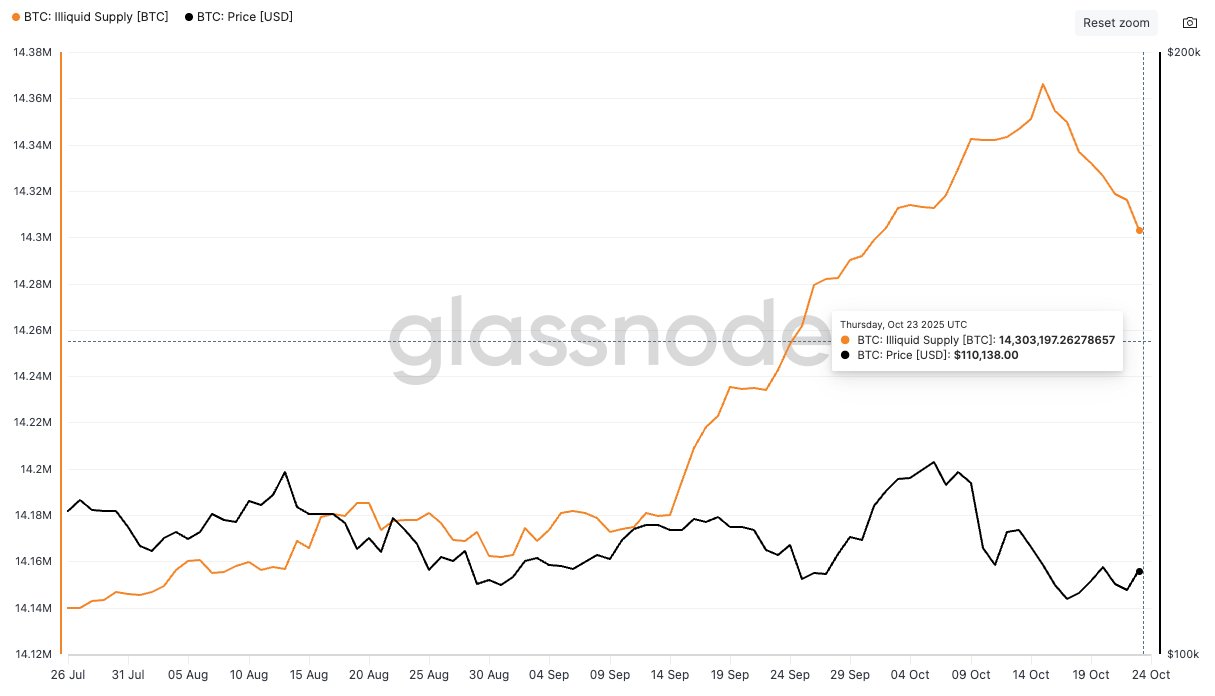

In an October twenty fifth X publish, Glassnode reported that Bitcoin’s illiquid provide has decreased by 62,000 BTC since mid-October. For context, illiquid Bitcoin refers to BTC held in wallets with little or no gross sales historical past. These are basically cash which might be unlikely to maneuver, as their holders hardly ever use them and they’re thought of to by no means depart the market.

Due to this fact, a lower in illiquid BTC means that extra cash are returning to energetic circulation, growing the accessible provide. This dynamic might make sustained worth will increase harder until offset by a surge in demand.

Glassnode explains that previous to the latest selloff, elevated illiquidity provide had been a optimistic catalyst on this market cycle. Traditionally, related pullbacks, such because the 400,000 BTC drop in January 2024, have tended to sluggish market momentum by growing the quantity of Bitcoin in energetic circulation.

Who’s behind the sale?

Whereas analyzing this decline in illiquid BTC, Glassnode additional found that the buildup exercise of Bitcoin whales is accelerating. Notably, BTC wallets have elevated their holdings over the previous 30 days, however giant positions have but to be liquidated since October fifteenth.

Due to this fact, the rise in BTC liquidity has been pushed by retail traders. Additional information from Glassnode reveals that wallets holding between 0.1 and 10 BTC, or between $10,000 and $1,000,000, persistently generate giant outflows. Notably, this set of merchants has been steadily lowering their BTC publicity since November 2024.

Relating to latest worth tendencies, Glassnode analysts level out that momentum consumers, primarily retail traders, are more and more exiting the market. Though push consumers, or whales, have stepped up their exercise, their demand has not been enough to soak up the surplus provide, resulting in the worth imbalances at the moment noticed.

On the time of writing, Bitcoin is buying and selling at $111,570, reflecting a modest enhance of 0.89% over the previous 24 hours. On the next time-frame, the main cryptocurrency registered a acquire of 4.11% over the previous week and a acquire of simply 0.05% over the previous month.

Featured picture from Flickr, chart from Tradingview