Bitcoin has entered a susceptible part after days of strain and uncertainty gross sales. The bull is working to guard this vital territory, however the momentum is clearly fading. The market is at present falling right into a retention sample, with traders being conscious that Bitcoin will stabilize or decline within the earlier session.

Regardless of its weaknesses, there’s nonetheless no clear sign for deeper corrections. Traditionally, retrace throughout the ongoing bull market usually acts as a reset quite than a development reversal, however strain on Bitcoin has however prompted debate over the short-term course. Holding past the present degree is turning into more and more vital. In any other case, they may change their emotions additional in favor of the bear.

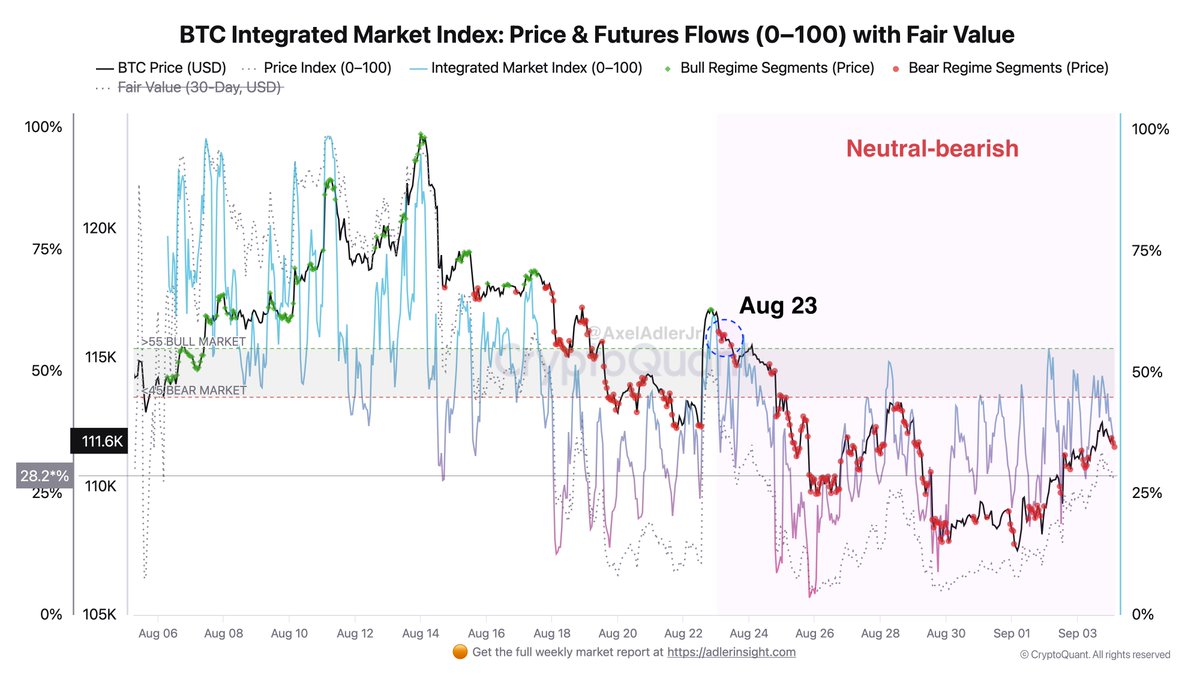

Prime analyst Axel Adler described the present surroundings as a impartial base. In different phrases, movement and worth motion lack the beliefs wanted for a important bullish push. Till stronger demand arises, Bitcoin’s restoration could possibly be restricted to technical bounce quite than sustained gatherings.

Bitcoin is caught on a impartial beash base

In accordance with prime analyst Axel Adler, Bitcoin’s present construction stays susceptible as each worth and by-product flows are beneath 50, indicating weak spot throughout key metrics. Adler emphasizes that short-term rebounds are potential, however the market doesn’t have the convictions wanted for a sustained upward development. With Taker’s movement nonetheless detrimental and weak, restoration from present ranges could possibly be a median reversal bounce, tailor-made to honest worth and 30-day vary, quite than the start of a brand new bullish part.

This surroundings means that danger urge for food stays absent and that the market stays susceptible to additional testing at low boundaries. Adler notes that until the movement shifts meaningfully, worth will increase will stay capped and are more likely to fade rapidly as gross sales pressures resurface. The closest bullish setup requires stabilization of flows that would push BTC from $113,000 to $115,000 areas.

For a real change in market construction, Adler refers to 2 vital thresholds. Movement > 55 and worth index > 50. Provided that each circumstances are met will Bitcoin have a stronger, trend-filling rally basis. Till then, the market has confronted an growing danger of repeated retesting of assist zones, with merchants carefully monitoring whether or not BTC exceeds $110,000 and even slipping into the realm of corrections.

BTC holding strains above $110K

Bitcoin continues to consolidate the $110-111K zone from round $1.1 million, exhibiting resilience after weeks of speedy gross sales strain. The chart highlights how BTC has bounced again from its latest lows of almost $108,000, nevertheless it nonetheless struggles to regain larger momentum. The 50-day transferring common now serves as resistance, suppressing upward makes an attempt and displays a decline in bullishness.

Regardless of the all-time excessive of pullbacks beginning at $123,000, the construction stays at a 200-day transferring common of almost $101,000, and has constantly served as long-term assist. Present pricing measures present a balanced market. The Bulls defend demand, however the bears are nonetheless underneath strain as they’re being rejected on the $112,000 degree.

The flat trajectory of the 100-day transferring common suggests {that a} important breakout is required to strengthen the combination part and ensure the orientation. If Bitcoin exceeds $113,000 within the quick time period, you possibly can arrange a retest of 118K, a midrange degree that acts as each assist and resistance.

Failure to carry the $110K degree will assist you to expose your BTC to a $100,000 repeat check. For now, the destiny of Bitcoin relies on whether or not consumers can stabilize the movement and take in ongoing gross sales strain.

Dall-E particular pictures, TradingView chart