If there was ever any doubt {that a} bear market was coming, the current drop within the worth of Bitcoin to round $81,000 has given some credence to its risk. Quite a few components have been attributed to this decline, together with geopolitical tensions, Microsoft’s income failure, and a cascade of liquidations, however the premier cryptocurrency seems to be struggling to catch a break for the time being.

Curiously, the current decline not solely shattered the remnants of Bitcoin worth’s bullish construction, but additionally tilted the on-chain framework in the direction of an much more bearish outlook. It seems that the bears are profitable the battle for management of the BTC market, with each technical and on-chain information wanting much less optimistic.

This indicator modifications first, BTC worth reacts later: Crypto Founder

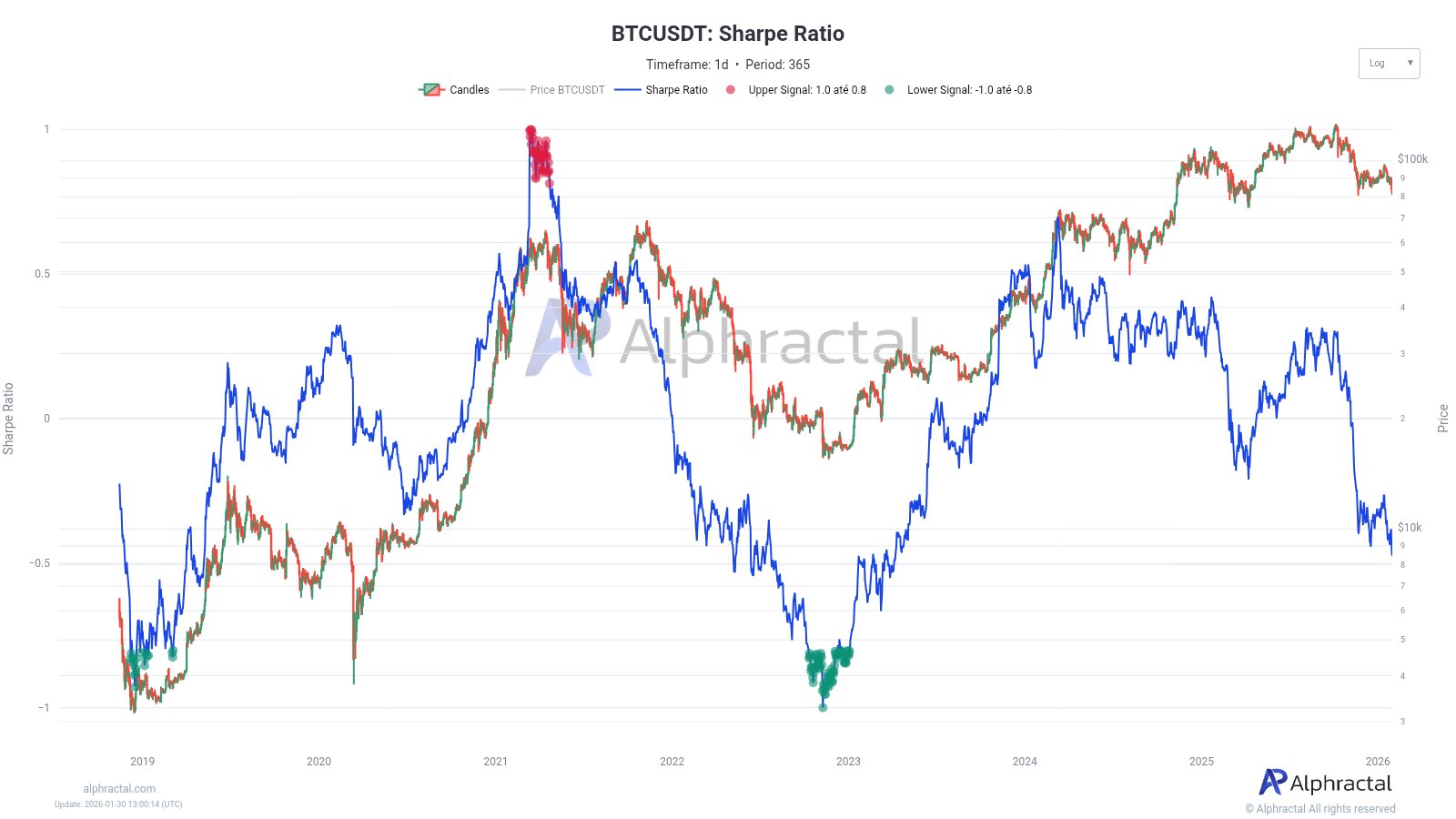

Joan Wesson, founder and CEO of Alpharactal, revealed in a January 30 put up on the X Platform that the Bitcoin Sharpe Ratio is falling quicker than the BTC worth. The related metric right here is the Sharpe ratio, which evaluates the risk-adjusted return of a selected cryptocurrency, on this case Bitcoin.

This on-chain metric primarily tracks the quantity of return an funding delivers per unit of danger (contemplating that danger is measured by volatility), with increased values indicating higher risk-adjusted efficiency. Then again, a unfavourable Sharpe ratio signifies that the returns realized on the funding will not be commensurate with the dangers assumed.

In a put up about X, Wesson wrote:

Merely put, the market is taking over extra danger for much less return.

Supply: @joao_wedson on X

In reality, Bitcoin Sharpe Ratio fell into unfavourable territory inside the first few days of the brand new 12 months. Nevertheless, even after this alteration, the worth pattern of BTC remains to be extremely sturdy, rising as excessive as $97,000, making on-chain observations much less essential.

What’s much more attention-grabbing is that the Sharpe ratio is declining and weakening quicker than the Bitcoin worth. Traditionally, this fee of decline has usually coincided with an extended interval of lack of momentum or sideways motion in costs. In reality, Wesson concluded that risk-adjusted metrics want to alter earlier than costs react positively.

If this occurs, Bitcoin worth may fall to $65,500

Wesson predicted a goal for BTC worth if main cryptocurrencies proceed their downward spiral. In an outdated put up on X, the Alpharactal founder revealed that the Bitcoin worth can’t fall under the $81,000 degree underneath any circumstances.

On-chain specialists stated that if the market chief falls under the $81,000 degree, a capitulation part much like the one seen in 2022 may unfold. Based mostly on Fibonacci-adjusted market common costs, Wesson recognized $65,500 as the subsequent main assist degree.

$81,000 got here into focus as Bitcoin worth approached this degree in the course of the decline on Thursday, January twenty ninth. Nevertheless, as of this writing, BTC has recovered above the $83,000 mark, with the worth nonetheless down practically 8% on the week.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView