TL; PhD

- Analyst Merlijn sees Bitcoin forming two inverted head and shoulder patterns, projecting a $150,000 rally.

- Resistance stays near $111,000, and if costs don’t rise, the draw back goal can be practically $103,000.

- Firms allocate 22% of their income to Bitcoin, whereas establishments add $43.5 billion to their steadiness sheet in 2025.

Double reversed head and shoulder formation

Crypto analyst Merlijn dealer has recognized what he calls “tremendous cycle formations” on Bitcoin’s long-term charts. He pointed to 2 reversed head and shoulder patterns.

Dream reverse head and shoulders

Left shoulder. head. Proper shoulder.

Not one, however two.

It is a tremendous cycle formation.That is the era setup. Do not fade it. $150k from $btc. Lock in. pic.twitter.com/imyhqjkjkc

-merlijn The Dealer (@merlijntrader) September 4, 2025

The primary sample has grown from 2021 to 2024, with the left shoulder between peaks and corrections from 2021 to 2022, and the top at its lowest stage in 2022, practically $15,000, and the precise shoulder recovering from 2023 to 2024. In 2025, the second small reverse head and shoulder fashioned within the vary of $70,000 to $95,000. Merlijn mentioned:

“This can be a generational setup. Do not fade it. $btc to $150k. Lock in.”

Particularly, the small patterned neckline prices practically $95,000. So long as the value is above it, the forecast is for $150,000. Bitcoin at present trades round $111,000, with consolidation seen within the $110,000-$115,000 zone.

Resistance and short-term stress

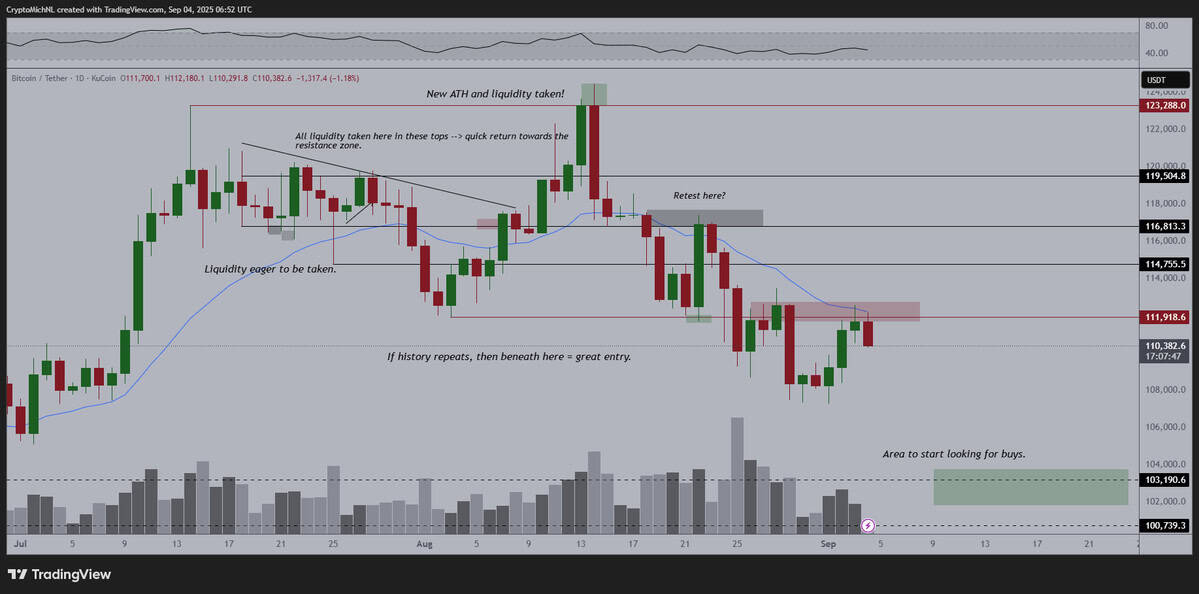

Michael Van de Poppe affords a short-term view, with resistance at $111,918, lining up on the 20-week EMA. Bitcoin is struggling to surpass this stage.

He commented:

“Resistance stays a resistance and the 20-week EMA was unable to interrupt by the resistance as nicely. If this hasn’t damaged, we predict that we are going to make a brand new low one.

If resistance is true, the chart reveals a drop that might vary from $103,000 to $101,000.

Cycle outlook for 2025

Analyst TED in contrast Bitcoin’s market habits to Wall Road’s cheat sheet cycle. He considers September 2025 a interval of sideways or bearish habits adopted by a robust This autumn rally.

In line with his outlook, a blow-off prime may arrive in December 2025 or January 2026, reflecting previous cycle peaks. He mentioned:

“September could possibly be bearish or mendacity down, and an enormous gathering may observe within the fourth quarter. Blow-off tops can be held in December 2025 or January 2026 in the identical method as previous cycles.”

He then hopes for a pointy revision to early 2026.

On the identical time, Bitcoin adoption is being strengthened. Analyst Fortunate famous that corporations at present allocate round 22% of their income to Bitcoin. He additionally reported that the establishment added $43.5 billion value of Bitcoin in 2025 alone to steadiness it.

He wrote:

“There aren’t any indicators of slowing down as hundreds of corporations purchase Bitcoin on daily basis.”

This pattern provides a elementary layer of assist together with technical forecasts, and institutional and company calls for strengthen long-term development expectations.