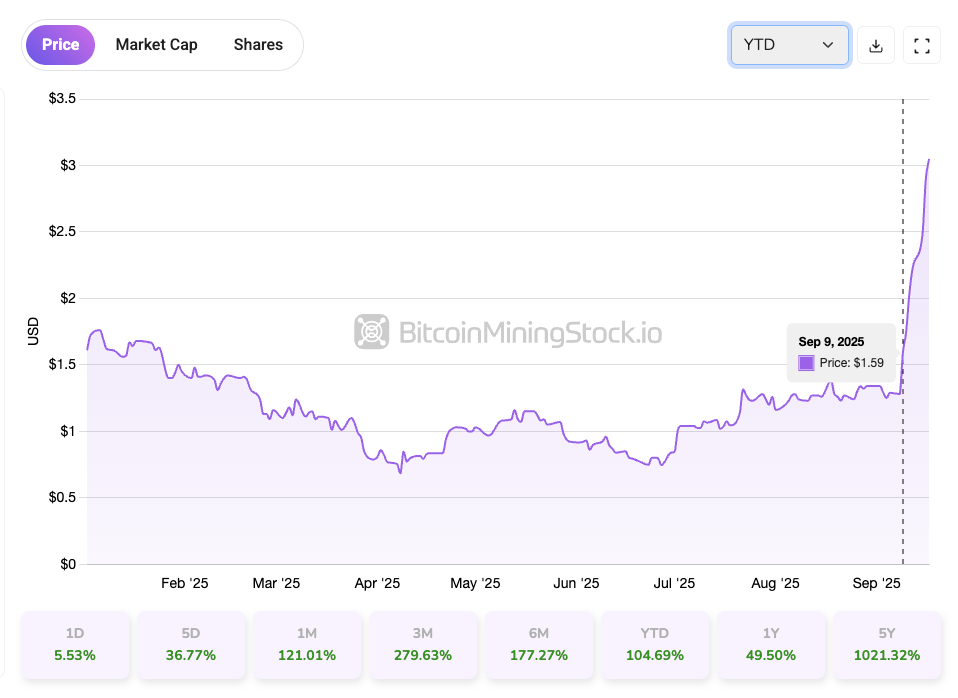

The BITF has taken off and the momentum has not waned. Are there any quietly priced developments available in the market? Or is it time to fully revalue the inventory?

The subsequent visitor publish comes from bitcoinminingstock.io, A public market intelligence platform that gives information on corporations uncovered to Bitcoin mining and cryptocurrency methods.

BitFarms Inventory Value Surge – What is the subsequent time?

BitFarms (NASDAQ: BITF) final week Prime Efficiency Bitcoin mining inventory tracked by BitcoinminingStock.io recorded a spectacular 72.86% enhance over the five-day buying and selling interval. The rally started round September ninth and there are few indicators of slowing down as of writing. This preparation particularly occurred when no firm information releases had been introduced. As a substitute, buyers’ emotions are A brand new understanding of BitFarms’ enterprise transformationCEO Bengagnon amplified at HC Wainwright’s twenty seventh Annual International Funding Convention.

The presentation was not broadly aired, however investor debates about X took the tempo and social feeds turned considerably bullish in BITF. For individuals who are accustomed to me December 2024 Reportthis marks the shift. On the time I wrote:

“BitFarms’ monetary and operational methods are according to trade developments, however the firm struggles to face out resulting from lack of a transparent and distinctive aggressive benefit.”

9 months later, it seems the corporate has discovered Edge – Turns into the North American vitality and computing infrastructure firm. And this evolving technique is lastly attracting buyers’ consideration.

So I want to return to the basics of BitFarms’ current developments and determine if it is time to revalue the inventory.

What Bitfarms CEO mentioned at HC Wainwright Convention

At HC Wainwright On the occasion, Gagnon positioned BitFarm as the long run “North American Power and Computing Infrastructure Firm.” He did the corporate’s 18 eh/s Bitcoin mining operations “Low-cost bridge funding device” To assist migration to HPC and AI infrastructure. Mining nonetheless covers all working bills and contributes to CAPEX. No additional miners purchases or fleet expansions are deliberate. As a substitute, current fleets, which profit from low-cost energy and excessive operational effectivity, are anticipated to generate secure free money flows all through 2026 in most BTC pricing situations. Briefly, BitFarms plans to unlock the potential of an vitality portfolio beforehand constructed to assist mining and serve the rising HPC/AI market.

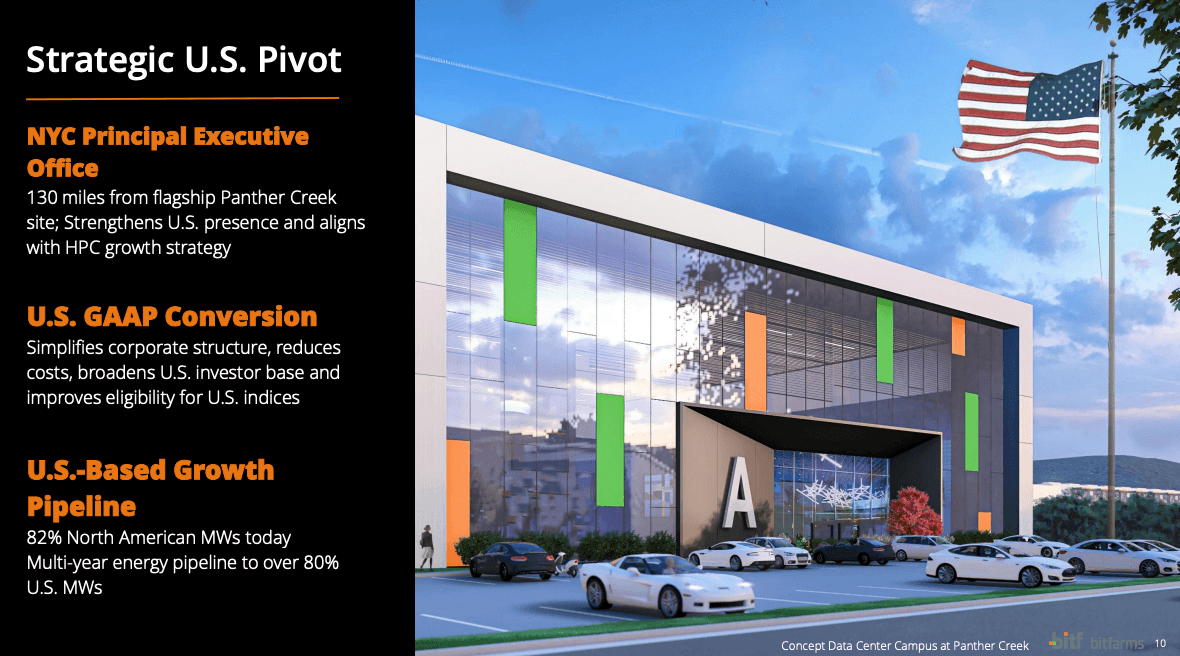

Bit Farm’ Geographical footprint We additionally shifted to assist this technique. When Gagnon turned CEO, solely 45% of the corporate’s footprint was in North America. Right now, that quantity is 82%, nearly every little thing Future progress By November 11, 2025, it exhibits the decisive pivot to turn into a US-focused platform, specializing in Latin America, notably Argentina, from the ultimate exit from Latin America, and particularly Argentina.

Screenshots from BitFarms presentation.

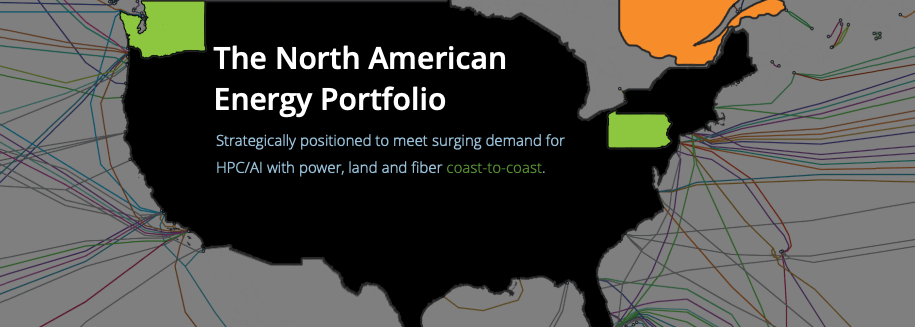

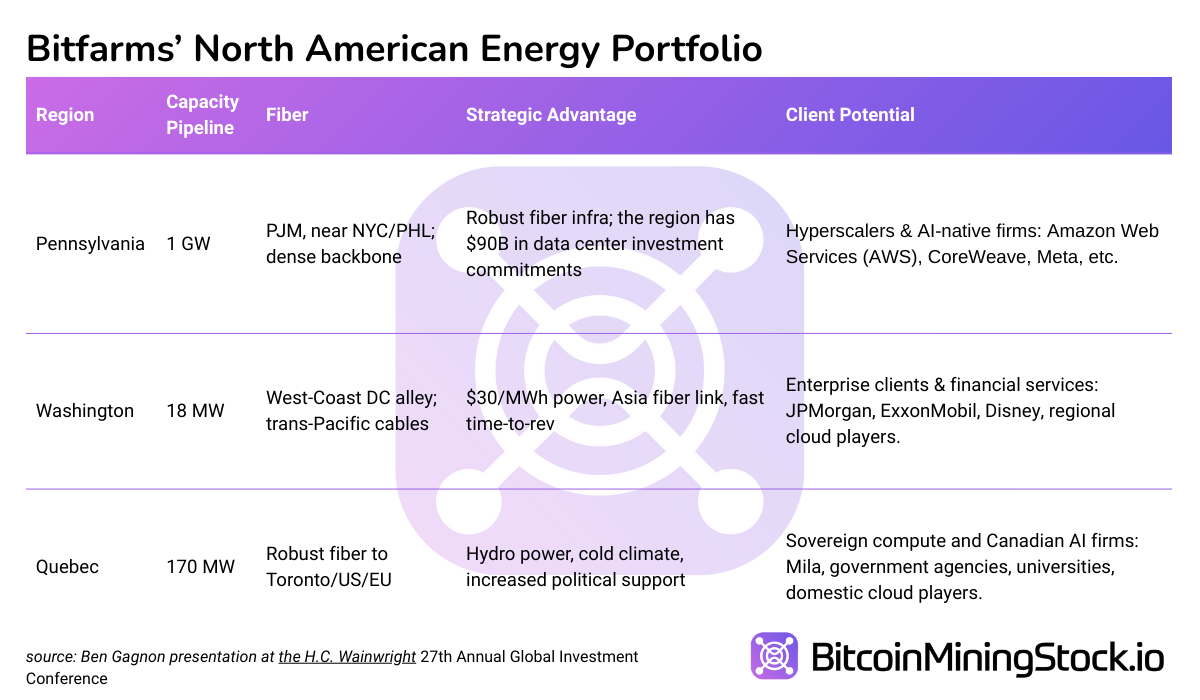

In North America, the corporate presently has a 1.2 GW energy pipeline. Essential WebsitesConsists of companies established in Panther Creek, Pennsylvania, Quebec, and footprint progress in Washington. These websites can be found Close to the principle fiber optic hallenabling assist for information heart workloads throughout North America and doubtlessly throughout the Atlantic. With favorable energy economics and improved energy utilization (PUE), BitFarms believes it will possibly present the next calculation charge per megawatt that offers it a major edge within the HPC market.

This evolving story of in the present day’s mining, tomorrow’s infrastructure, is according to buyers’ emotions. The market clearly exhibits that it prefers long-term, secure revenues from AI infrastructure internet hosting.

Bitfarm HPC Growth: Hype or Actual Advances?

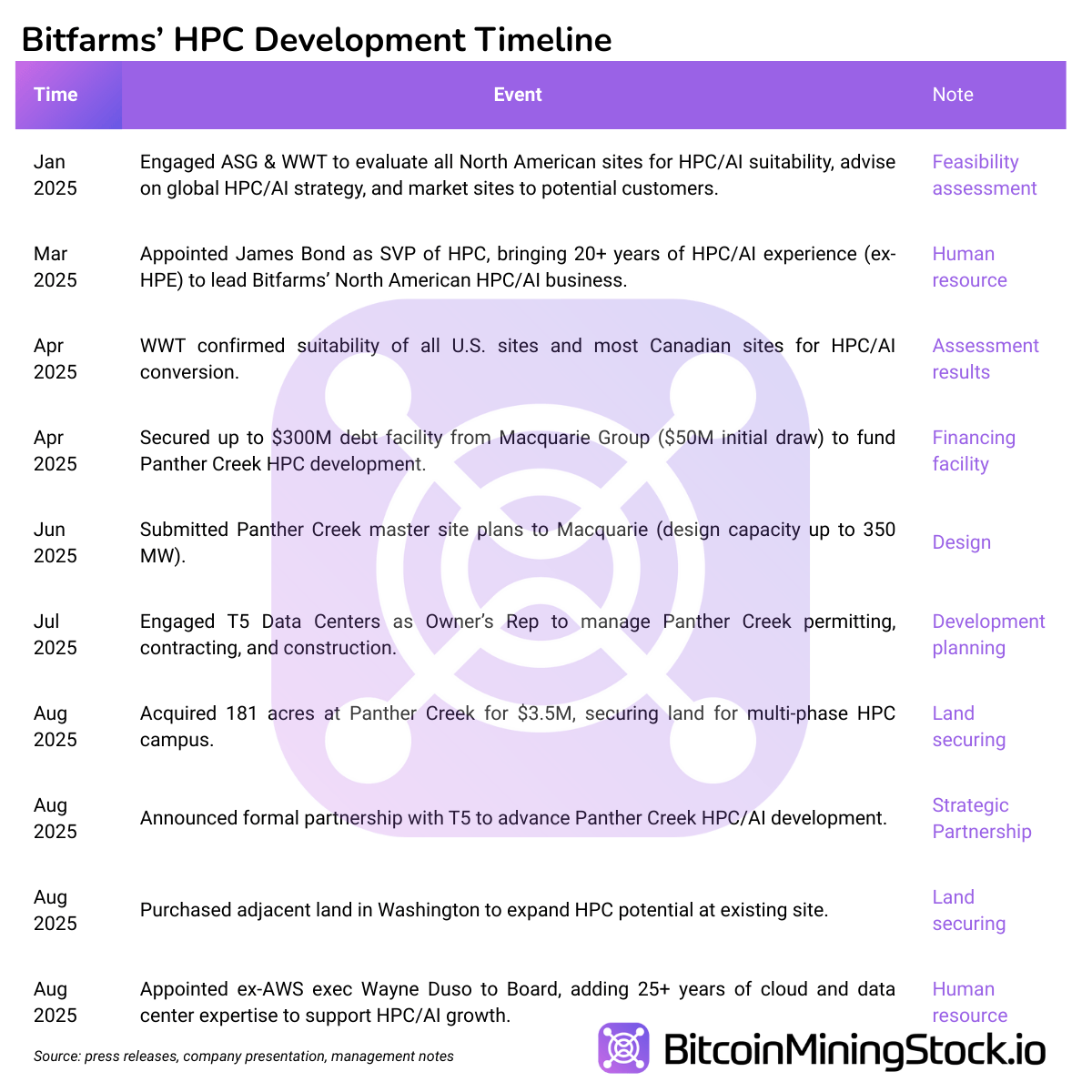

BitFarms HPC growth is Begin taking concrete typesthough it stays within the early phases. Over the past quarter, the corporate has began Web site-level feasibility evaluationprotected permissions and capability, I strengthened my staff Associated experience and institution Strategic Partnerships To promote the location to potential clients.

Many individuals have been criticized for a very long time. Acquisition of the bottomas soon as thought-about a excessive, it turned out to be a strategic asset. With this acquisition, BitFarms has supplied a big, scalable footprint for Pennsylvania, an rising hub for AI and HPC information heart growth. This will increase the probabilities of attracting future AI and HPC purchasers.

Actually, Pennsylvania, a part of the PJM interconnection, is a serious area for AI/HPC buildout BitFarms (the corporate has a 1GW vitality pipeline). In response to that Newest Investor ShowsBitFarms is positioned to satisfy the demand for HPC and AI with cost-based infrastructure from the coast. East (Pennsylvania), West (Washington) and North (Quebec).

Screenshots from BitFarms presentation.

Collectively, these fiber-connected websites enable BitFarm to supply potential susceptibility workloads on each US coasts and hyperlink them to Europe. This community structure is Essential differentiators The corporate pivots in the direction of the HPC infrastructure.

The next desk summarizes the traits of every space.

Briefly, BitFarms has laid a significant basis for HPC and AI pivots, however the initiative stays firmly in place. Pre-profit stage. The subsequent few quarters can be vital in figuring out whether or not this technique will mature right into a scalable income engine or as a substitute turn into a capital-intensive distraction that may burden your steadiness sheets with out short-term rewards.

Pivot funding

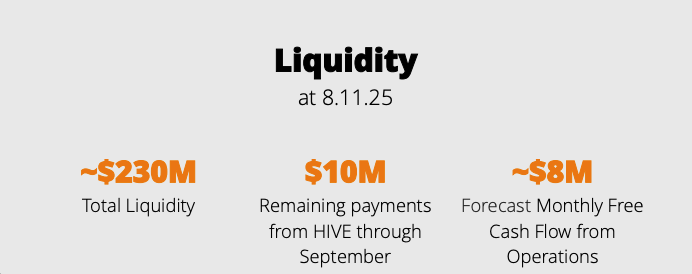

BitFarms funds the transition to HPC via a mix of inner money circulation, asset optimization, and a brand new credit score facility. Half 17.2 EH/S mining fleet generates$8 million per thirty days FCF Within the present market. Administration continues to promote Bitcoin to fund CAPEX and OPEX, whereas retaining 1,005 BTC on its steadiness sheet. By November 11, 2025, Bitfarm’s exit in Argentina will unlock roughly $18 million resulting from lease releases, legal responsibility reductions and the sale of not too long ago imported S21+ miners.

As of August eleventh, the corporate was held ~$230 million liquidity (Money Plus Encumbered BTC), an extra $10 million is anticipated from Yguazu/Hive gross sales and pending miner gross sales.

Screenshots from BitFarms Fluidity Place Firm presentation).

Moreover, BitFarms has secured a As much as $300 million credit score facility from Macquarie Funding the Panther Creek Web site. The primary $50 million was drawn to assist early growth. The remaining $250 million is tied to building milestones. As soon as activated, the construction is transformed to non-licors undertaking debt. The power 8% rate of interestIt features a warrant, a minimal $25 million money requirement, and a BTC value hyperlink settlement. The subsequent tranche is anticipated for the fourth quarter of 2025 and is topic to progress permission.

Such a funding construction Save flexibility and restrict dilutionthere’s a timing hole to handle. HPC income stays quarterly aside (doubtlessly since 2026). In the meantime, fellow members like Core Scientific, Terawulf and Utilized Digital have already onboarded boarding purchasers. Working pace, price administration and buyer acquisition are key to filling the hole.

Last Ideas

BitFarms is actively pivoting from international Bitcoin miners to North American vitality and computing infrastructure corporations. Its US web site is near main textile traces, offering technical viability to assist AI internet hosting workloads from coast to coast* And even Hypotheticallyto Europe for low energy prices and favorable geographical areas.

*The “coast to coast” reaches a convincing sound, however requires some grounded perspective. BitFarms’ West Coast presence in Washington solely has an capability of 18 MW. Its North (Quebec) web site, though fairly giant, is topic to regulatory approval earlier than being reused for HPC workloads. This may depart the East as the corporate’s solely HPC-enabled asset with a transparent roadmap for now.

Nevertheless, the transition is early. The corporate is both prepared for purpose-built information facilities or has not landed materials HPC transactions. Till then, lots of the advantages stay formidable. However insider conduct provides some confidence: the corporate Share the buyback program CEO Bengangon has it He elevated his private holdings.

For buyers with a 12-24 month horizon, BitFarms could current a chance for asymmetrical resulting from their urge for food for early-stage infrastructure progress at a deep valued entryway. From superior recruitment to fiber-enabled properties and incremental funding, its growth supplies particular causes to revisit the paper.

In the end, it is your enchantment whether or not or not you need to revalue your inventory. Nevertheless, if BitFarms supplies even a part of the infrastructure story, the upward case could look fairly totally different from typical Bitcoin mining play.