Regardless of the business’s most profitable merchants betting on Ethereum’s value to fall, Bitmine Immersion Applied sciences, the world’s largest company holder of Ethereum, continues to purchase on the bullshit.

Based on blockchain information platform Lookonchain, Bitmine has acquired $199 million value of ether (ETH) prior to now two days by means of purchases of $68 million on Saturday and one other $130.7 million on Friday.

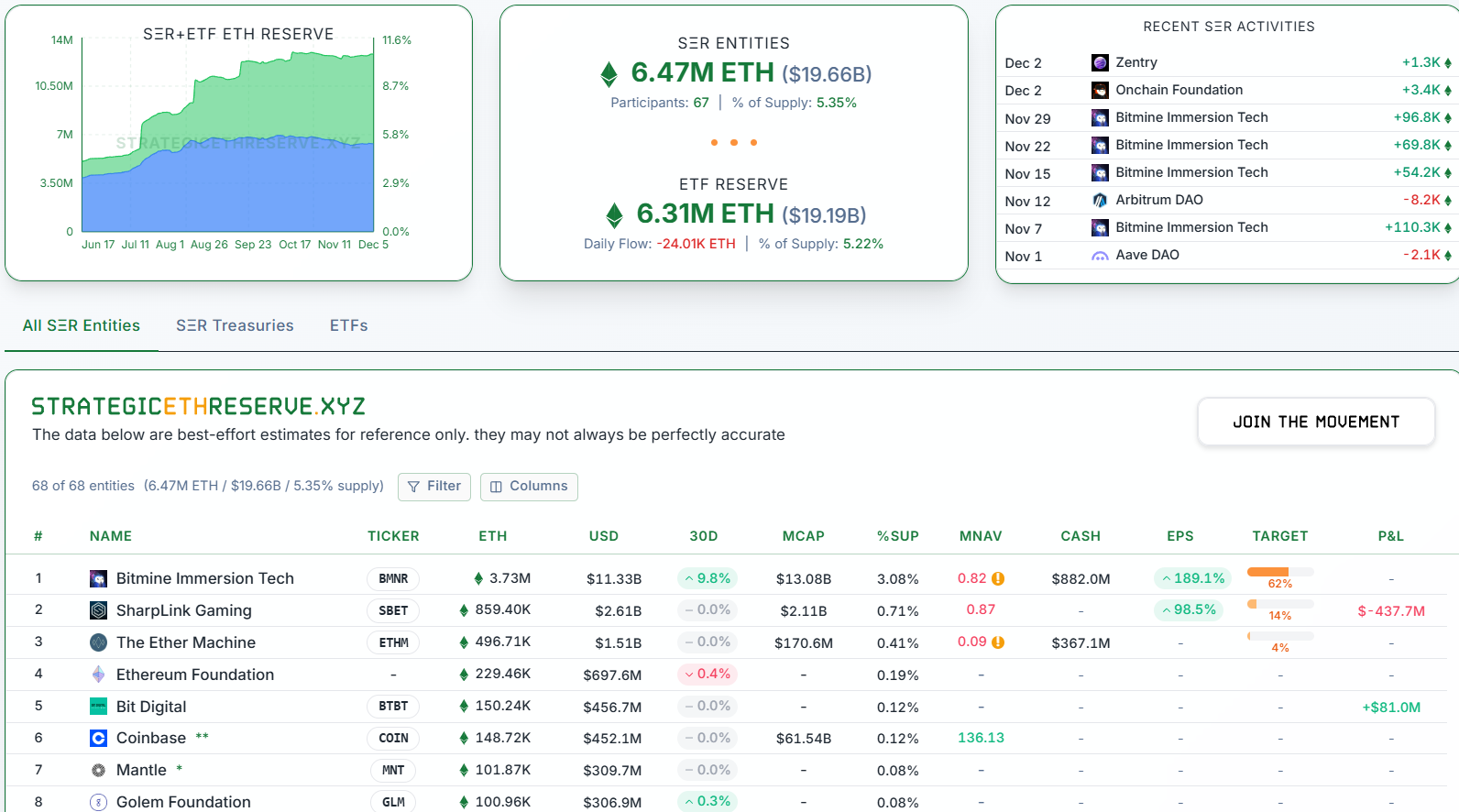

Based on information from StrategicEthReserve, with the newest funding, BitMine now holds $11.3 billion, representing 3.08% of the overall Ether provide and approaching its 5% accumulation aim.

BitMine’s continued accumulation is a powerful signal of confidence in Ether’s long-term progress potential. The corporate additionally has $882 million in money that might be used to build up extra ether.

Largest company ether holder. Supply: strategicethreserve.xyz

BitMine’s funding comes amid a major slowdown in digital asset treasury (DAT) exercise, with company Ether acquisitions dropping 81% in three months, from 1.97 million Ether in August to 370,000 web ETH acquisitions in November.

Regardless of the slowdown, BitMine collected the biggest share over the previous month, or 679,000 Ether value $2.13 billion.

Sensible cash merchants are betting on a decline within the value of Ether

The crypto business’s most worthwhile merchants, tracked as “sensible cash” merchants on Nansen’s blockchain intelligence platform, are betting on a short-term decline within the value of Ether.

Sensible cash merchants maintain high perpetual futures positions in Hyperliquid. Supply: Nansen

Sensible cash merchants added $2.8 million briefly positions prior to now 24 hours, Nansen mentioned, including that the group was web shorting Ether, bringing the overall brief place to $21 million.

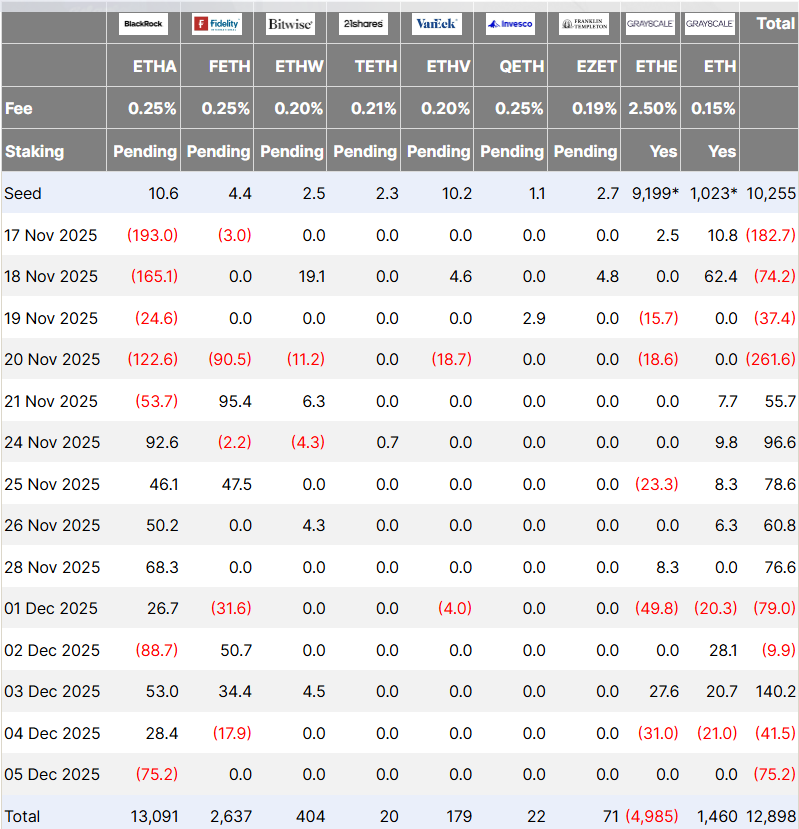

Ethereum exchange-traded funds (ETFs), a key driver of Ether liquidity, additionally proceed to lack demand.

Ethereum ETF Movement USD (in thousands and thousands). Supply: Farside Traders

The Spot Ether ETF recorded web outflows of $75.2 million for the second straight day on Friday, following November’s $1.4 billion in month-to-month outflows, in keeping with Pharcyde Traders.