Bitmine Immersion added 78,791 ETH to its funds, bringing its complete holdings to just about 1.8 million ETH.

abstract

- Bitmine Immersion spent $354.6 million to win 78,791 ETH, growing its complete holdings to 1,792,960 ETH, price greater than $8 billion.

- The corporate goals to carry 5% of its complete provide of Ethereum.

- Tom Lee predicts that ETH may attain $5,500 and surge from $10,000 to $16,000 every year.

- The strategic pivot from Bitcoin to Ethereum was introduced in late June and is supported by a $250 million wage improve.

Bitmine Immersion has added 78,791 Ethereum (ETH) to its holdings, spending roughly $354.6 million. The acquisition will convey the corporate’s complete Ethereum holdings to 1,792,960 ETH, price greater than $8 billion as ETH trades round $4,400. It additionally brings Bitmine nearer to the acknowledged aim of gaining 5% of complete ETH provide.

This newest buy continues Bitmine Immersion’s aggressive Ethereum accumulation technique. Underneath Tom Lee’s steering, the publicly-published firm introduced its strategic pivot from Bitcoin (BTC) mining to Ethereum accumulation in late June. The transfer was marked by a $250 million wage improve geared toward buying Ethereum as the corporate’s most important Treasury Protected Asset. The announcement has resulted in Bitmine’s inventory value surged by 3,000%.

You would possibly prefer it too: Tom Lee predicts that Ethereum can be on the backside a number of hours after Bitmine snaps 4,871 ETH

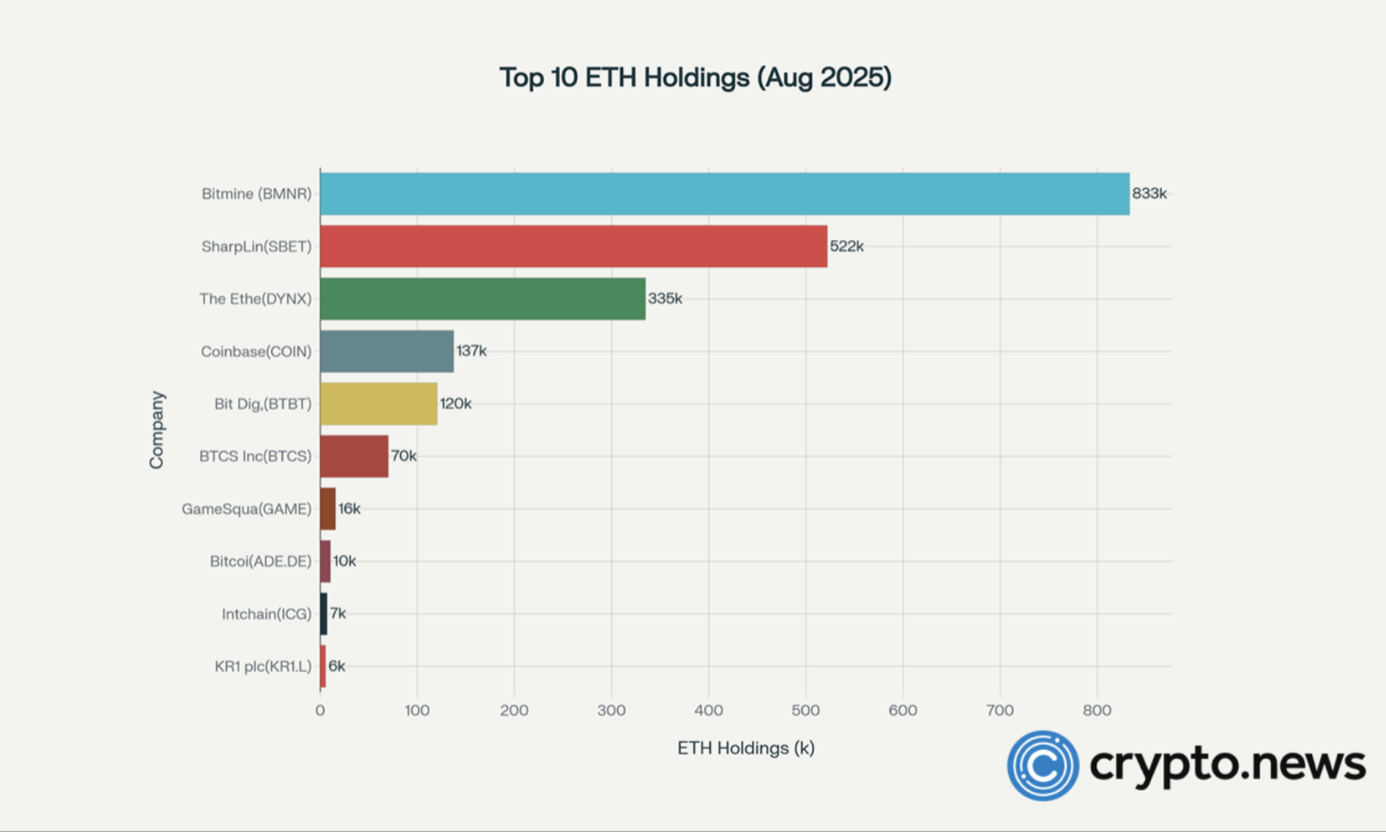

Bitmine Immersion leads the system’s ETH accumulation

Bitmine Immersion’s pivots on ETH accumulation replicate the rising institutional curiosity in Ethereum for this bullish circulation. This development contrasts with the earlier cycle by which ETH was largely missing help from key companies or institutional finance ministries.

Alongside Bitmine, different publicly obtainable ETH financing corporations, together with Sharplink Gaming (SBET) and BTCS Inc. (BTCS), are seeing related momentum.

Supply: crypto.information

Analysts counsel that ETH Treasury shares could supply extra enticing valuation and operational flexibility than ETFs, as they mix liquidity, effectivity and potential earnings by means of a capital construction that isn’t obtainable in passive ETF merchandise.

You would possibly prefer it too: Bitmine Immersion’s $500 Million ETH Pivot Shakes Crypto Monetary