The controversy erupted simply days after Bitmine’s (BMNR) annual shareholder assembly in Las Vegas, revealing a pointy rift between administration and buyers.

It facilities round governance, transparency, and the corporate’s formidable transition from pure Ethereum staking automobiles to “digital Berkshire-style” capital allocation.

BitMine executives handle shareholder considerations after controversial shareholder assembly

Shareholders criticized the overall assembly, citing absenteeism from executives, rushed shows and unclear voting outcomes.

Neither the brand new CEO nor CFO attended, nor did any promised high-profile visitor audio system. On this foundation, buyers have described the gathering as poorly managed and impolite, with some likening it to a “clown present.”

Respectfully?

You and your board have to cease and take a tough take a look at what occurred and be sincere in regards to the elephant within the room. Shareholders are very offended and for good cause. I despise myself for being one among them.

We hardly met at that shareholder assembly… https://t.co/uhLWwTEXvx

— Christopher O’Malley (@chris_t_omaley) January 18, 2026

Considerations have been raised when Tom Lee assumed management of Fundstrat on the identical time, elevating questions on whether or not he would be capable to commit sufficient consideration to Bitmain.

Director Rob Sechan acknowledged shareholders’ dissatisfaction, however careworn that the overall assembly was held throughout a transition interval. A number of government positions have been reportedly crammed a number of days in the past.

He defended the board’s oversight, noting that the aim of the overall assembly was to clarify the corporate’s “DAT Plus” technique and display its long-term potential.

I’ve heard folks complaining about this, and I need to straight acknowledge it.

This common assembly was held throughout a interval of considerable transition. @BitMNR’s administration staff is generally new members, with a number of positions crammed inside days of the assembly. This was the primary annual common assembly…

— Rob Sechan (@RobSechan) January 18, 2026

However critics argued the board’s response failed to deal with basic problems with planning, transparency and accountability.

Strategic shift: From staking to digital capital allocation as MrBeast deal divides buyers

Regardless of criticism of governance, administration emphasised essential strategic shifts. BitMine goes past Ethereum We intention to turn into a digital holding firm and can make investments capital in tasks that increase the adoption of Ethereum.

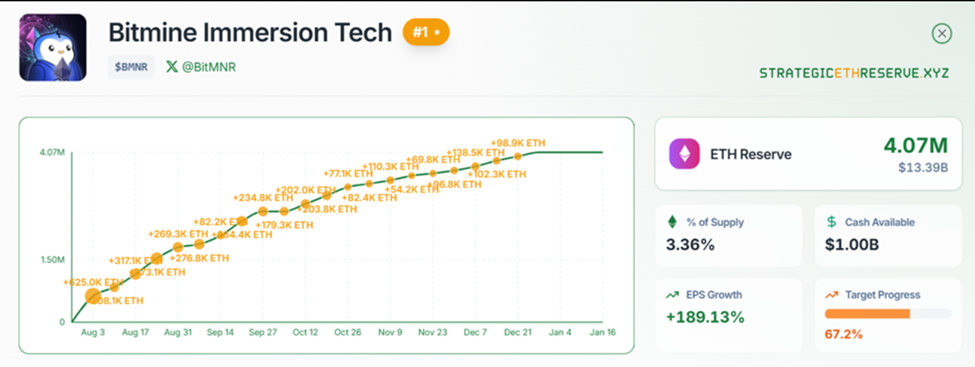

The corporate holds over 4 million Ethereum (roughly $14 billion), producing $400-430 million yearly from staking and focusing on 5% of Ethereum’s complete provide, elevating the forecast to $540-580 million.

Bitmine Ethereum Holdings. Supply: strategyethreserve.xyz

Sechan likened the technique to Berkshire Hathaway, describing it as a disciplined capital allocation tailored to the digital age.

“A disciplined enlargement right into a capital-based and productive enterprise is what $BRK is doing. Identical idea, completely different period and rails,” he wrote, pushing again towards critics who dismissed the transfer as too formidable.

Essentially the most controversial component was BitMine’s $200 million pledge to MrBeast’s Beast Industries. This funding goals to combine Ethereum into the creator financial system via a tokenized platform and distribution community.

Proponents argue that the deal leverages one of many world’s largest consideration engines to speed up adoption amongst Gen Z and Alpha audiences.

However critics see the partnership as a distraction from governance and operational priorities and query whether or not the corporate is overextending itself.

Taken collectively, the convention revealed a stark pressure between ambition and accountability. BitMine’s strategic imaginative and prescient guarantees long-term progress, however stakeholders stay cautious of execution dangers and management gaps.

Mr Sechan pledged to extend transparency and engagement, with future conferences anticipated to be extra structured and interactive.

As BitMine seeks to stability governance, investor belief, and daring innovation, the corporate faces important challenges. The corporate must show that its “Digital Berkshire” mannequin can ship each capabilities. Ethereum Obtain earnings and a broader imaginative and prescient with out alienating shareholders.

The publish BitMine management reacts after controversial shareholder assembly appeared first on BeInCrypto.