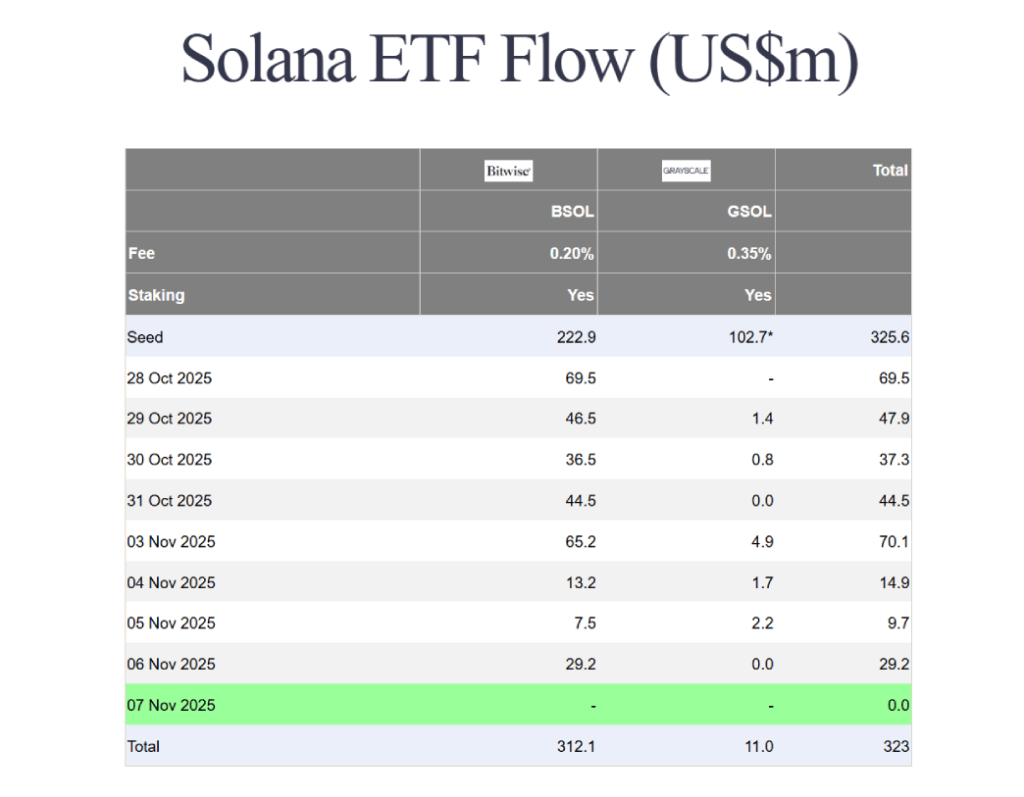

- Bitwise’s Spot Solana ETF recorded constructive inflows for eight consecutive days, totaling $312.

- Solana worth is poised for a bullish rebound from the $150 flooring.

- Solana surpassed Ethereum in app income, producing $4.34 million within the final 24 hours.

SOL, the native cryptocurrency of the Solana blockchain, made a bullish rebound from the $150 help on Friday, posting an intraday acquire of 5.3%. The rally comes as a broader market correction slows, with Bitcoin displaying resilience above the $100,000 stage. Nonetheless, Solana gained much more momentum because the Bitwise SOL Spot ETF continued to obtain inflows and Solana’s app income elevated considerably. Will this set off be sufficient to gas a sustained restoration for this altcoin?

Bitwise Solana ETF data 8 consecutive days of inflows

Following the crypto market decline on November third, Solana worth moved sideways above the $150 help. Since then, worth motion has proven a number of failed makes an attempt to interrupt out of this help, however a long-tail rejection has introduced it again down, indicating that demand stress stays intact.

Along with the slowing market correction, Solana worth resilience will be attributed to constant investor demand for the not too long ago launched Bitwise Solana ETF (ticker: BSOL).

In accordance with information shared by Farside Buyers, the Bitwise Solana ETF has recorded eight consecutive days of internet inflows, bringing the full quantity invested for the reason that ETF’s inception to $312 million. The product did very properly throughout this era, attracting roughly $39 million in new funding per day. This exhibits curiosity from institutional buyers and retailers regardless of the general market volatility.

Whereas asset flows are displaying constructive indicators, on-chain efficiency information exhibits that Solana is outperforming its closest rival Ethereum in shocking areas. In accordance with DeFiLlama, decentralized purposes on the Solana community generated an estimated $4.33 million in income previously 24 hours, in comparison with $1.82 million for Ethereum-based purposes.

Over a 30-day interval, the distinction is much more dramatic, with Solana persevering with to guide by way of complete app income. This can be a uncommon reversal of the long-term development by which Ethereum dominated in protocol and utility income metrics.

Ethereum has persistently outperformed its rivals by way of community exercise and developer income in earlier quarters, however Solana’s fast development in DeFi and shopper purposes is more likely to change that dynamic.

Solana worth poised for short-term rebound in direction of $180

Over the previous two weeks, Solana’s worth has seen a notable correction from $205 to its present buying and selling worth of $163, a 20% loss. Because of this, the asset market capitalization plummeted to $90.5 billion.

Throughout this pullback, the coin worth decisively broke away from the help development line of the channel sample on the each day chart. Since March 2025, the altcoin has adopted a gradual restoration development inside this channel, with the worth resonating between two parallel development strains.

The current breakout due to this fact indicators a change in market dynamics, strengthening sellers’ management over this asset. Nonetheless, with right now’s 5.32% improve, Solana worth exhibits a rebound from the $150 help and a attainable retest of the damaged development line at $180.

The damaged trendline is now in step with the 200-day exponential shifting common, offering a robust protection towards worth will increase. If sellers proceed to stick to this barrier, the correction might transfer under the $150 flooring and prolong in direction of the $125 help.

SOL/USDT-1d chart

Conversely, if the coin worth manages to make a bullish breakout at $1.80 and re-enter the channel vary, the bearish thesis will likely be invalidated.