Ripple’s Swell 2025 convention in New York might have marked one of the crucial defining moments within the relationship between the digital asset business and Wall Avenue. The XRP neighborhood specifically acquired some long-awaited validation.

Maxwell Stein from BlackRock’s digital belongings crew instructed the viewers in his keynote that “the market is prepared for blockchain adoption at scale” and that Ripple’s infrastructure may quickly transfer trillions of {dollars} on-chain.

BlackRock Validates Ripple in Swell 2025 — Cheers to the XRP Neighborhood

Stein praised early business builders like Ripple for proving the real-world utility of blockchain, not simply as a speculative idea however as a practical layer of economic infrastructure.

“They’re already tokenizing bonds, bonds, stablecoins…that is a begin. However this can be a rail for trillions of capital flows,” Stein stated.

BlackRock executives publicly praised Ripple for serving to show blockchain’s real-world performance, marking a milestone in a narrative that XRP holders have championed for years.

The remark got here like a thunderclap for a neighborhood that has lengthy argued that Ripple’s expertise helps institutional liquidity.

The XRP neighborhood has lengthy held to the assumption that Ripple’s expertise acts as a bridge between conventional finance and the decentralized financial system.

Following Mr. Stein’s remarks, XRP supporters throughout Twitter considered the remarks as a much-needed validation from the world’s largest asset supervisor.

🚨Breaking information: BlackRock exec on Ripple swell: “The market is prepared — trillions of {dollars} coming on-chain” 💥

This might need been probably the most emotional second of @Ripple Swell 2025.

Maxwell Stein, president of @BlackRock, took to the stage and spoke candidly about what everybody has been as much as… pic.twitter.com/OpuysMrq47— Diana (@InvestWithD) November 4, 2025

“We’ve got seen what the early adopters of cryptocurrencies have finished. They confirmed us what is feasible, and now the market is prepared for broader adoption,” he added.

His assertion highlighted a shift in tone from TradFi that blockchain is not an experiment. Reasonably, it’s the new regular.

Authorized warning and institutional readability tempers the hype

However the ensuing pleasure was tempered by authorized warning. Invoice Morgan, an Australian lawyer and distinguished XRP supporter, was one of many first to query Stein’s feedback. He questioned in the event that they mirrored BlackRock’s official place or had been merely Stein’s private opinions.

“Very attention-grabbing…however was he talking in a private capability or on behalf of BlackRock?” Morgan posted on X.

What’s at stake? This query resonated deeply. If Stein’s assertion indicators BlackRock’s strategic confidence in tokenized finance, it might be one of many clearest indicators but that institutional adoption is imminent.

Personally, this stays a powerful however unofficial endorsement of Ripple and the route of blockchain.

On the similar occasion, Nasdaq President and CEO Adena Friedman stated the digital asset market is clearly maturing. Nonetheless, she additionally acknowledged that regulatory readability is important for severe institutional participation.

He famous that banks are already experimenting with tokenized bonds and stablecoin frameworks, and burdened that “we’d like regulatory readability to permit banks to completely take part out there.”

Collectively, Stein and Friedman’s feedback painted an image of convergence the place TradFi, blockchain, and regulation work collectively.

Ripple’s “Swell 2025” convention, as soon as an business occasion primarily for crypto insiders, grew to become the stage for a number of the most influential voices in international finance to sign preparations for consolidation.

Regardless of these developments, Ripple’s worth stays depressed because the community’s institutional buying and selling expands and XRP’s adoption explodes.

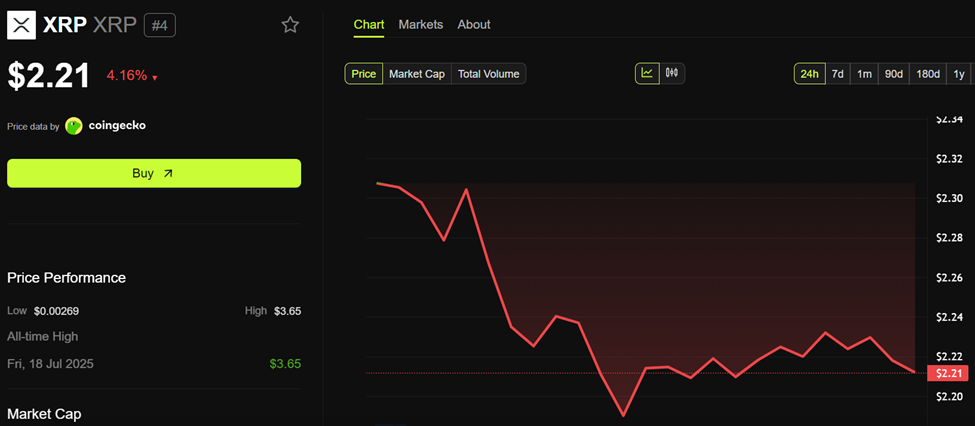

Ripple (XRP) worth efficiency. Supply: BeInCrypto

Prior to now 24 hours, XRP worth has fallen by greater than 4%. On the time of writing, it was buying and selling at $2.21.

The publish What BlackRock has in retailer for the XRP neighborhood appeared first on BeInCrypto.