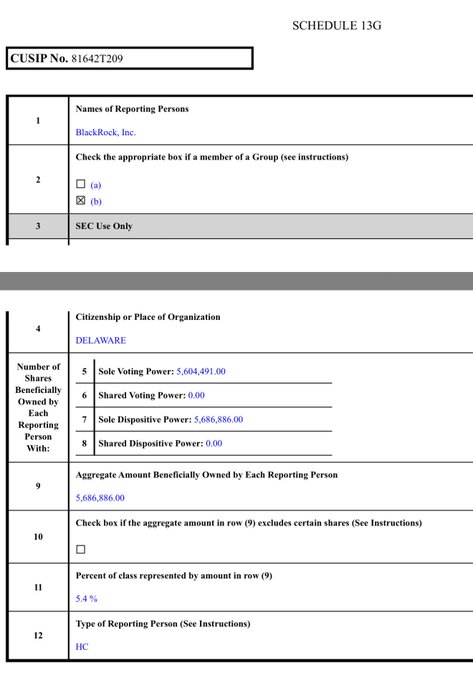

BlackRock (NYSE: BLK), the world’s largest funding administration firm, has introduced a 5.4% possession curiosity in biopharmaceutical firm Seras Life Sciences Group (NASDAQ: SLS).

Particularly, the inventory will quantity to five,686,886 shares and the funding big may have voting energy within the firm, in accordance with a Schedule 13G submitting with the U.S. Securities and Alternate Fee.

BlackRock’s endorsement comes at a crucial time, particularly as SLS inventory has proven sturdy bullish momentum in latest buying and selling. Shares rose 38% to shut at $2.14 in after-hours buying and selling on Friday, marking a 100% improve for the reason that starting of the 12 months.

Fundamentals of SLS inventory

On the identical time, the corporate’s fundamentals seem to assist potential sustained progress. Sellas Life Sciences, a late-stage biotechnology firm, not too long ago demonstrated significant medical advances throughout its pipeline.

The corporate’s lead candidate, galinpepimut-S (GPS), is at present in a Part 3 trial generally known as REGAL for acute myeloid leukemia (AML). Median unbiased affected person survival is reportedly greater than 13.5 months, greater than double the historic common for traditional of care. Remaining information readout is predicted to be accomplished by the tip of 2025.

Seras’ second main notable program, SLS009 (tanbiciclib), a selective CDK9 inhibitor that additionally targets AML, has produced promising ends in Part 2.

To this finish, Friday’s improve got here partly following studies that SLS009 confirmed sturdy preclinical ends in T-cell prolymphocytic leukemia, bettering survival and decreasing tumor burden when used alone or together with venetoclax.

The U.S. Meals and Drug Administration (FDA) has already granted Seras Quick Monitor and Orphan Drug Designations for each packages and has supplied steerage to start a first-line AML examine of SLS009 in early 2026.

Total, BlackRock’s disclosures recommend that the establishment has rising confidence in Seras’ long-term potential, regardless of the dangers inherent in biotech investments.

For traders, future valuations are prone to rely upon the outcomes of the REGAL trial, which may very well be transformative if closing information confirms an early survival profit.

Featured picture through Shutterstock