Blockchain infrastructure firm World Settlement Community has introduced a pilot to tokenize a water therapy facility in Jakarta, with the intention of finally scaling out to different elements of Southeast Asia with $200 million in tokenized property over the following 12 months.

Tokenization of real-world property includes minting monetary property and different tangible property on a blockchain to extend investor accessibility and buying and selling alternatives.

Within the first pilot, eight government-contracted water therapy services in Jakarta are focused for tokenization, with the intention of elevating as much as $35 million for facility upgrades and growth of the native water community, in keeping with an announcement on Wednesday.

As a part of a phased rollout of this initiative over the following 12 months, the businesses plan to check Rupiah and stablecoin cost rails in managed corridors, after which scale as much as further international change corridors.

Following the pilot in Jakarta, the businesses hope to increase the mission to as much as $200 million in tokenized property throughout Southeast Asia.

Tokenization may assist clear up funding hole

Mas Wichaksono, chairman of Indonesia-based Globalasia Infrastructure Fund, stated: “This mission provides important development alternatives as Indonesia has plenty of main infrastructure developments and pure property that may be accessed for tokenization.”

The businesses say water infrastructure funding gaps are rising throughout Southeast Asia, and long-term water investments of greater than $4 trillion can be wanted by 2040, exceeding present spending.

Some crypto executives predict that the tokenized real-world property (RWA) market will develop considerably in 2026, pushed by adoption in rising international locations dealing with challenges in capital formation and attracting international funding.

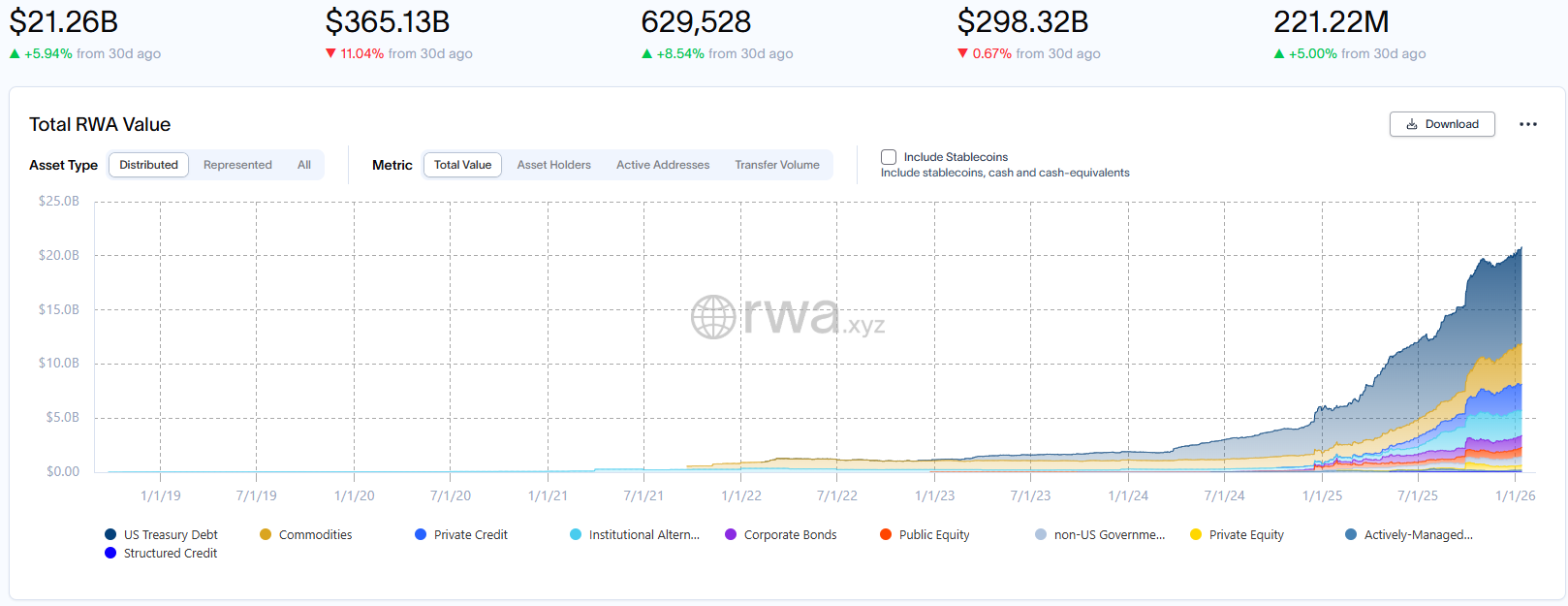

In keeping with RWA.xyz, as of Thursday, greater than $21 billion in RWA is estimated to be on-chain, with greater than 629,528 holders.

It’s estimated that over $21 billion of real-world property are on-chain. sauce: RWA.xyz

Southeast Asia is already a hotbed for cryptocurrencies

Southeast Asia already has a excessive degree of cryptocurrency adoption. The Chainalysis Cryptocurrency Adoption Index, launched in September, recognized the APAC area, which incorporates Southeast Asia, because the quickest rising area for on-chain cryptocurrency exercise, with receipts growing 69% year-on-year.

Associated: Plume CEO suggests RWA will outgrow crypto natives and develop 3-5x by 2026

In a follow-up report, Chainalysis reported that Indonesia is the second-largest marketplace for on-chain worth, with a 103% improve within the 12 months to June 2025.

journal: The massive query: Can Bitcoin survive a 10-year blackout?