The smarter net firm, the UK’s largest firm Bitcoin holder, is contemplating buying rivals struggling to broaden the Treasury Division, CEO Andrew Webley mentioned.

Webley advised the Monetary Instances that it will “definitely think about” shopping for up rivals and getting Bitcoin (BTC) at a reduced value.

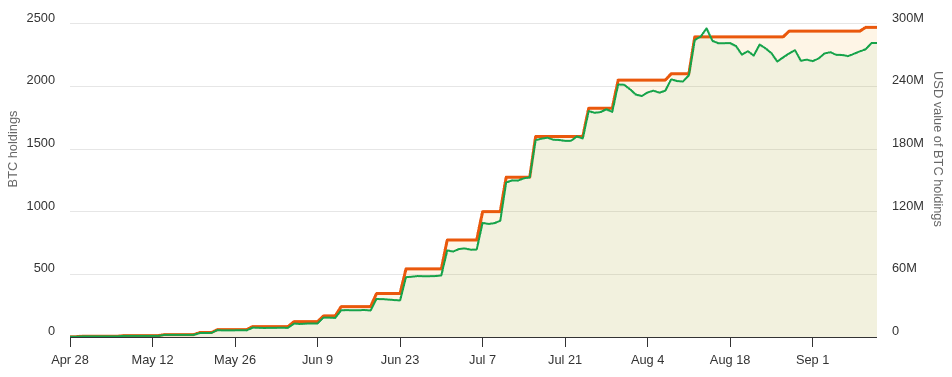

In line with information from bitcointreasuries.web, the smarter net firm is the twenty fifth largest on the earth and the UK’s prime company Bitcoin Treasury. It at the moment holds 2,470 BTC, almost $275 million.

Smarter Net Firm’s BTC Holdings (Orange) and BTC Holdings USD Worth (Inexperienced). Supply: bitcointreasuries.web

The CEO of Smarter Net Firm mentioned the corporate is aiming to affix the FTSE 100. That is the index of the highest 100 UK firms. He additionally mentioned that firms that might change their identify have been “inevitable,” however that it will should be “to do it correctly.”

“Buy belongings from bankrupt crypto firms usually promise reductions, however in actuality it is a lot harder than everybody thinks,” mentioned Alex Obchakevich Analysis founder.

Associated: Metaplanet, Smartweb provides almost $100 million to Bitcoin to Treasury

Obchakevich cited the chapter of Crypto Trade FTX and Crypto Lender celsius. He defined that the low cost initially reached 60% to 70%, however “after deducting liabilities settled in chapter, liabilities eliminated by courts and taxes, the web low cost falls to 20-50%.”

“This attracts knowledgeable buyers as a result of belongings are undervalued because of urgency.”

Webley’s feedback come after Smarter Net’s inventory fell almost 22% on Friday, down from $2.01, which was open to $1.85 on the time of writing. The decline occurred regardless of BTC having elevated by greater than 1% over the past 24 hours.

Smarter net firm inventory charts. sauce: Google Finance

Final month, Bitcoin additionally misplaced greater than 4% of its worth, however costs for smarter net firms fell by round 35.5%.

The Smarter Net value changes will even happen after the UK allowed retail buyers to entry Cryptocurrency Trade Money owed (CETNS) in early August, which grew to become efficient from October eighth.

Associated: The UK’s smarter net firm is elevating $21 million via Bitcoin-denominated bonds

Make revenue from competitor failures

Webley’s feedback on the acquisition of rivals observe experiences that Bitcoin’s funds, notably new and small Treasury, are more likely to run into bother. Coinbase analysis director David Duon and researcher Colin Basco lately mentioned they’ve entered the “participant vs. participant” stage the place public firms shopping for crypto are fiercely competing for investor cash.

They mentioned, “Strategically positioned gamers will flourish.” Analysts additionally mentioned the market section has been quickly oversaturated, and lots of cryptocurrency ministries can’t survive in the long run.

Josip Rupena, CEO of lending platform Milo and former Goldman Sachs analyst, advised Cointelegraph late final month that Crypto Treasury Corporations mirrored the dangers of secured debt that performed a key function within the 2008 monetary disaster.

“For instance, there may be this facet of individuals taking photos of fairly wholesome merchandise, mortgages right this moment, and Bitcoin and different digital belongings right this moment.

journal: Bitcoin can sink to “Beneath $50K” on Justin Solar’s WLFI Saga: Hodler’s Digest, August thirty first – September sixth.