The Crypto market sees Bitcoin and XRP as potential buy-out alternatives, in accordance with on-chain analytics agency Santiment. Retailers present that they’ve far much less pleasure about Bitcoin and XRP in comparison with Ethereum.

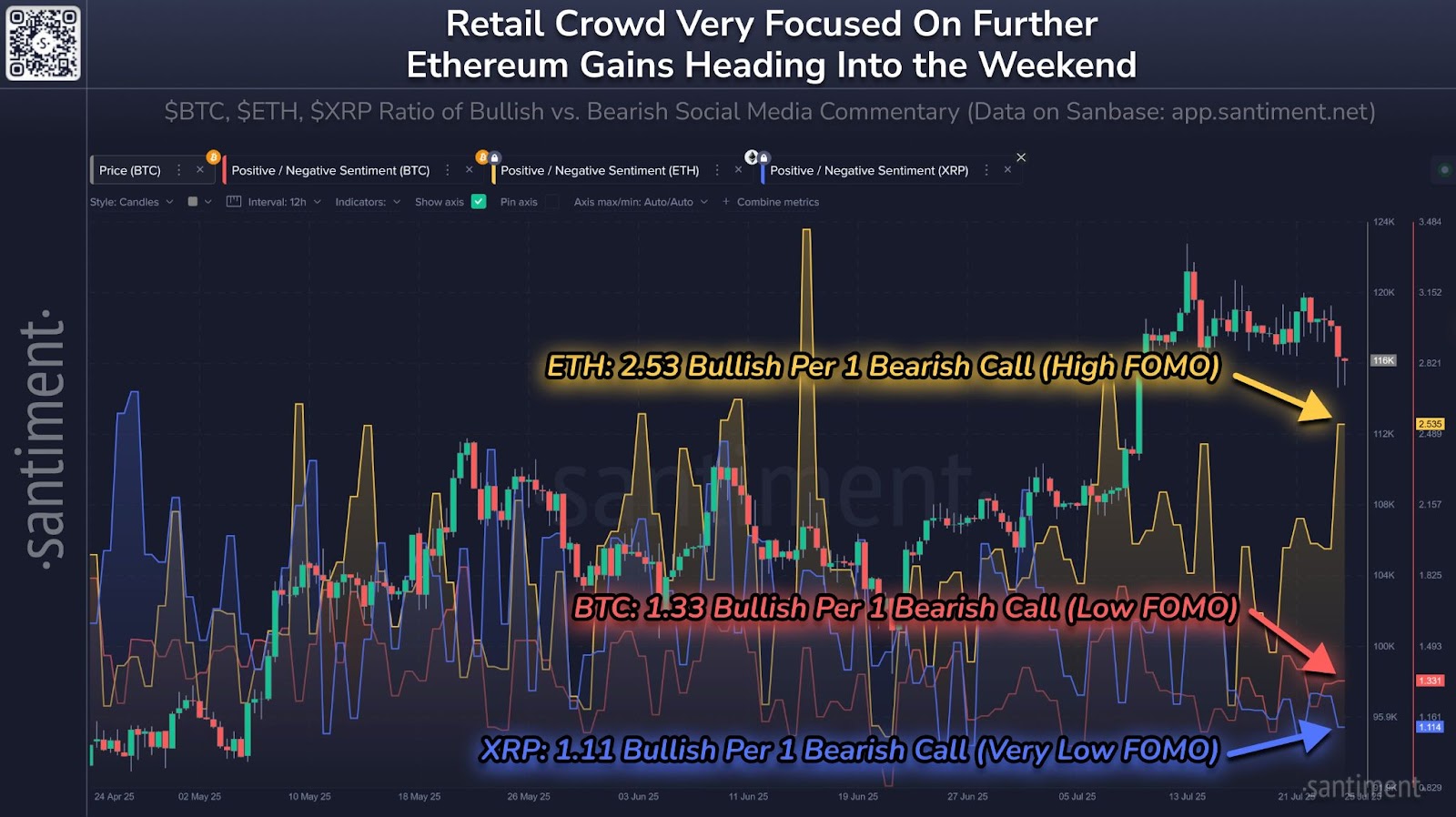

Santiment Feed shared a social information chart on X’s Friday. This reveals the imbalance of what retailers are speaking in regards to the high three cryptocurrencies on social media.

Santiment Feed Retail Crowd Social Point out Chart. Supply: Santiment

Ethereum leads the sentiment index with a 2.53-1 ratio of bullish and bearish calls. A excessive stage of optimism is interpreted as proof of the FOMO of the etheric crowd, the worry of lacking out. This usually precedes the worth adjustment of the related property.

However, Bitcoin and XRP confirmed a extra muted emotion measurement of 1.33 to 1, and a bullish and favorable ratio of 1.11 to 1, respectively. Santiment analysts notice that such circumstances usually create entry factors, as markets are likely to go in opposition to the expectations of the bulk.

Though Ethereum is extra weak to inversion, decrease ranges of enthusiasm in BTC and XRP can create room for accelerating the rising costs.

Bitcoin has come near its highest ever excessive and has seen income

Regardless of having comparatively impartial sentiment, Bitcoin is approaching the all-time excessive of $123,000. Over the previous week, it has been traded inside a good band between $123,120 and $123,471 after a number of days of aggressive income initially of the month. The biggest coin by market capitalization closed buying and selling periods on Friday, indicating the potential transition part of the market.

Funding charges throughout key spinoff exchanges, together with Binance, OKX, Bybit, Deribit, Bitmex and HTX, had been impartial to barely constructive.

No excessive lengthy positioning or extreme leverage signifies that merchants are on a “wait and look” stance, and desire a clear value path.

Market conduct is a seasonal lull in actions which are sometimes called “summer time droop,” which precedes refined volatility within the second half of the third quarter of 2025, in accordance with cryptographic contributor Nino.

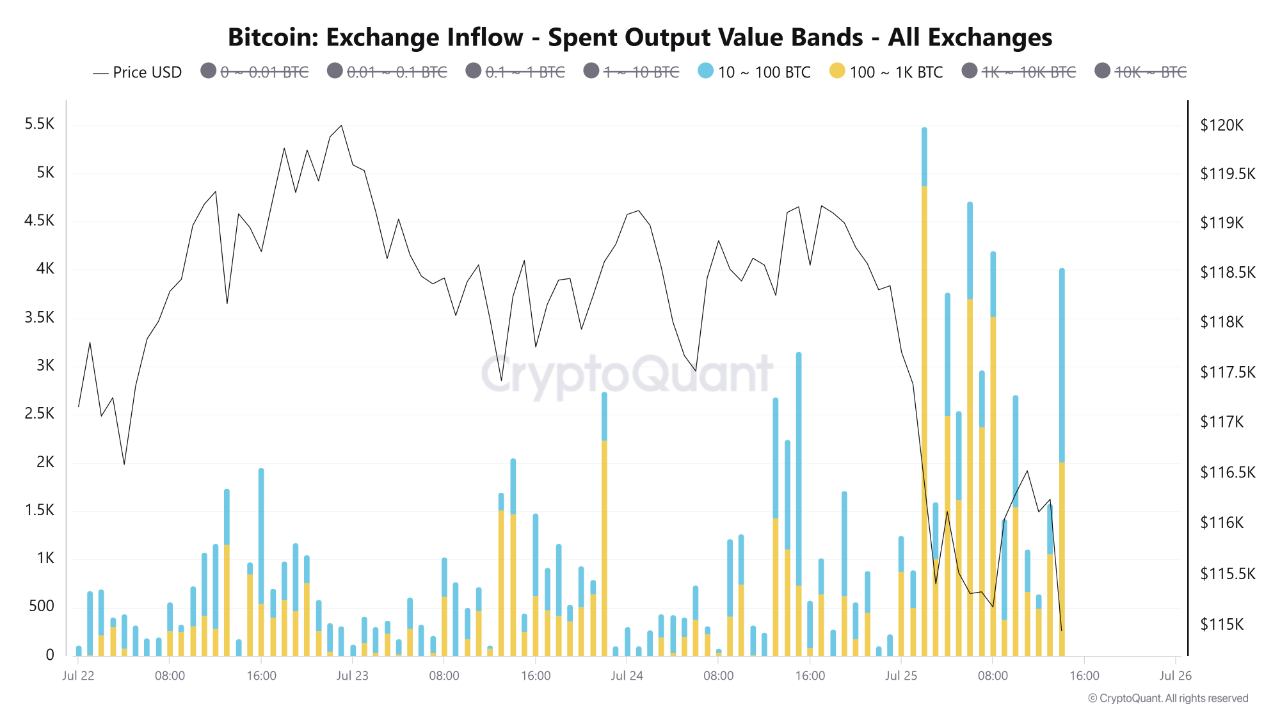

Change inflows point out institutional exercise at peak costs

Between July 22 and July 25, Bitcoin costs ranged between $115,000 and $119,500, peaking on July twenty fourth, falling to round $115,000 by the morning of July twenty fifth.

Cryptoquant’s trade inflow information reveals a rise in exercise from giant holders on the time, particularly within the mid-band to most worth bands. Wallets holding 10-100 BTC recorded spikes on trade deposits round value peak on July twenty fourth.

BTC trade influx chart. Supply: Cryptoquant

Equally, wallets with 100-1,000 BTC and 1,000-10,000 BTC bands had a big inflow on the identical time, suggesting that enormous stakeholders might have benefited or contributed to cost actions via relocation.

Small transactions between 0.01 and 1 BTC remained steady all through the interval, with a slight enhance registered on the peak of July twenty fourth, however inflows from addresses holding over 10,000 BTC remained minimal.

Low social curiosity in XRP can set off short-term conferences

In the meantime, XRP has modest social media sentiment as it’s the lowest of the three property tracked by Santiment. The bullish and informative commentary ratios of 1.11-1 counsel that few merchants are at present listening to the potential of XRP.

The XRP value has not fallen under $2.99 within the final seven days. The Bulls and Bears haven’t had sufficient influence to rock the token in both path.

Santiment’s evaluation reveals that this lack of consideration itself could possibly be a bullish indicator. XRP has beforehand been gradualizing value restoration in periods of low engagement, and it’s potential that present circumstances have set comparable phases of motion.