Bitcoin is sustaining a decent integration vary with decreased value motion as merchants await tonight’s FOMC determination. A stunning velocity discount can function a serious catalyst and doubtlessly trigger a sudden, upward breakout.

Technical Evaluation

Shayan Market

Every day Charts

BTC continues to commerce inside a decent vary, displaying modest market exercise and low volatility. The asset stays locked between the $116,000 and $123,000 ranges, reflecting the non permanent stability between patrons and sellers. This lateral motion signifies market indecisiveness forward of the foremost macrocatalysts.

The $114,000 degree alongside the decrease boundary of Bitcoin’s multi-month ascending channel serves as vital help. So long as this trendline applies, the bullish construction will stay intact and we count on a retest of $123,000 resistance. Nonetheless, if this degree is compromised, a deeper repair to the $111,000 help zone is a extra seemingly situation.

4-hour chart

Within the decrease timeframe, the dearth of route for Bitcoin turns into extra pronounced. The belongings proceed to consolidate inside the bullish continuation flag sample, a traditional indication of non permanent revisions throughout the uptrend.

All eyes are scheduled for the FOMC assembly tonight. Political tensions and growing strain from President Trump have elevated the chance of a stunning determination as they search aggressive price cuts. If the Federal Reserve broadcasts sudden price cuts, Bitcoin may reply with a pointy rally, escape from its present vary and purpose for a brand new all-time excessive.

Till then, the market may stay muted as merchants look ahead to affirmation from the event of macroeconomic coverage.

On-Chain Evaluation

Shayan Market

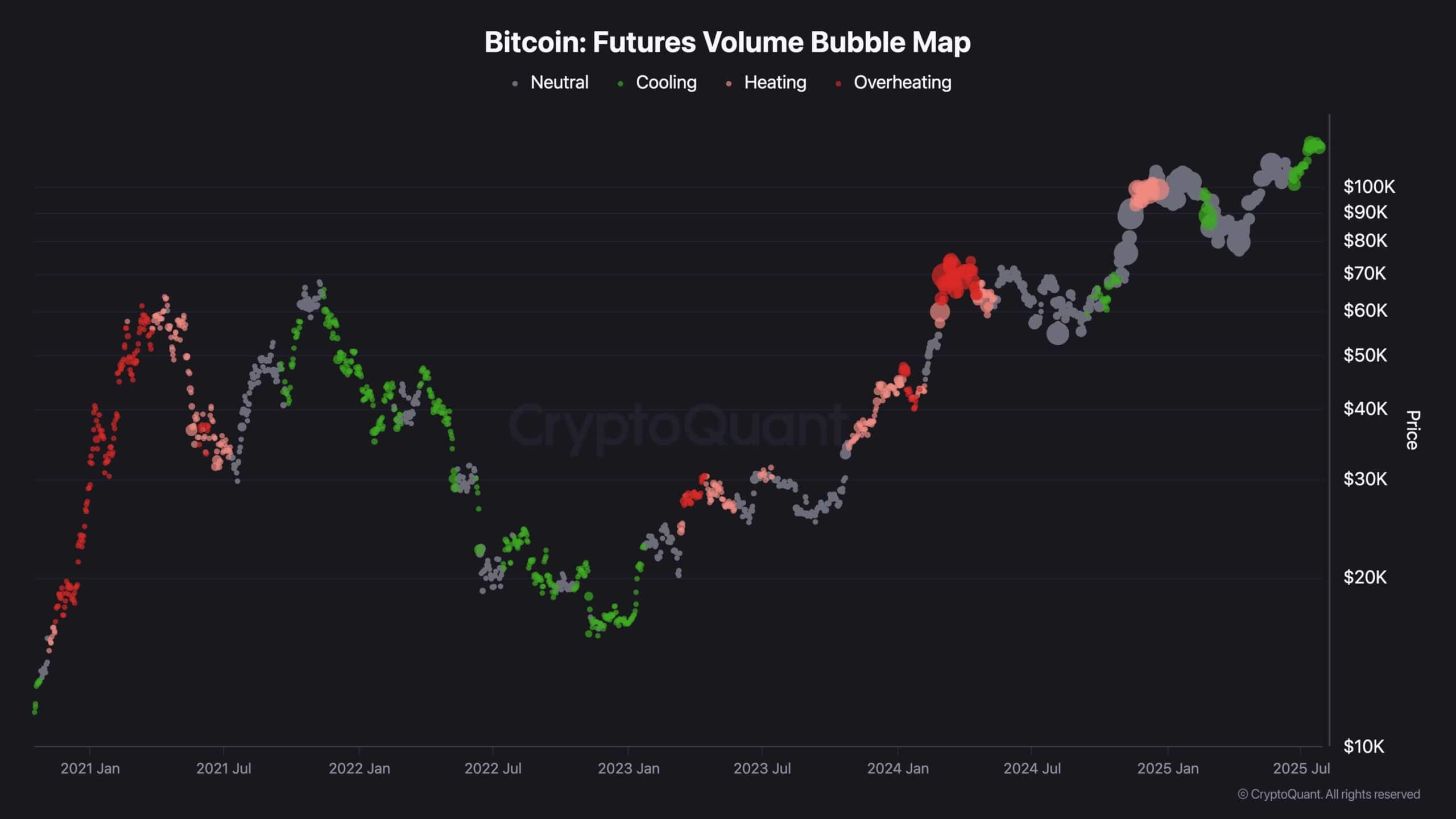

Over the previous few months, the BTC has skilled a interval of great futures market exercise, significantly throughout gatherings which might be approaching the $70,000-$90,000 degree. These runs coincided with the heating and overheating phases, as indicated by the dense purple clusters that traditionally resulted in correction or integration.

Nonetheless, the most recent market habits attracts a distinct image. Regardless of the near $123,000 in Bitcoin buying and selling, the bubble map exhibits a transition again to impartial and cooling phases (gray and inexperienced bubbles), suggesting a decline in speculative strain within the futures market. This cooling highlights leverage and reset of risk-free habits between merchants regardless of rising costs.

From a series perspective, such market cooling after overheating is commonly a wholesome sign, indicating that costs are supported by natural demand quite than extreme leverage. Whereas Bitcoin has risen above $10,000, futures volumes present indicators of normalization strengthening bullish outlook because it avoids the pitfalls of overheated hypothesis available in the market.

If the present development of low speculative strain persists, BTC may have doubtlessly aggressively impulsive legs in direction of a brand new historical past excessive that’s doubtlessly above 123K.