Bitcoin (BTC) miners raised $11 billion in convertible bonds final yr on the again of their transformation into synthetic intelligence information facilities.

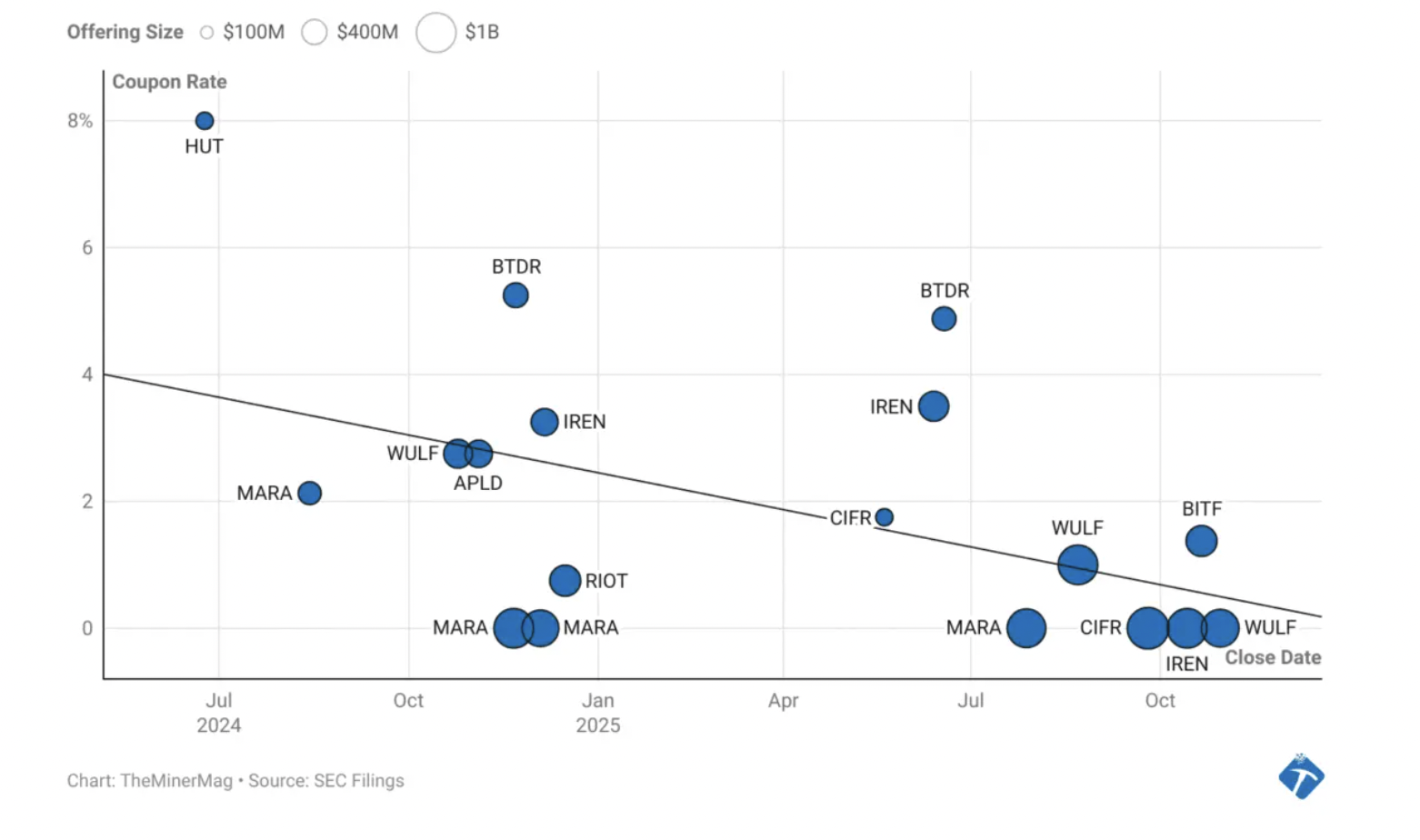

In keeping with TheMinerMag, miners accomplished 18 convertible bond transactions after the April 2024 Bitcoin halving, when block rewards had been decreased by 50%.

Common convertible bond issuance greater than doubled, with mining corporations MARA, Cipher Mining, IREN and TeraWulf every elevating $1 billion by way of single bond issuances. Some merchandise provide coupons as little as 0%, demonstrating buyers’ willingness to waive curiosity funds in change for potential inventory worth appreciation.

Convertible bond transactions from July 2024 to October 2025. supply: the minor mug

In distinction, most convertible bonds issued by Bitcoin miners within the earlier yr ranged from $200 million to $400 million.

The mining business has diversified into AI information facilities to handle the income shortfall after the April 2024 halving. Miners proceed to wrestle with difficult enterprise fashions which might be affected by tokenomics, commerce coverage, provide chain points, rising power prices, and extra.

Associated: Bitcoin miners revenue after Jane Road publishes stakes

Miners put together for hashrate wars and energy-intensive AI operations

In keeping with a latest report from funding supervisor VanEck, miner debt has elevated by 500% within the final yr, totaling $12.7 billion.

However VanEck analysts Nathan Frankowitz and Matthew Siegel stated these debt ranges replicate a elementary drawback within the mining business: excessive capital expenditures on mining {hardware}, which in some instances have to be upgraded yearly.

“Traditionally, miners have relied on the inventory market relatively than debt to cowl these excessive capital funding prices,” they wrote, calling the excessive {hardware} prices of staying aggressive “melting ice.”

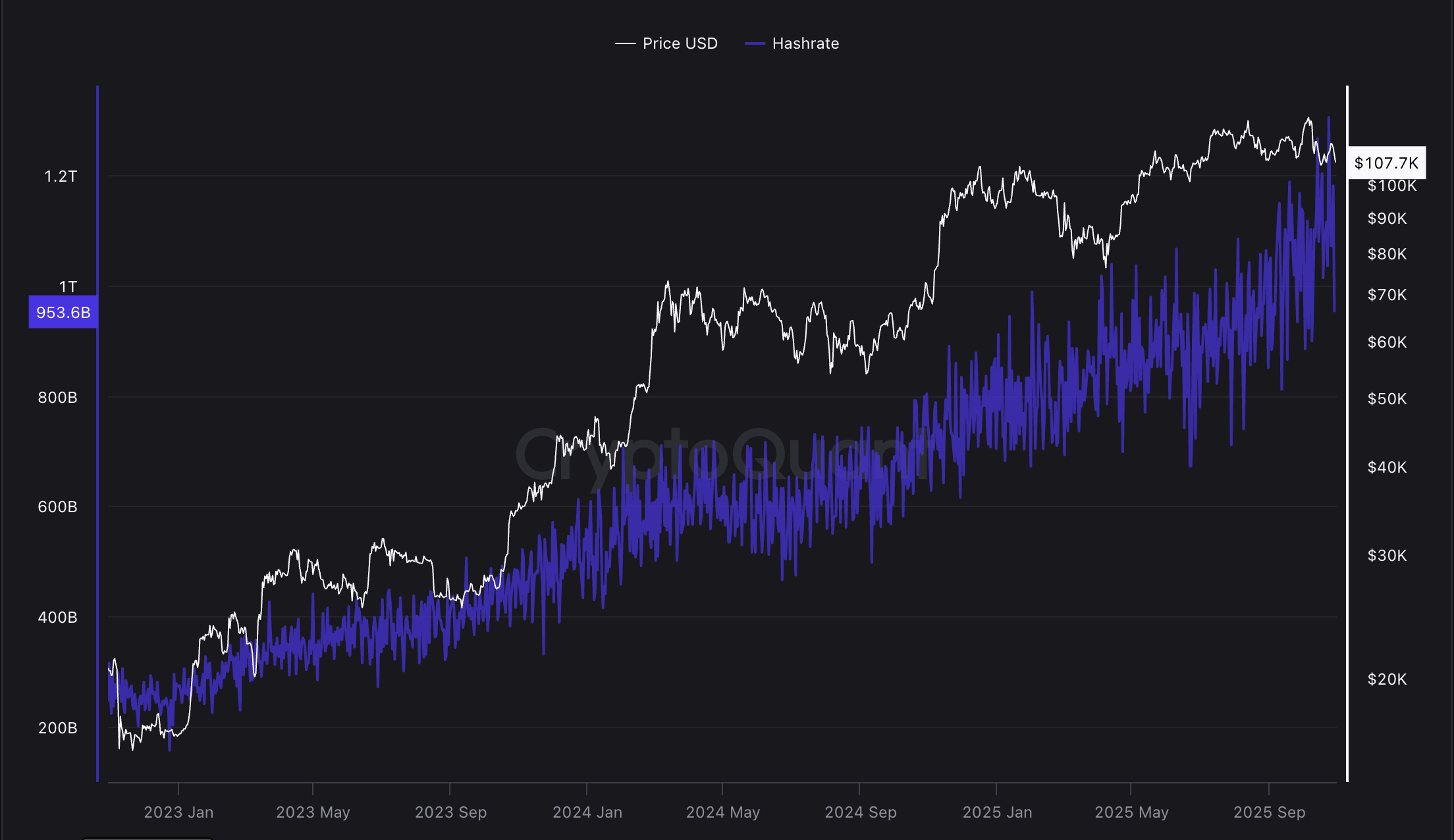

Bitcoin’s community hashrate continues to rise.

The Bitcoin mining hash fee, or the full quantity of computing energy securing the Bitcoin community, additionally continues to rise, forcing miners to expend increasingly more computing and power assets over time.

In October, U.S. Power Secretary Chris Wright proposed regulatory adjustments to the Federal Power Regulatory Fee (FERC) that may enable information facilities and miners to attach on to the power grid.

This permits these energy-intensive functions to fulfill power calls for whereas concurrently appearing as a controllable load useful resource for the power grid, balancing and stabilizing electrical infrastructure throughout peak demand occasions and decreasing extra power throughout low demand occasions.

journal: 7 explanation why Bitcoin mining is a horrible enterprise concept