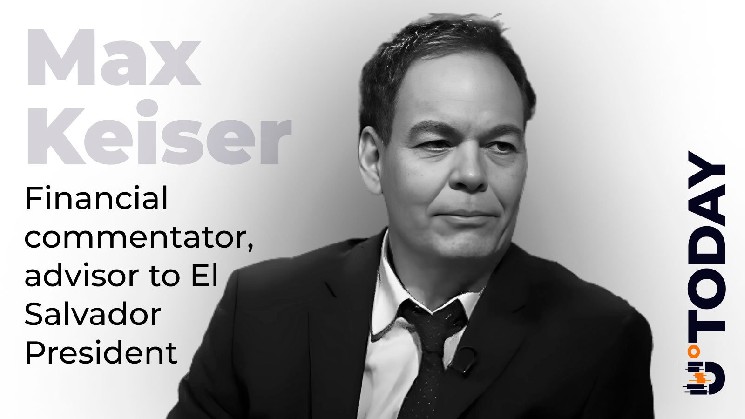

Distinguished Bitcoin evangelist Max Kaiser branded the present market decline as simply the final breath of a protracted distribution part, on the identical day that Bloomberg’s screens confirmed what the market had all however given up on seeing this month: a uncommon session of web inflows into the Bitcoin ETF complicated, pushing the group to a constructive day at the same time as BlackRock’s IBIT, the heaviest product within the lineup, additionally closed within the pink.

The distinction between the bleeding market and the inexperienced ETF column was precisely on show when Bitcoin’s weekly chart hit a zone that merchants have been monitoring for the reason that starting of the primary quarter. Bitcoin has now retreated about 32% from its peak of $129,000, touchdown within the mid-price vary between $86,000 and $80,600.

The ETF numbers again this up with numbers, not tales. Regardless of dropping greater than $4.3 billion for the whole month, the cryptocurrency funding market recorded a one-day acquire of $238 million. This means that some buyers with actual cash are shopping for the latest dip within the inventory worth moderately than ready for it to fall.

Distribution has ended.

Accumulation begins.

New excessive for BTC in 2025. https://t.co/f0FJgTzonO— Max Keiser (@maxkeiser) November 23, 2025

That is in step with Kaiser’s assertion that the market has moved in direction of accumulation, whether or not retail buyers prefer it or not.

Featured Bitcoin worth

The chart provides one other layer of context, as under $80,600 lies the ultimate main structural degree at $74,110. That is, coincidentally or not, the typical buy worth of Michael Saylor Technique, which at present holds 649,870 BTC value $55.96 billion.

If this zone stays untouched on candlesticks over the following few weeks, Bitcoin will keep a potential path in direction of its former resistance hall close to $112,000, in addition to a pocket of $120,000-$125,000 that must be recovered earlier than discussions relating to a 2025 all-time excessive get severe.