Bitcoin priced at $119,128, with a market capitalization of $2.37 trillion, and 24-hour buying and selling quantity is $63.34 billion. The each day intraday vary of $117,201 to $121,073 displays the marketplace for consolidation following the latest sale from the August excessive.

Bitcoin

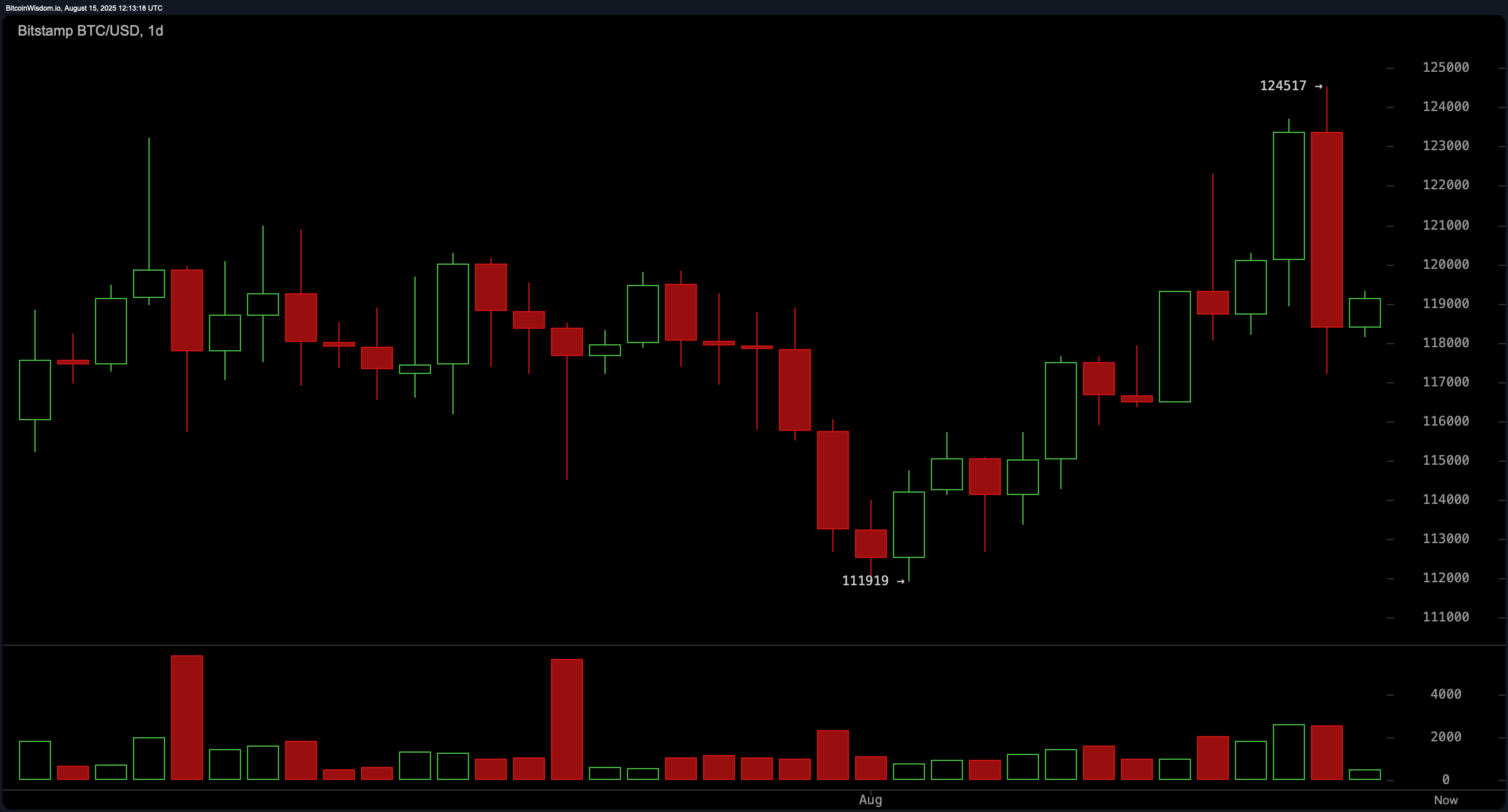

The each day chart reveals Bitcoin (BTC) retreated from the native peak of $124,517 after forming a possible double-top sample. The most recent candles are bearish siege formations with elevated quantity and displaying sturdy gross sales stress. The relative power index (RSI) of 55.1 stays impartial, suggesting that it’s neither over-acquisition nor oversold, whereas a shifting common convergence divergence (MACD) degree of 1,224.5 signifies bullish part. Every day buildings will elevate warning, and breaks under $117,000 might pave the way in which from $113,000 to $115,000. Conversely, a large quantity of sustained landfills of between $119,500 and $120,000 can reset bullish momentum.

BTC/USD 1-Day Chart by way of BitStamp on August fifteenth, 2025.

The four-hour Bitcoin chart highlights a extra rapid bearish bias. A low excessive has been fashioned for the reason that high of $124,517, with pink quantity spikes in the course of the sale and weak inexperienced quantity on the rebound. Impartial measurements from the stochastic oscillator of 68.7 and the commodity channel index (CCI) of 57.9 present a scarcity of sturdy momentum, however optimistic indicators from the exponential shifting common (EMA) and easy shifting common (SMA) over all intervals mirror long-term development assist. Merchants are aiming to replenish between $120,000 and $121,500 for breakout eventualities, however failing to carry $119,500 might set off an up to date draw back to $116,000.

BTC/USD 4-hour chart by way of BitStamp on August fifteenth, 2025.

On the hourly chart, Bitcoin ranges from $117,800 to $119,300 after a pointy drop from $124,000. Quantity stays restrained within the chop zone, which means market indecisiveness. The momentum index of 5,055.0 signifies bullish alternatives and helps the potential of an intraday reversal, whereas the magnificent oscillator at 2,431.5 is usually impartial and displays the dearth of dominant traits. Scalp merchants can method $117,800-118,000 if quantity is confirmed.

BTC/USD 1-hour chart by way of BitStamp on August fifteenth, 2025.

Transferring averages (MAS) proceed to be bullish throughout all necessary time frames. The exponential shifting common (10) is $118,680.5, and each easy shifting common (10) is $118,481.9, which helps short-term purchases, whereas the exponential shifting common (200) is $102,562.0, and the straightforward shifting common (200) maintains a robust long-term uptrend bias of $100,151.8. This alignment of short-term and long-term averages strengthens the broader bull market construction, however short-term merchants are cautious of present consolidation collapse.

Total, the short-term technical image of Bitcoin displays the market on the intersection of integration and potential breakouts. The oscillator mixes impartial and impartial indicators, and on common reveals delicate bullishness with no leanness. The moment degree to look at is $119,500-120,000 for breakout confirmations, and $117,000 on the draw back, as there’s a risk of a shift in the direction of a deeper retracement. Till a important transfer happens, disciplined vary buying and selling with quantity checks stays a smart method.

Bull Verdict:

If Bitcoin will be collected and held in sturdy buy volumes to exceed $120,000, then all main shifting common alignments within the territory of purchase assist a continuation of between $122,000 and $124,000. Momentum indicators resembling shifting common convergence divergence (MACD) and momentum stay in bullish territory, suggesting {that a} wider upward development can resume when resistance is decisively damaged.

Bear Verdict:

Not sustaining it above $119,500, in addition to each day closures and under $117,000, exams latest bearish-encompassing patterns and potential double-top formations. In that case, the draw back goal of $113,000 to $115,000 is in focus, indicating a lower in rebound quantity and weakening bullish participation.