Bitcoin’s worth has fluctuated between $94,925 and $95,051 up to now hour, with a excessive market capitalization of $1.89 trillion and lively 24-hour buying and selling quantity of $68.71 billion. Intraday motion has not slowed down, with the value fluctuating between $91,820 and $96,474. The query for 1,000,000 satoshis is whether or not this transfer is a prelude to a breakout or only a breather in bullish territory.

Bitcoin chart outlook

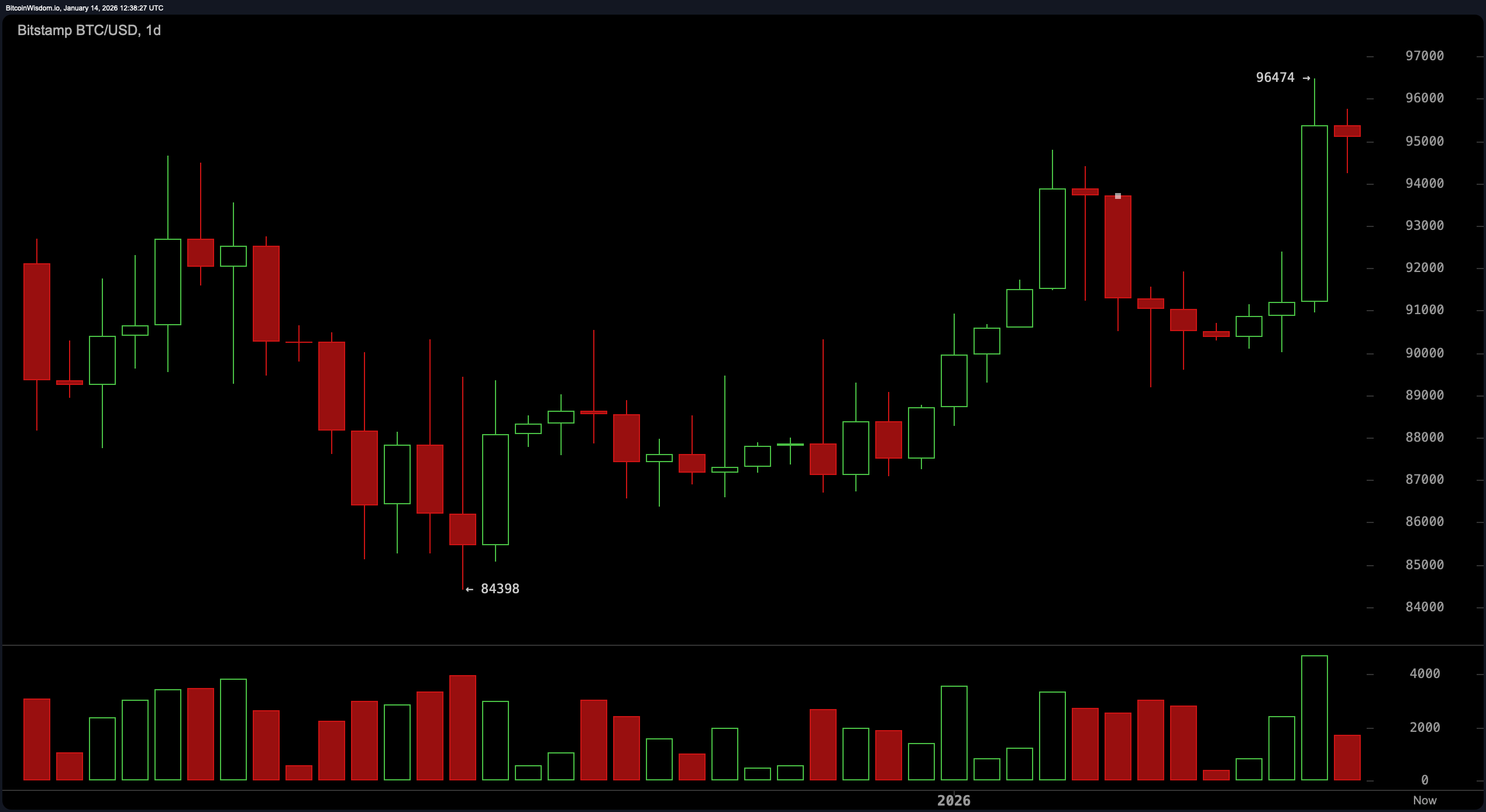

From the every day chart, Bitcoin has clearly rebounded from the lows of $84,398 and is rising purposefully to current highs of $96,474. The bullish narrative is underlined by a collection of inexperienced candlesticks, however the newest pink footprint suggests a slight stall, or momentum fatigue.

Quantity tells its personal story. It spiked on the way in which up, however tapered off as a pink candle appeared, suggesting the bull is likely to be catching its breath earlier than one other dash.

Zooming in on the four-hour chart, Bitcoin spiked from round $89,000, however hit cruise management slightly below its current excessive. A sideways chop resembles a basic bullish flag or consolidation field and screams “potential continuation” to merchants aware of the sample. Breakout settings stay the identical. If worth strikes above $96,500 on conviction and quantity, the following leg in the direction of and above $97,000 is off the desk. Nonetheless, if it teeters in the direction of $92,000, bullish reinforcement might be wanted to maintain the construction wholesome.

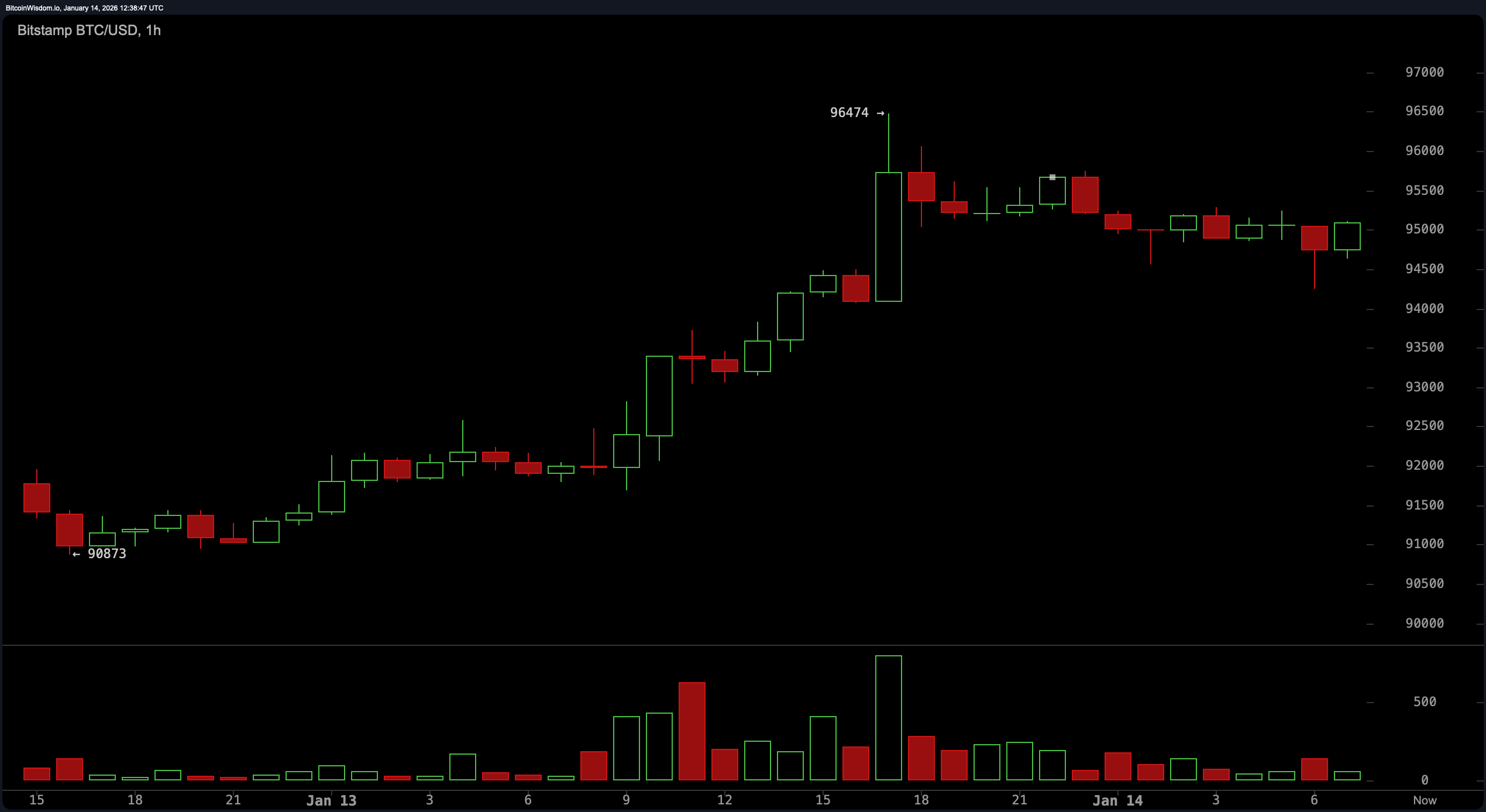

On the hourly chart, issues look just a little uneven, however nonetheless constructive. The sharp rally main as much as January 14 pushed Bitcoin towards the all-time excessive, with pink candlesticks creeping in however not inflicting panic. Brief-term help seems to be nicely held between $94,500 and $95,000, however there has but to be any stunning promoting that might counsel additional draw back. Merchants with sturdy nerves and tight stops could eye this degree as a possible springboard so long as $94,000 holds the road.

In the meantime, the oscillators are conserving their playing cards near their chest. The Relative Power Index (RSI) is 65, the Stochastic Oscillator Index is 76, and the Commodity Channel Index (CCI) is 170, all studying as impartial. A median directional index (ADX) of 29 means the pattern energy is reasonable however not overwhelming. Momentum turns a nook at a worth of three,610 and is trending destructive, whereas the Shifting Common Convergence Divergence (MACD) degree stays at 1,060, sustaining a bullish stance. translation? The engineering neighborhood has been sending combined indicators, neither full throttle nor chucking up the sponge.

Shifting averages (MAs) are the place issues get difficult. Brief-term indicators such because the 10-, 20-, and 30-period exponential transferring common (EMA) and easy transferring common (SMA) are all under the present worth, giving off a bullish tone. Nonetheless, when the transferring averages of intervals 100 and 200 are reached, each the EMA and SMA flash pink. The EMA (100) of 95,959 and SMA (100) of 97,320 counsel overhead friction, whereas the EMA (200) of 99,572 and SMA (200) of 106,059 verify that there are nonetheless hurdles to this rally. Clear. For now, Bitcoin continues to steadiness between the fun of latest highs and the load of long-term resistance.

Bullish verdict:

If quantity rebounds strongly and Bitcoin climbs above $96,500, the technical setup will help a brand new rally above $97,000. Brief-term transferring averages are aligning in favor of Bitcoin, and consolidation throughout the chart suggests bullish continuation. So long as the value stays above the $91,000-$92,000 zone, the bulls will keep the higher hand.

Bear verdict:

Regardless of the upward momentum, the presence of resistance within the 100 and 200 interval transferring averages can’t be ignored. The oscillator is exhibiting warning, and the reducing quantity of current advances means that enthusiasm could also be tapering. A break under $91,000 may invalidate the bullish construction and open the door to a deeper retracement in the direction of the $88,000 degree.

Steadily requested questions ❓

- What’s the present worth of Bitcoin? Bitcoin is buying and selling at $95,051 as of January 14, 2026.

- What’s Bitcoin’s market capitalization immediately? Bitcoin’s market capitalization is $1.89 trillion.

- What’s the 24-hour worth vary for Bitcoin? Bitcoin has ranged from $91,820 to $96,474 over the previous 24 hours.

- Is Bitcoin exhibiting a bullish or bearish sign? Bitcoin’s charts counsel bullish potential, however resistance close to $96,500 stays key.