Bitcoin’s value on Sunday was $95,101, with its market cap holding regular at $1.89 trillion, 24-hour buying and selling quantity remaining excessive at $19.02 billion, and merchants hawkishly eyeing a slim intraday vary between $94,869 and $95,543. How are you feeling? I am stressed. The chart evokes indecision with the delicacy of a marching band.

Bitcoin chart outlook

Let’s begin by wanting on the day by day chart. Momentum constructed a pleasant staircase to $97,939, however since then Bitcoin has been hovering just under $96,000 as if ready for somebody to convey them espresso. The pattern nonetheless exhibits greater highs and better lows, confirming a broader uptrend, however do not mistake a nap for a dash.

Current candlesticks have shrunk and quantity has tapered off, a basic signal of bullish fatigue. Assist is Lunging between $90,000 and $91,000, however resistance is glassing close to $97,939. If this vary have been a celebration, the host would simply go outdoors and everybody would collect across the snack desk.

BTC/USD 1-day chart by way of Bitstamp on January 18, 2026.

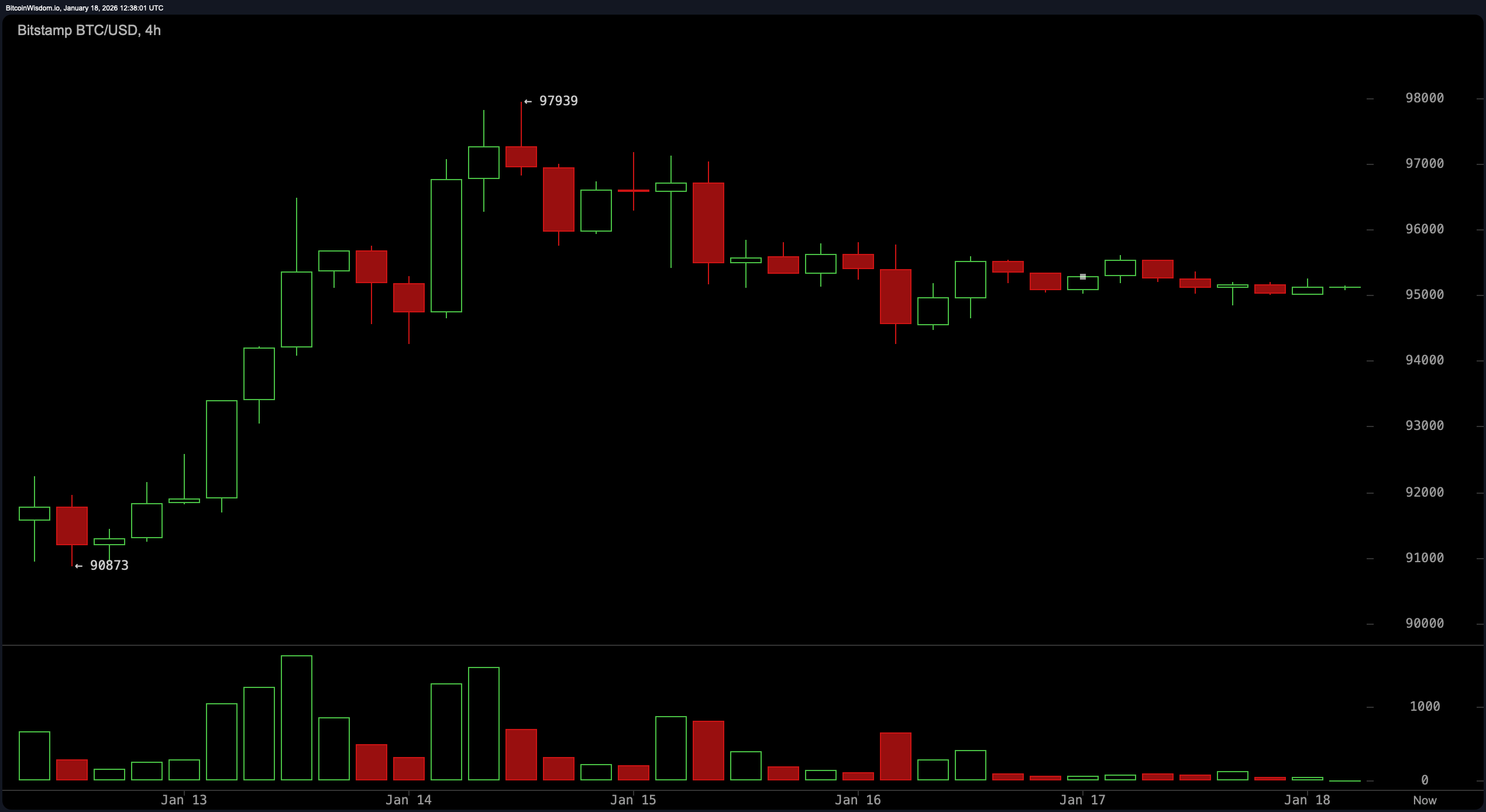

The 4-hour chart reveals a narrative of consolidation disguised as technique. Bitcoin is caught between $94,500 and $96,000, forming a descending triangle that smells faintly of bearish intent. Manufacturing is drying up sooner than a summer season puddle, suggesting a scarcity of dedication. If the worth breaks above $96,500, the subsequent transfer could possibly be in the direction of $97,900. However under $94,500, chances are you’ll end up revisiting the $92,000 to $91,000 area. That is the code model of making an attempt to make it within the huge metropolis and returning to your hometown.

BTC/USD 4-hour chart by way of Bitstamp on January 18, 2026.

On the hourly chart, Bitcoin seems to be in a little bit of a foul temper. A collection of decrease highs and decrease lows, bolstered by the lack to interrupt above $95,600, paints a short-term downtrend. The assist at $94,839 is making an attempt to carry, however enthusiasm is missing. Momentum is whispering moderately than screaming, and this sample is more likely to proceed limping except the amount is restored. A break under $94,600 may trigger intraday merchants to deal with the exit sooner than a boardroom hearth drill.

BTC/USD 1-hour chart by way of Bitstamp on January 18, 2026.

Subsequent, let’s speak about indicators. It is a dependable software with a drill sergeant-like angle on the bedside. The Relative Energy Index (RSI), Stochastic Oscillator, Commodity Channel Index (CCI), Common Path Index (ADX), and Superior Oscillator are all impartial and dispassionate, the cryptographic equal of a shrug. Nevertheless, the momentum indicator has recovered at 4,065 and the Shifting Common Convergence Divergence (MACD) is on the lighter facet at 1,552, each of that are in a bullish pattern.

In the meantime, short-term shifting averages (MAs) such because the 10-50 interval exponential shifting common (EMA) and easy shifting common (SMA) all proceed to recommend energy. Nevertheless, the long-term crowd (EMA 100, SMA 100, EMA 200, SMA 200) has worth above the present value and isn’t satisfied. It is a basic bull versus bear battle, youth versus knowledge.

In abstract, Bitcoin could also be flashing a bullish undertone on the long-term timeframe, however the short-term motion is energizing the wallflower. The oscillators are modest, the candlesticks are modest, and the amount is non-existent. Till we see a convincing transfer out of this congestion zone, this chart will basically be the crypto equal of “it’s difficult.”

Bullish verdict:

If Bitcoin can muster the energy to interrupt above $96,500 with conviction and quantity, it could possibly be in competition for a retest above $97,900. Brief-term shifting averages are already getting cheers from the sidelines, and momentum indicators are beginning to heat up as effectively. This bull can cost with just a bit push.

Bear verdict:

Nevertheless, if Bitcoin fails and falls under $94,500, it dangers falling in the direction of $92,000 and even $91,000, particularly with out enough quantity assist. A descending triangle on the 4-hour chart and a depressed 1-hour pattern don’t essentially encourage confidence. For now, the Bears are circling and ready for indecision to develop into a blunder.

Regularly requested questions ❓

- What’s the present value of Bitcoin right this moment? Bitcoin is buying and selling at $95,101 as of January 18, 2026.

- Is Bitcoin in an uptrend now?The day by day chart exhibits an uptrend, however the momentum is slowing down.

- What value ranges ought to merchants deal with within the brief time period?Main assist lies close to $94,000 and resistance lies close to $96,500.

- The place will Bitcoin go subsequent?Above $96,500 may head in the direction of $97,900, whereas under $94,500 may goal $92,000.