Bitcoin misplaced steam and fell 1.3% on Thursday morning, just under $110,000, however the circulation of ETFs is robust, and which may be the important thing to BTC getting away from one other crimson September, analysts mentioned Decryption.

Encrypted blockchain analyst JA_Maartun mentioned market information reveals Bitcoin With long-term holders, wallets are steadily shifting to ETFs.

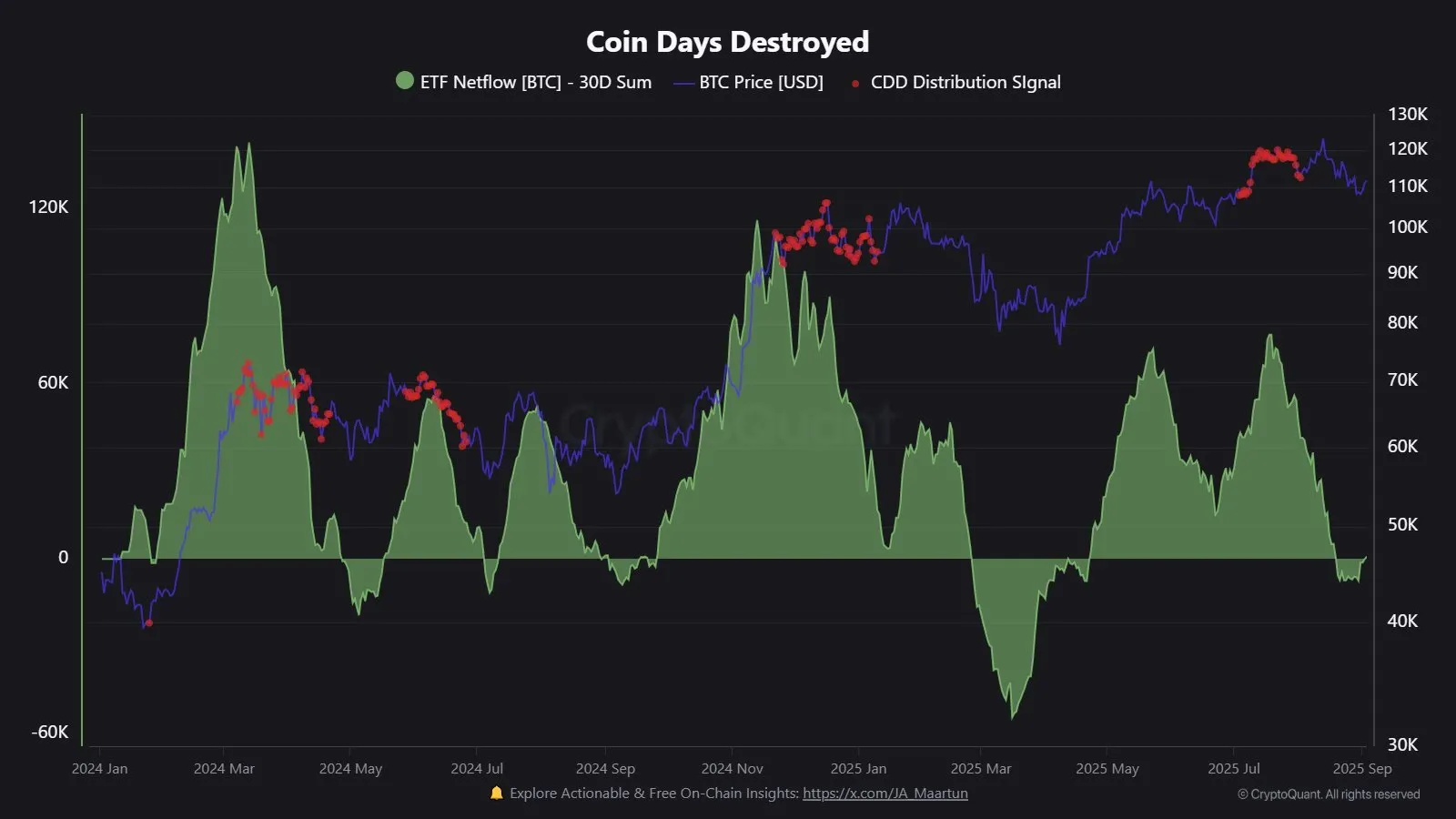

Supply: cryptoquorant / ja_mamaun

“Visually, the chart reveals a significant redistribution. Bitcoin is shifting from long-term holders to new addresses managed by ETFS,” he mentioned. Decryption. “As ETFs create demand, provide is being supplied by older house owners.”

The Bitcoin ETF was first authorized by the SEC in January 2024 after greater than a decade of rejection, permitting buyers to the touch BTC with out the necessity to purchase, maintain or retailer Bitcoin immediately, avoiding crypto exchanges and pockets complexity. BlackRock’s Bitcoin ETF alone holds over $83 billion in property beneath administration.

Nonetheless, just lately, Bitcoin ETFs have been rebounding after being delayed in comparison with Etherum ETFs. The BTC fund recorded two-day inflows of over $300 million, totaling $633.3 million in each periods.

And it is fairly uncommon when a lot of it’s facilitated by longtime Hodlers who convert stacks into ETF strains, as Martin hypothesizes.

“This redistribution could be very distinctive,” he mentioned. “We have already seen three intervals like this — 2024, 2024, Autumn 2024, Summer season 2025. In earlier cycles, this often solely occurred as soon as.”

He added that ETF tides could possibly be a robust predictor of whether or not Bitcoin can escape from Pink September, even when they see crimson August. If an asset ends at a lower cost than its begin, the month (or different interval) is taken into account crimson.

September has been eight down months for Bitcoin for the previous 12 years. Nonetheless, for the previous three years, Crimson has shifted to August, with September being inexperienced.

“ETF flows can be crucial,” Maartunn mentioned. “So long as there is a scarcity of robust new inflow, I do not count on something spectacular. Demand must be picked up, or there is a danger that new holders will add gross sales stress.

Nonetheless, there are different massive market gamers to think about, such because the Bitcoin Treasury Corporations, in response to Rick Maeda, a analysis analyst at Presto Analysis. He’s significantly thinking about one thing just like the Japanese Metaplanet, which he vowed to promote BTC Stash.

“If we obtained the Pink September, I might count on Metaplanet to lean on it fairly than retreat,” he mentioned. Decryption. “They are saying they’re by no means going to promote, and CEO Simon Gerovich repeated that time: the cadence of their acquisition is programmatic.

However final week, Metaplanet confronted headwinds. On Monday, the corporate’s shareholders authorized a $884 million capital elevate proposal, a 60% drop since mid-June.

On the identical assembly, the corporate introduced that it had acquired 1,009 BTC for round $112.2 million and raised the Treasury Division to only 20,000 Bitcoin. At present costs, the BTC stockpile is price round $2.2 billion.

Myriad has been created by forecast market Decrypt’s Mum or dad firm Dastan, customers are nonetheless pessimistic about which worth milestone Bitcoin hit subsequent: $125,000 or $105,000. The chances had been flipped over a number of occasions in August, however now reveals that 65% of customers suppose Bitcoin will fall to $105,000 earlier than it exceeds its all-time excessive.

And final month, just one in 4 of the 1,900 buyers voted by Binance Australia estimated that Bitcoin will exceed $150,000 within the subsequent six months.

Half of the polls mentioned BTC would keep between $100,000 and $150,000 over the identical interval. Half of customers voted between the tip of July and August tenth exchanged with the intention of accelerating their Bitcoin holdings.

Nonetheless, Gadi Chait, Xapo Financial institution’s funding supervisor, mentioned there could also be a change in feelings in two weeks. Decryption.

“The Federal Reserve Sept. assembly is the dominant macrocatalyst,” he says, hinting on the Federal Open Market Committee conferences on September sixteenth and seventeenth. “A possible US price discount on the horizon might ease liquidity situations, enhance demand for dangerous property, and enhance Bitcoin by 5-10%.”