Necessary factors

- BTC is buying and selling at $89,000 after dropping lower than 1% of its worth prior to now 24 hours.

- This main cryptocurrency might break by the $90,000 resistance degree within the close to future.

BTC will commerce under $90,000

Cryptocurrency markets are off to a bearish begin with a brand new weekly candlestick, with Bitcoin and different main cryptocurrencies at the moment within the purple. Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are at the moment buying and selling close to key ranges after a slight correction over the previous few days.

The three main cryptocurrencies by market capitalization might file additional losses within the close to time period as bearish momentum will increase throughout main indexes.

In the intervening time, merchants and buyers are intently monitoring key help zones for indicators of stabilization or a deeper correction.

Merchants are keeping track of upcoming macroeconomic occasions in world monetary markets. In america, the unemployment price, ADP employment statistics, weekly unemployment insurance coverage claims, in addition to November’s inflation statistics and December’s PMI preliminary figures shall be introduced.

Moreover, speeches from Federal Reserve President Stephen Milan and Christopher J. Waller might give buyers clues as to the place rates of interest will go.

The Financial institution of Japan can be anticipated to lift rates of interest to 0.75% at its coverage assembly on Thursday.

Bitcoin might face additional correction

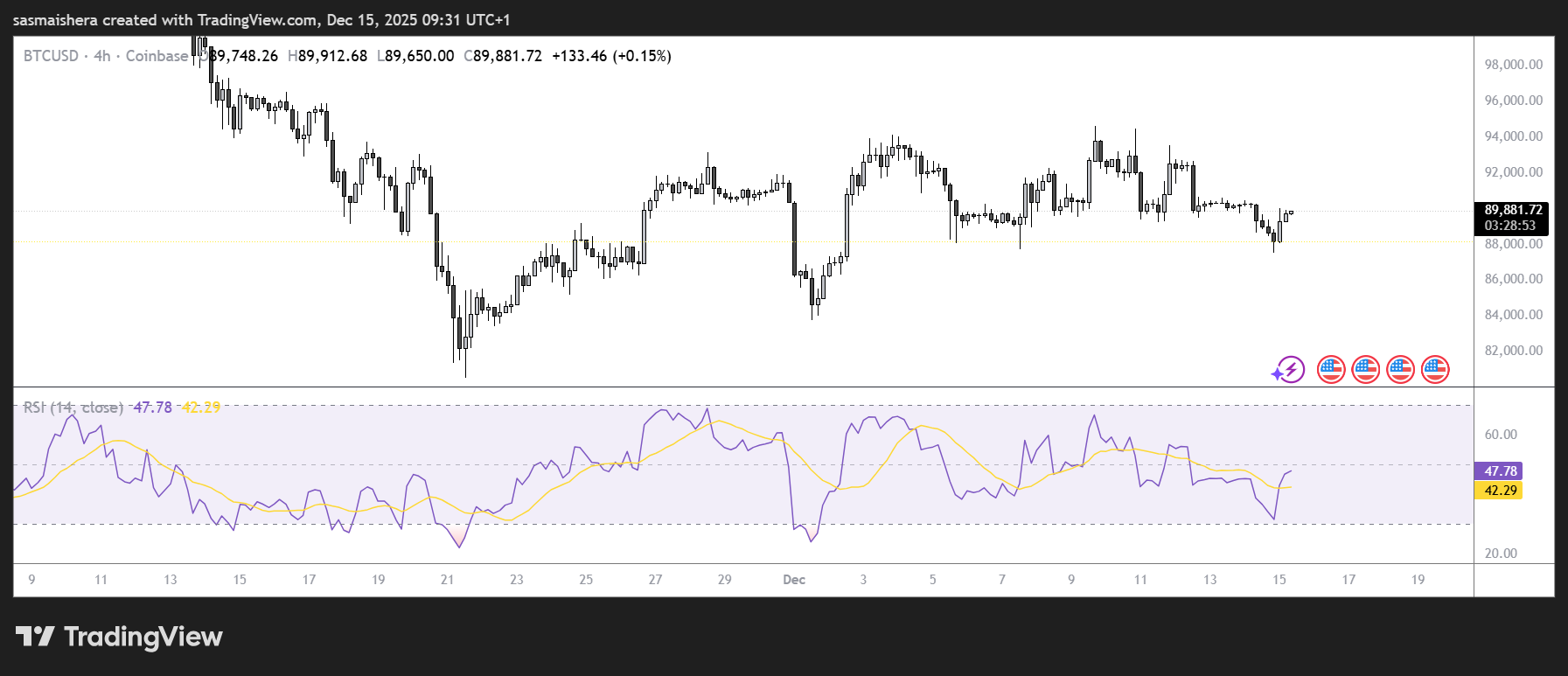

The 4-hour chart of BTC/USD is bearish and environment friendly as Bitcoin has underperformed in latest days. The cryptocurrency confronted rejection from the downtrend line final week and failed to beat the $94,000 resistance degree. As of Monday, BTC is hovering round $89,000.

If the bearish pattern continues, Bitcoin might fall in direction of the subsequent key help degree at $85,569. Nevertheless, this help degree stays sturdy in the mean time.

The Relative Energy Index (RSI) on the 4-hour chart is 42, under the impartial degree of fifty, indicating bearish momentum is gaining momentum. Moreover, the Transferring Common Convergence Divergence (MACD) line is converging and a reversal to a bearish crossover might add additional confluence for the bears.

If the bulls regain management and Bitcoin breaks by the $94,000 resistance degree, the rally might lengthen in direction of the psychological degree of $100,000.