Bitcoin costs right now are buying and selling almost $118,400 as they could not maintain above the $120,000 breakout stage. Momentum from the early July rally pushed BTC to a contemporary excessive in 2025, however latest candles have proven indicators of fatigue beneath the boundary above the important thing ascending triangle. This deceleration of construction is accompanied by a dominance of blended by-product indicators and fade, suggesting that bulls are dealing with elevated resistance.

What is going to occur to Bitcoin costs?

BTCUSD Worth Dynamics (Supply: TradingView)

On the 4-hour chart, Bitcoin worth motion exceeds the 20/50/100/200 EMA cluster. That is presently lined up between $116,420 and $113,653, suggesting that patrons nonetheless have medium time period management. Nevertheless, Worth has struggled to shut the Bollinger Band midline at $118,727, however the band, near $122,056, continues to refuse to rise even additional. Latest candlesticks present indicators of decrease cores and diminished physique measurement, patrons’ hesitation close to key resistance.

BTCUSD Worth Dynamics (Supply: TradingView)

On the each day charts, BTC just lately broke out from a long-term ascending triangle, however now stalled close to horizontal resistance at $120,000. This zone has beforehand been untapped since December 2024, inflicting consolidation regardless of a clear trendline break. Vertex compression patterns often end in aggressive breakouts, but when Bitcoin fails to don’t exceed $120K, the bullish momentum weakens.

The Chande Momentum Oscillator exhibits a worth above 64.8, but it surely has begun to bend barely downward. There may be typically an early warning of fatigue in sturdy traits. Merchants are wanting carefully on the answer as costs are compressed between Bull Market Help Band (now $100,297) and rising wedge resistance.

BTCUSD Worth Dynamics (Supply: TradingView)

Parabolic SAR, in the meantime, falls beneath costs, suggesting a unbroken development. Nevertheless, the steadiness quantity (OBV) indicator is flattened at 1.84m to mirror stagnant inflows.

Why is Bitcoin worth dropping right now?

BTCUSD Worth Dynamics (Supply: TradingView)

Why the worth of Bitcoin is falling right now is basically on account of its decline in momentum throughout a number of indicators and weakening BTC’s management. The weekly BTC dominance chart exhibits a sudden drop in RSI to 50.98 and breakdowns from rising wedges. MACD additionally recognized bearish crossover areas, suggesting a possible risk-off rotation from BTC to Altcoins.

BTCUSD Worth Dynamics (Supply: TradingView)

The Good Cash Ideas (SMC) chart noticed a latest Construction (BOS) break (BOS) adopted by a weakly top sweep of 119.2K. The value then can’t be held above the liquidity zone, suggesting that the newest top will be slower lengthy distance traps. The foremost liquidity swimming pools stay uncontrolled with the roughly $100,000 and $100,000 swimming pools, which is able to strengthen the adverse facet threat if BTC loses its present construction.

Indicators and derivatives recommend incoming volatility

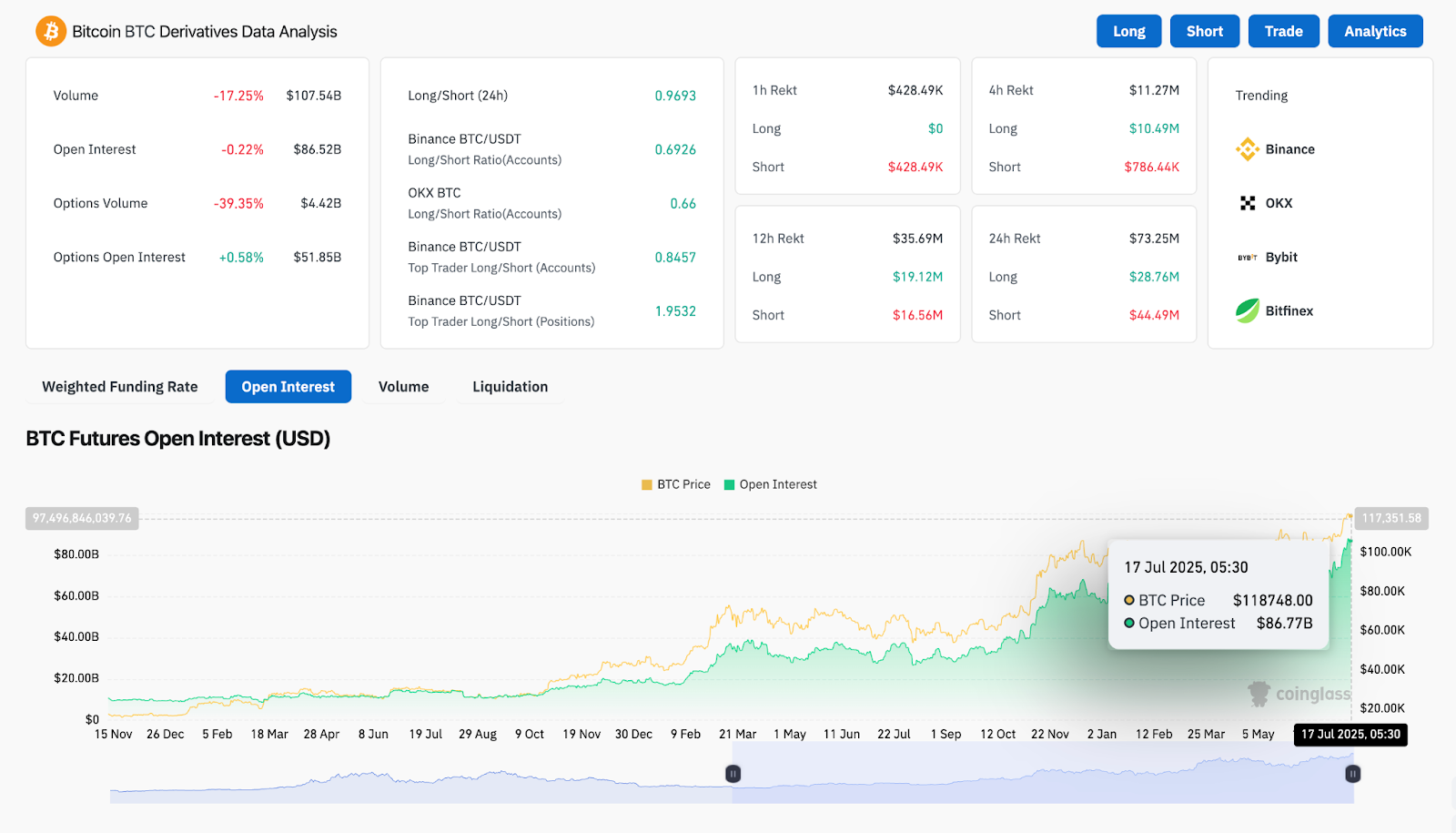

BTC Spinoff Evaluation (Supply: Coinglass)

Spinoff information attracts blended footage. In accordance with Coinglass, Bitcoin’s 24-hour quantity has dropped by 17.25%, whereas non-obligatory volumes improve by 39.35% to $4.42 billion. Nevertheless, open curiosity on choices has risen barely at $51.85B, whereas open curiosity on futures stays rising at $8.677 billion.

The lengthy/brief ratio is close to parity (0.969), indicating market indecisiveness. Specifically, Binance’s prime merchants have maintained a long-standing bias (1.95), suggesting that regardless of wider cooling, the establishment should still be positioned upward.

The technical compression can also be clear on the Bollinger bands, particularly on the 4-hour charts. With the bandwidth near $118,000, the market is getting ready to increase its volatility. Whether or not it is up or down will depend on the Bulls’ skill to regain $120,000 in quantity.

BTC worth forecast: Brief-term outlook (24 hours)

BTCUSD Worth Dynamics (Supply: TradingView)

If right now’s Bitcoin worth isn’t essential to clear $120,000 within the subsequent session, there’s probably a breakdown of $116,000 and $113,600. Bollinger Band’s help for the $115,398 on the four-hour chart stays on the short-term stage till viewing, with draw back targets of $108,000 and $103,400 close to the liquidity cluster.

Nevertheless, as soon as the Bulls regain $120,500 on affirmation, the upward goal is $122,700 (higher band extension), adopted by $125,000, working with the Fibonacci extension and historic rejection zone.

Regardless of development help from EMA and parabolic SAR, weakening of OBV and rising volatility threat may help short-term corrections earlier than sustained breakouts. Merchants ought to carefully monitor zones between $118,000 and $120,000 as direct battlefields.

Bitcoin Worth Prediction Desk: July 18, 2025

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.