Though some Bitcoin bulls consult with BTC as digital gold, the bodily valuable steel could also be a great way to foretell Bitcoin’s future worth actions.

One Bitcoin dealer introduced up the BTC/Goldmayer a number of when explaining his bullish stance on the cryptocurrency.

Mayer A number of Historical past

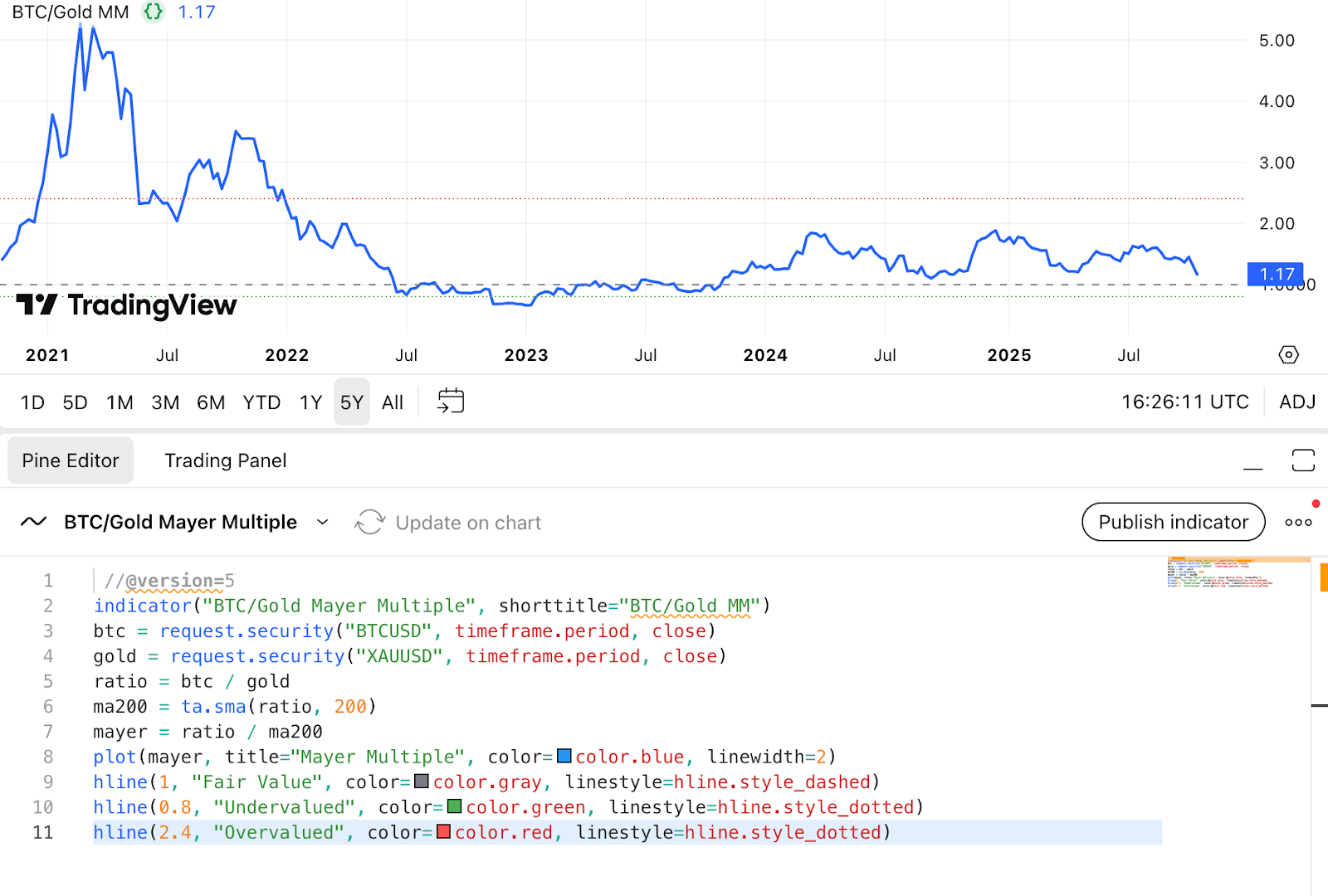

This a number of compares the Bitcoin to gold ratio to the 200-day transferring common, and proponents of this indicator imagine that Bitcoin is undervalued if the Mayer a number of is under 1.

Consumer X famous that the one time this ratio was this low was in the course of the Bitcoin crash, suggesting a shopping for alternative.

The BTC/Goldmeyer a number of is at present at its lowest stage exterior of the Bitcoin crash interval.

If you happen to’re not prepared but, now’s the time. pic.twitter.com/thk0EDVz5z

— Alpine (@Alpine1031) October 19, 2025

Nonetheless, earlier than traders place their belief within the Mayer a number of, it might be good to see how the costs of gold and Bitcoin correlate. We additionally clarify how the worth of silver can predict Bitcoin’s subsequent transfer.

On the coronary heart of this chance is the bullish indicator from the BTC/Goldmayer a number of, so it might be good to know the way it turned out.

Entrepreneur and monetary scientist Hint Meyer created the a number of to trace Bitcoin’s historic worth actions and uncover traits and shopping for alternatives.

It’s the present worth of Bitcoin divided by the 200-day transferring common.

For instance, if Bitcoin is at present buying and selling at $120,000 and its 200-day transferring common worth is $100,000, the Meyer a number of for that Bitcoin is 1.2.

Sometimes, a ratio above 2.4 signifies Bitcoin is overbought, whereas a Mayer a number of of 0.8 tends to recommend a beautiful shopping for alternative.

October 27, 2025: Meyer multiplier is 1.06.

The worth of $BTC is 114,874.81 $USD and its 200 day transferring common is $108,797.55 $USD. @TIPMayerMultple has been larger 61.22% of the time to this point with a median of 1.20.

For extra data, please go to https://t.co/9n0xlTWuNP. pic.twitter.com/x1njmg55rv

— Mayer A number of (@TIPMayerMultple) October 27, 2025

You’ll be able to additional complicate the Mayer a number of by evaluating the ratio of two property, reminiscent of Bitcoin and gold, as Consumer X did.

Like different indicators, Mayer multiples depend on lagging indicators and historic patterns to foretell future worth actions.

How gold and silver costs have an effect on Bitcoin

When the worth of gold or silver rises sooner than Bitcoin over an prolonged time frame, it usually signifies that Bitcoin could also be gearing up for a rebound.

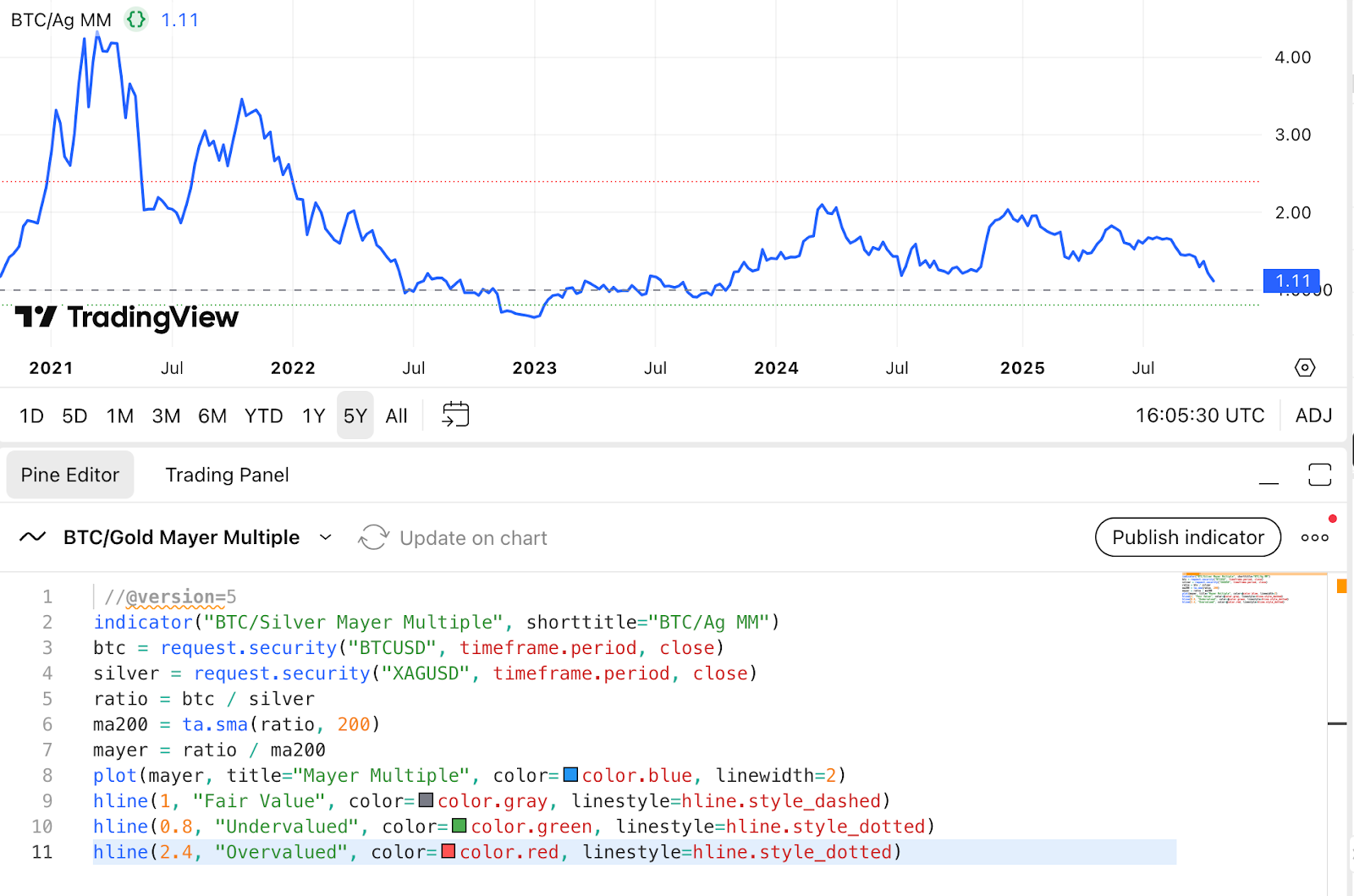

This relationship is captured by the BTC/Gold Meyer a number of and the BTC/Silver Meyer a number of. Each of those indicators measure worth efficiency in opposition to Bitcoin’s 200-day transferring common for these metals.

a Mayer a number of lower than 1 Because of this Bitcoin is undervalued in comparison with gold and silver. Traditionally, these moments have offered sturdy shopping for alternatives.

Determine 1: BTC/Gold Meyer A number of over the previous 5 years. Values under 1 (dashed line) traditionally point out main accumulation levels for Bitcoin.

for instance:

- The BTC/Goldmayer a number of fell to 0.70 in November 2022 and 0.85 in March 2020, each close to the underside of the Bitcoin market. Within the months that adopted, Bitcoin’s worth greater than doubled.

- The BTC/Silvermayer a number of fell under 1 in September 2020, when Bitcoin was round $10,900, however soared to just about $60,000 by April 2021. It fell under 1 once more from the top of 2022 to the start of 2023, and Bitcoin nearly doubled in the identical 12 months.

BTC/Gold ratio has elevated not too long ago 0.84 And the BTC/Silver ratio quickly fell under 1 In late October. Even a small drop under this threshold, e.g. 0.98 In previous cycles, it has confirmed to be a powerful entry level for long-term traders.

So, traditionally, when the ratio of Bitcoin to valuable metals falls under 1, “Purchase on the sting” window earlier than the massive rally.

Determine 2: BTC/Silver Mayer A number of exhibiting an identical undervaluation sign. Every decline under 1 (dashed line) occurred previous to a serious Bitcoin rally.

What gold and silver costs imply for Bitcoin

Presently, the Mayer multiples for each gold and silver are bullish outlook Within the case of Bitcoin. The concept is easy. When valuable metals outperform Bitcoin for an prolonged time frame, Bitcoin tends to catch up after which dramatically outperform.

This 12 months to this point, Gold up 54%, Silver rises 63%and Bitcoin rises 21%. If historical past repeats itself, Bitcoin may quickly shut the hole and ship large good points within the coming months.

In the long run, Bitcoin’s efficiency reveals that it’s on the rise. Over 700% within the final 5 yearswhereas gold and silver are roughly doubled.

Past the Mayer a number of sign, macro circumstances additionally assist Bitcoin’s upside. Decrease rates of interest, pro-crypto insurance policies, and a rise in institutional traders are creating the best circumstances for Bitcoin to outperform once more.

The publish Can gold and silver costs predict Bitcoin’s subsequent transfer? appeared first on BeInCrypto.