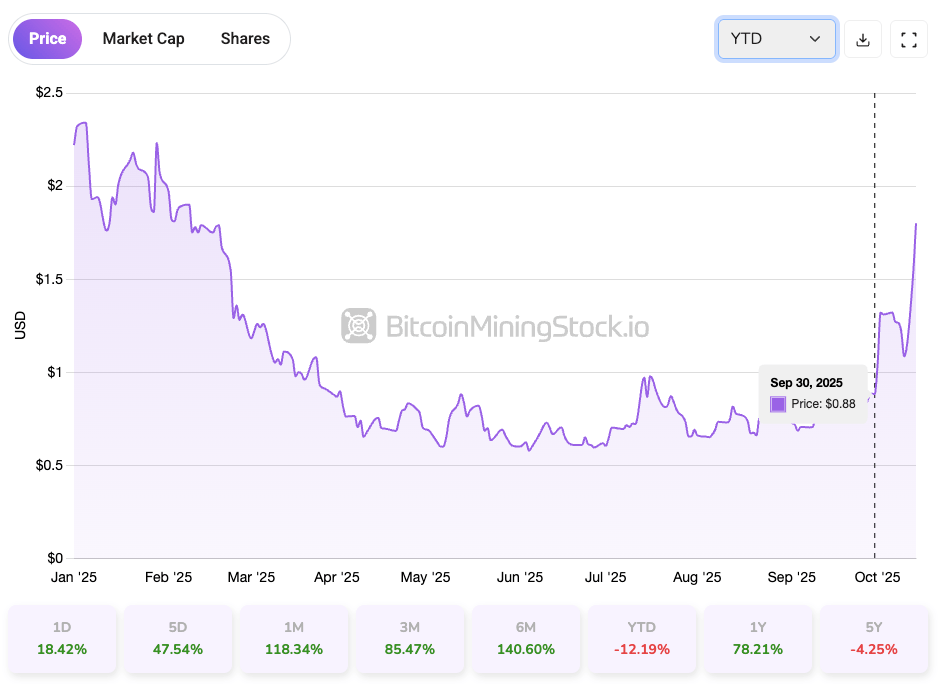

CAN had been buying and selling under $1 for a number of months, but it surely has as soon as once more surpassed that degree. With a landmark 50,000-unit ASIC order and new partnerships with SLNH and Luxor, sentiment is altering quickly. So is that this a sensible entry level?

The next visitor publish is from bitcoinminingstock.io, A public market intelligence platform that gives knowledge on firms uncovered to Bitcoin mining and crypto treasury methods. First revealed by Cindy Feng on October 15, 2025.

Just a few weeks in the past, a few of my followers pinged me about Canaan Inc. (NASDAQ: CAN). They argue that the corporate’s inventory worth is affordable in comparison with its OG friends, a lot of which have posted triple-digit earnings this yr. Whereas these names dominate the headlines, Kanan has been quietly making a comeback since final week.

Canaan, primarily identified for its Avalon ASIC mining machines, spent a lot of 2025 out of sync with the market’s concentrate on HPC and AI infrastructure. On prime of that, the continued U.S.-China tariff warfare has pushed the inventory under $1 for months, elevating actual considerations a couple of doable Nasdaq delisting.

However one thing has modified lately. Since September thirtieth, due to the wave of company growth, the inventory worth has exceeded $1 and continues to rise. Though the year-to-date efficiency nonetheless stands at -12.19%, momentum is clearly shifting. So the actual query is Is now a clever time to leap in? Let’s break it down.

Firm profile: Extra than simply an ASIC producer

Based in 2013, Canaan Inc. is a Singapore-based know-how firm with deep roots in China’s semiconductor ecosystem. Canaan, greatest identified for designing and manufacturing Avalon-branded ASIC Bitcoin mining machines, step by step remodeled From pure {hardware} suppliers to extra various contributors within the crypto mining area.

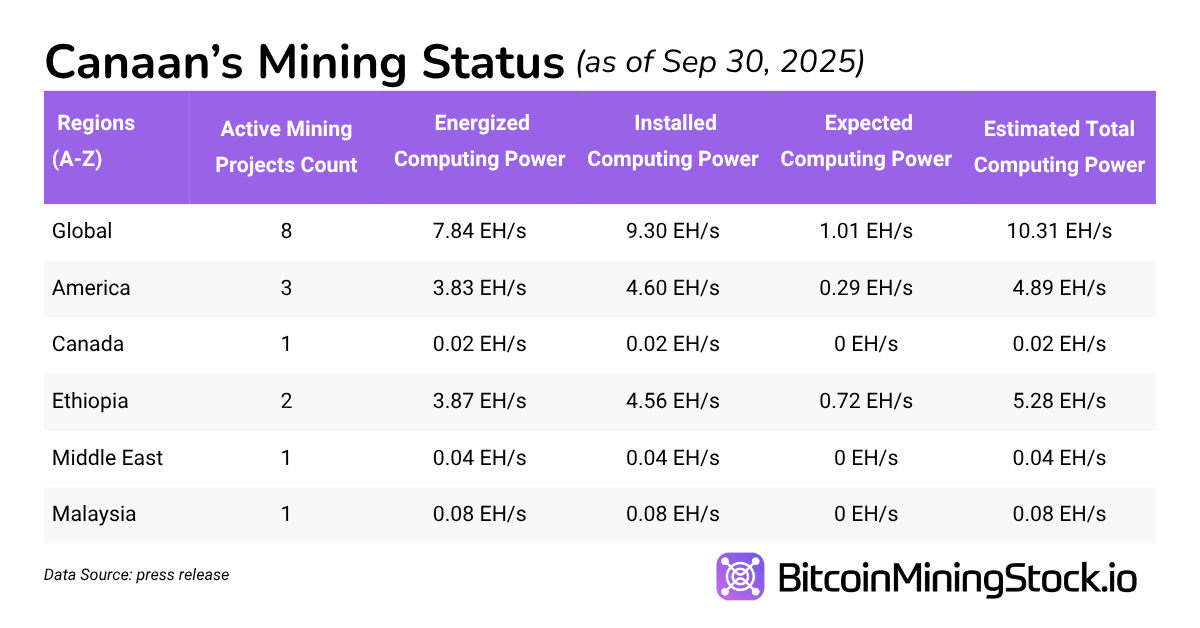

self mining

As of September 2025, Canaan is operational 9.30 EH/s hash priceprimarily in the USA and Ethiopia. As soon as the pending ASIC supply is put in, the self-mining capability could be scaled as much as 10.31 EH/s. Since January of this yr, Canaan has reported that as much as 87 Bitcoins have been mined every month. Income from this enterprise phase has been constantly growing since Q2 2024.

bitcoin treasury

Canaan holds 1,582 BTC as of September 30, 2025. In keeping with the second quarter earnings presentation, BTC combine Self-mining, paying for {hardware} gross sales, buying on the spot market, and so forth. The corporate additionally actively makes use of its Bitcoin holdings as collateral to fund analysis and growth and {hardware} manufacturing, and a few Brief-term interest-bearing account to generate yield. In keeping with CFO James Jing Chen, the corporate’s Bitcoin funds are nonetheless within the early phases.. Regardless, our web site already ranks the corporate’s Bitcoin property because the thirty fifth largest amongst publicly traded firms on the earth. By way of publicity, Canaan’s Bitcoin holdings account for 20.29% of its market capitalization, a ratio much like some massive firms. riot platform and clear spark.

retail residence mining gear

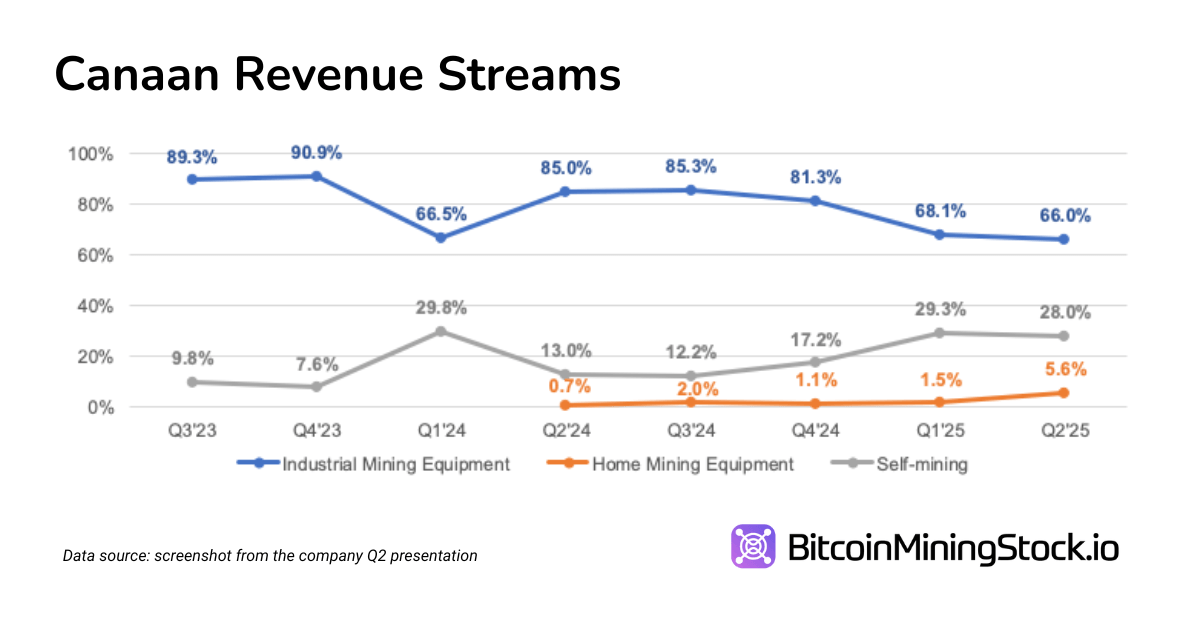

Canaan lately launched pre-assembled Avalon Miner kits geared toward residence miners and small companies. These kits are designed for simple deployment and embody plug-and-play containerization models. Though present revenues from this line are nonetheless modest, Strengthen model consciousness and helps scale back dependence on unstable institutional demand cycles.

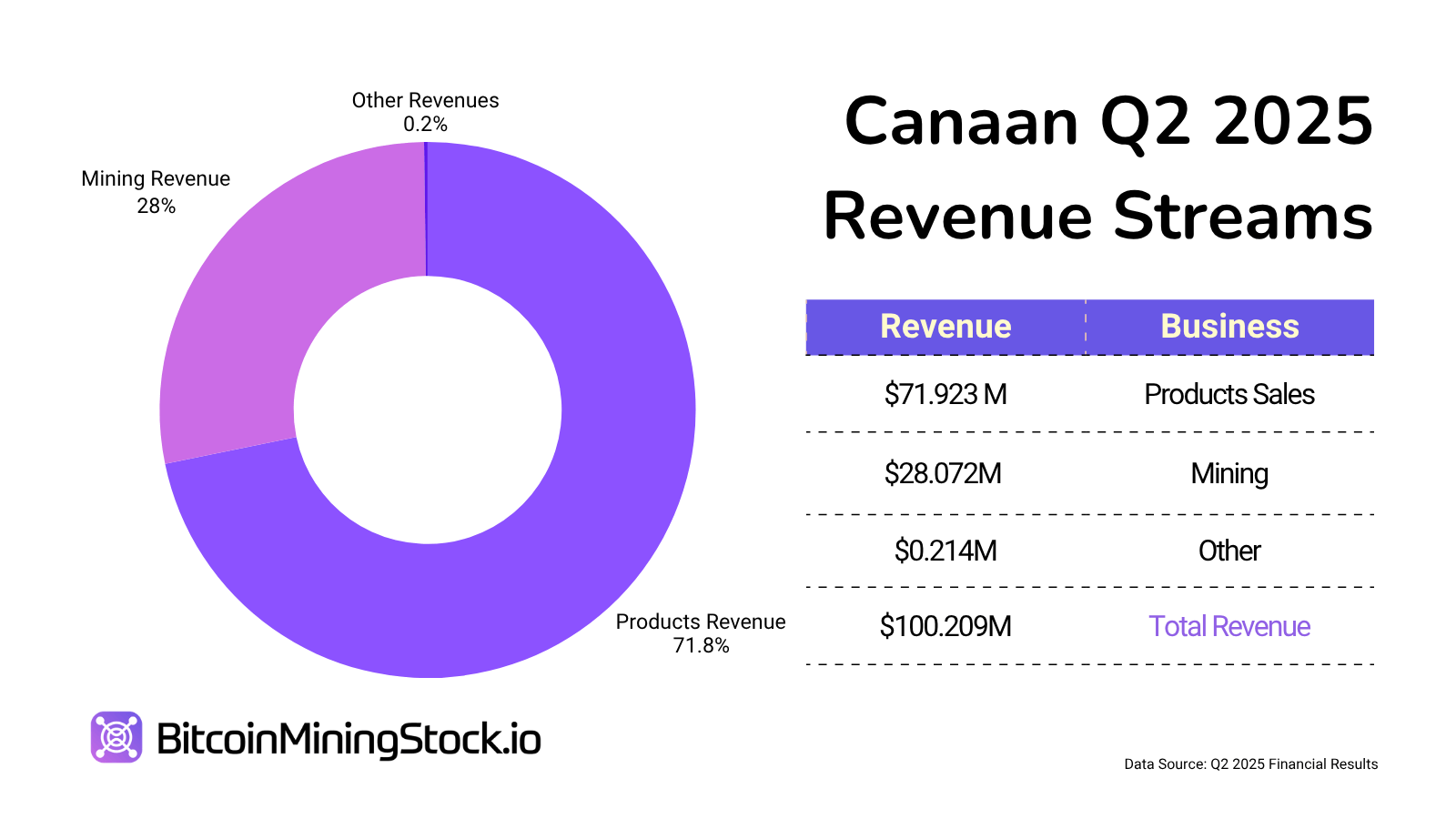

In Q2 2025, Canaan generated whole income of $73.9 million. Of this quantity, 71.7% got here from {hardware} gross sales, 28.1% from mining operations, and fewer than 1% from different providers.

Current Catalysts: Momentum is constructing

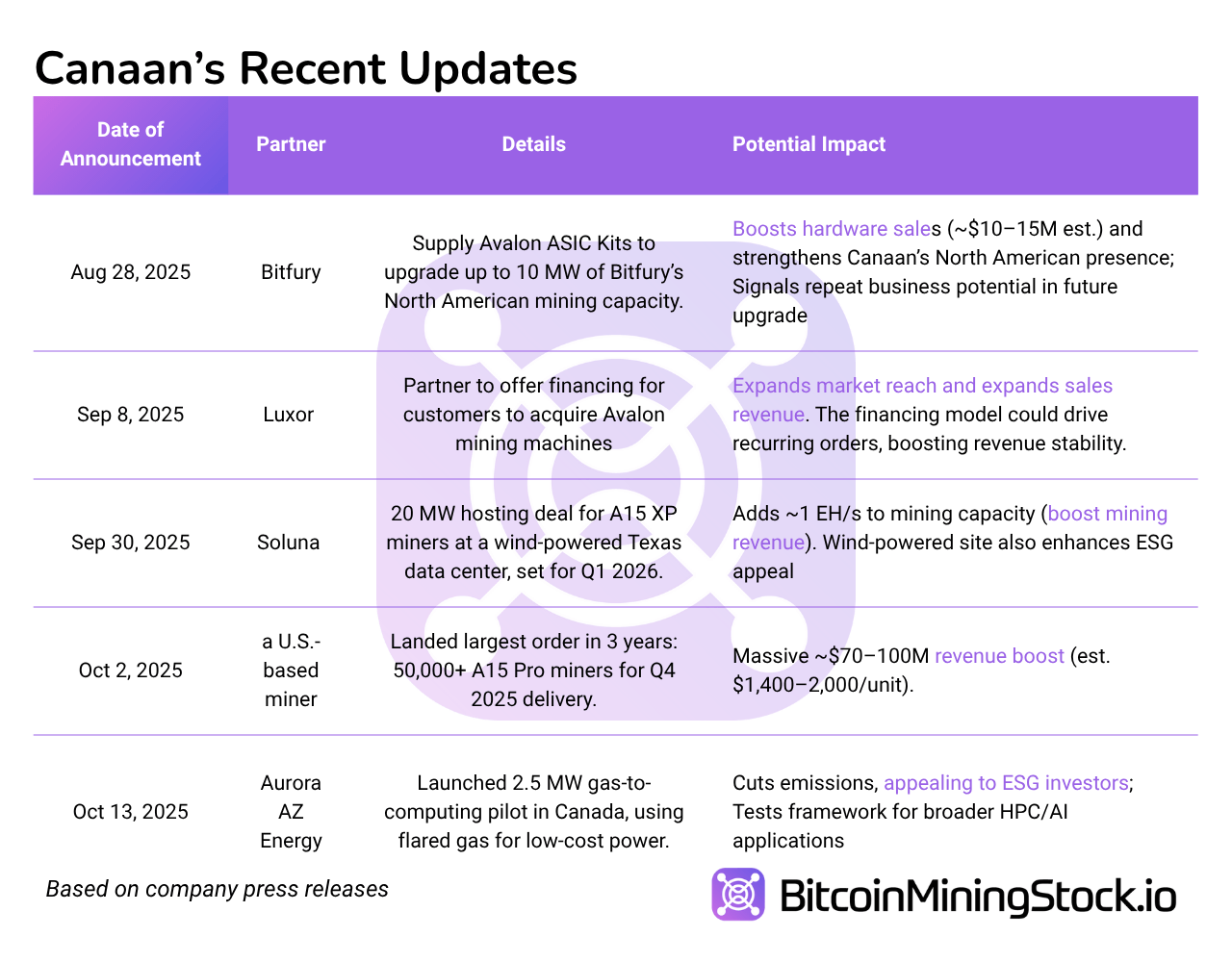

Investor sentiment in the direction of Canaan is altering due to a sequence of enterprise successes and strategic partnerships. Current updates present the corporate gaining momentum, with every deal serving to to not solely improve gross sales potential but in addition generate new investor curiosity. That can assist you observe the scenario, under is a timeline of key enterprise updates.

Placing these developments collectively, Means that Canaan is doubling into North America. Some offers trace at a shift to renewable vitality, which may very well be engaging to ESG-minded buyers. a very powerful factorthese actions seem within the numbers. The corporate expects third-quarter income to be between $125 million and $145 million, representing progress of 25% to 45% sequentially.

Is CAN Inventory a discount at $1.80?

Canaan’s valuation of $1.80 seems convincing in comparison with its friends, however let’s examine if it is nonetheless a discount.

As of October 15, 2025, Canaan’s market capitalization is $881.96 million. Enterprise worth after adjusting for $179 million in Bitcoin (1,582 BTC x $112,833), $11.63 million in Ethereum (2,830 ETH x $4,111), $65.9 million in money, and $268.5 million in debt (EV)* sit round $894 million. This supplies a clearer image of the corporate’s core working worth excluding fairness.

*for My calculations: EV = Present Market Capitalization + Whole Debt – Money and Money Equivalents – Truthful Worth of Bitcoin Holdings – Truthful Worth of Ethereum Holdings. Debt and money figures are taken from the most recent quarterly report, whereas the honest worth of the crypto property relies on present spot costs and the corporate’s lately disclosed holdings.

Canaan’s third quarter 2025 income is predicted to be between $125 million and $145 million, implying an annual income run price of $500 million to $580 million. Based mostly on these forecasts, the corporate’s buying and selling worth is EV/income a number of 1.5-1.8xunder the two.5x to 4x vary generally seen for U.S.-listed friends throughout bull cycles.

From a profitability perspective, Canaan posted $25.3 million in adjusted EBITDA within the second quarter, which interprets to roughly $100 million yearly. Translating this, EV/EBITDA a number of is roughly 8.9xwhich is modest in comparison with top-tier miners that commerce at 10-20x below favorable market situations. Subsequently, there’s room for a number of expansions if revenue margins are maintained and investor sentiment strengthens.

On an asset foundation, the corporate reported internet property of roughly $484.5 million excluding cryptocurrencies and $592.1 million together with crypto holdings. This determines the reservation worth (P/B) 2.7x to 4x It will depend on the way you deal with your digital property. These aren’t deep worth ranges, however they’re additionally not overly stretched, particularly provided that a lot of Canaan’s latest partnership offers have had no full monetary affect.

In the long run, the inventory worth was $1.80, not a deep low cost, but in addition not aggressively priced. The market is recognizing Enhancing fundamentals and visualizing short-term returnshowever has not but assigned a premium for progress or broader strategic upside elements.

remaining ideas

Canaan is evolving from a {hardware} provider to a provider. Extra vertically built-in crypto mining gamerswith the growth of self-mining operations, significant crypto property (1,582 BTC and a pair of,830 ETH), and growth of world partnerships. The latest 50,000 unit miner order ought to considerably increase income within the coming quarters and assist enhance valuation metrics.

Nonetheless, challenges nonetheless stay. Canaan posted a internet lack of $11.1 million within the second quarter, and its backside line might proceed to be below strain until Bitcoin costs proceed to rise or value efficiencies enhance. Excessive working prices and depreciation bills proceed to strain revenue margins.

Specifically, geopolitical dangers surrounding US tariffs on Chinese language high-tech exports are additionally lingering. Canaan is working to alleviate this subject via new manufacturing strains within the US and Malaysia, however execution dangers stay.

In the end, the outcomes for the following few quarters, particularly Q3 (Estimated quantity is $125 million to $145 million.), Bitcoin worth path, and community problem traits might decide whether or not Canaan is valued available in the market. For buyers betting on a broader crypto bull cycle, this inventory has potential, but it surely’s not with out danger.