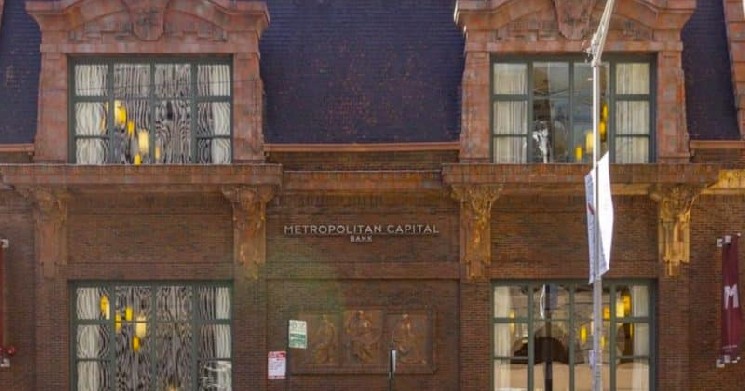

Metropolitan Capital Financial institution & Belief, a Chicago-based single-branch lender, turned the primary U.S. financial institution to fail this yr after regulators shut it down Friday and appointed the FDIC as receiver, in response to the Federal Deposit Insurance coverage Company (FDIC).

First Independence Financial institution will assume considerably all the deposits of failed Metropolitan Capital Financial institution & Belief, buying roughly $251 million in property. The previous Metropolitan Capital department will reopen as a First Independence Financial institution retailer on February 2nd.

Prospects robotically keep FDIC protection and have fast entry to funds by way of examine, debit card, or ATM whereas persevering with to make common mortgage funds. The FDIC expects the failure to end in a lack of roughly $19.7 million to the Deposit Insurance coverage Fund.

The closure follows a interval of minimal financial institution failures, with two small banks failing in 2025.