As soon as praised as China’s “M&A King,” the Chinese language Renaissance is reshaping its future with regard to digital property. Boutique Funding Financial institution authorised a $200 million allocation to Web3 in 2025.

This consists of $100 million invested in BNB, the BNB chain’s native token, by means of a strategic settlement with former Binance Labs, YZI Labs.

From M&A legacy to digital property

The choice marks the turning level for the corporate that has constructed a status for brokering China’s groundbreaking web mergers. From the partnership between driving large Diddy and Quadi to the merger of Matean and Diamping, the corporate flourished in an period of super-growth.

Nevertheless, China’s web growth light, antitrust scrutiny led to a decline in session prices. The Chinese language Renaissance was dealing with rising strain to reinvent its enterprise mannequin. The corporate presently holds its place as a bridge between conventional finance and a decentralized world.

Web3 Pivot comes from a change in management after founder Bao Fan’s lack of failure in 2023. His spouse, Xu Yanqing, has developed a “China Renaissance 2.0” technique, envisaging the chairman. The plan locations Arduous Expertise, Digital Finance and Web3 on the Progress Middle.

In June, the board authorised a $100 million finances for crypto asset exposures in step with Hong Kong’s secure laws and up to date digital asset coverage. By August, the Chinese language Renaissance had doubled by signing a memorandum with YZI Labs to accumulate $100 million for $100 million.

Market observers shortly in contrast micro methods recognized for company Bitcoin Holding. The media has named the Chinese language Renaissance Hong Kong’s “BNB MicroStrategy.” The deliberate initiative will work with the Huaxing and Huaxia Fund (Hong Kong) to construct BNB-backed merchandise, set up real-world property (RWA) funds, and develop BNB adoption within the metropolis’s listed ecosystem.

On the BNB chain’s fifth anniversary occasion in August, Xu highlighted the rising institutional curiosity.

“We are able to now not ask why digital property are essential. Establishments wish to know find out how to correctly allocate core property like BNB.”

She added that China’s Renaissance goals to turn into a “bridge between Web2 and Web3” by leveraging its experience in funding banking, asset administration and wealth providers.

The strategic transfer was strengthened by YZI Labs, which launched an official assertion on X after BNB’s record on Hong Kong’s OSL Trade.

“BNB adoption continues to develop. As @official_crshk leads the initiative, @OSL_HK’s $BNB record marks its first milestone because the Chinese language Renaissance strategic partnership with YZI Labs.

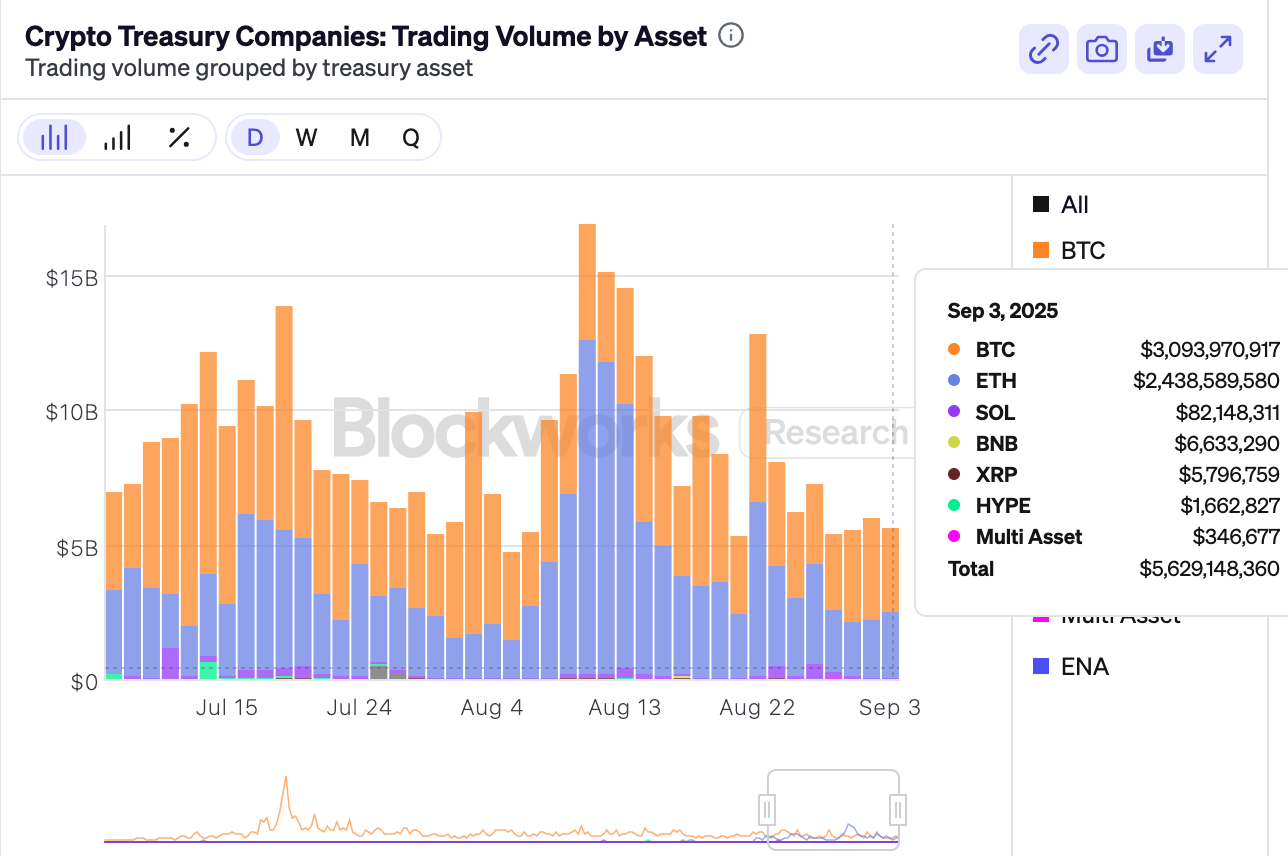

Crypto Treasury Firms: Commerce volumes by Asset BlockWorks Analysis

BlockWorks survey knowledge on September 3 confirmed that BTC and ETH management the Treasury transaction, totaling over $5.5 billion. BNB’s $6.6 million shares spotlight that tough climb.

Hong Kong and past challenges

Financial institution timing displays wider adjustments as Hong Kong is making an attempt to rebrand itself as a hub for digital property. Nonetheless, insiders warn regulators that they’re skeptical of cryptocurrency methods. In line with Caixin, Hong Kong authorities have used their stability sheets on Token Holdings to point out “low perceptions” of listed corporations. Market contributors may have in depth lobbying.

The context of regulation provides one other layer of complexity. Beincrypto reported that Hong Kong has deployed a licensing framework for Stablecoin issuers and launched a tokenization initiative. Mainland China continues to implement strict guardrails. Offshore Yuan Shortage has restricted stubcoins on CNH pages, leaving the area’s USD and HKD-related tokens dominated. This distinction highlights why the Chinese language Renaissance’s Hong Kong-based technique is essential. It offers publicity to digital property in jurisdiction in the direction of cautious legalization, in distinction to Beijing’s restrictions.

In the meantime, the worldwide capital markets tighten guidelines for Chinese language issuers. Reuters reported that NASDAQ plans to implement the next float requirement and quicker registration of thinly traded Chinese language shares. It raises one other hurdle for companies just like the Chinese language Renaissance, spanning digital and conventional finance.

Pivoting additionally poses operational dangers. Not like the standard function of recommendation, Web3 funding means navigating the risky cycle, quickly altering narratives, and reputational threats. A protocol hack or challenge failure might lead to purging your evaluation inside 48 hours. Institutional buyers like Singapore’s Temasek have already suffered reputational injury from publicity to collapsed platforms like FTX.

The corporate’s story is now just like a excessive stakes experiment. The Chinese language Renaissance has constructed a status for 20 years by matching capital with Chinese language web pioneers. An identical function is predicted to exist in decentralized finance in 2025. Whether or not it turns into a Web3 financial institution or fades to obsolescence is not any exception, and will depend on how properly it adapts to a world the place non-intermediation is the rule.

The previous Chinese language M&A King bets that the long run concerning Crypto was first launched in Beincrypto.