The $300 million HPC deal for Cipher Mining (CIFR) was speculated to be a catalyst, however stock lay down because the $1.3 billion convertible increase stole the highlight. Here is why the establishment hastened and what it means to shareholders:

The subsequent visitor put up comes from bitcoinminingstock.io, A public market intelligence platform that gives information on corporations uncovered to Bitcoin mining and cryptocurrency methods. Initially revealed by Cindiffen on October 1, 2025.

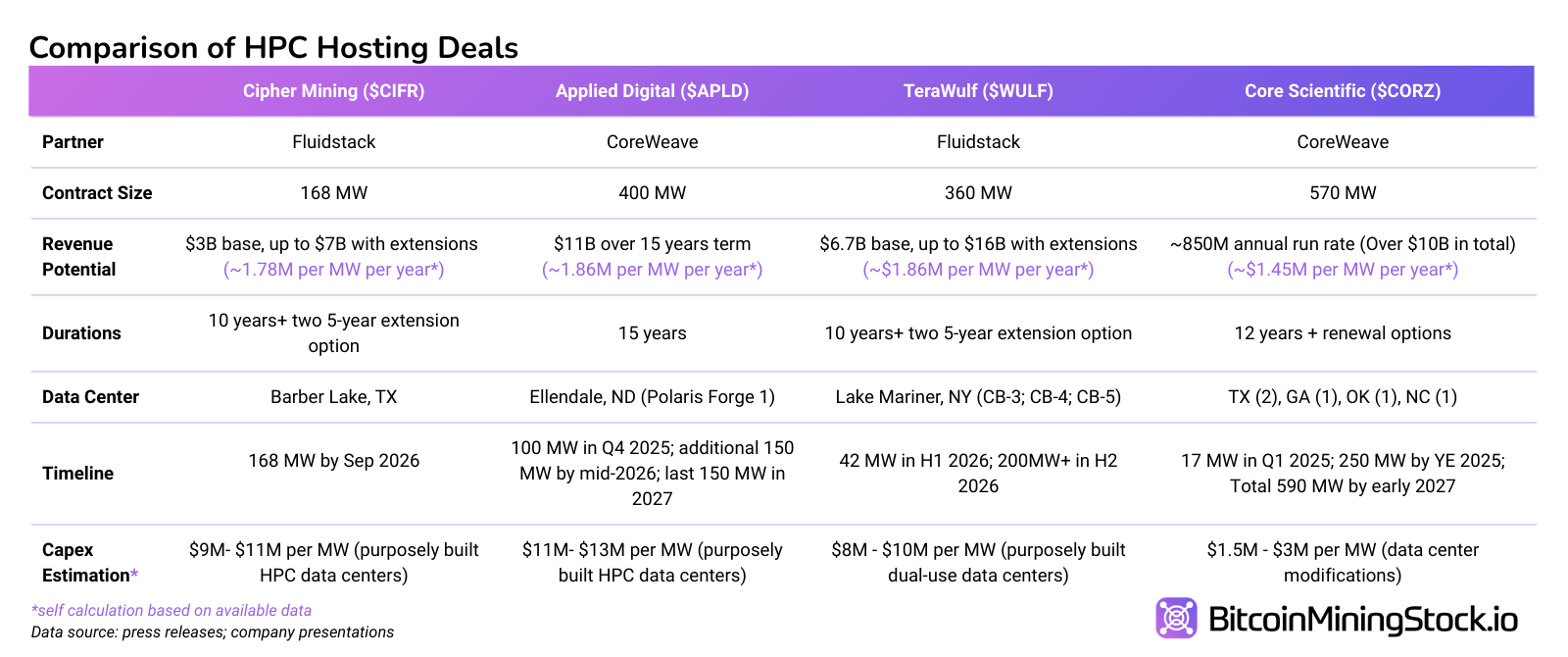

Latest Crypto Mining announcement The primary hyperscale buying and selling revealed Fluidstack as an HPC consumer. This marks the fourth main HPC internet hosting settlement amongst public miners and enhances the sector’s pivot to HPC as a complement to Bitcoin mining.

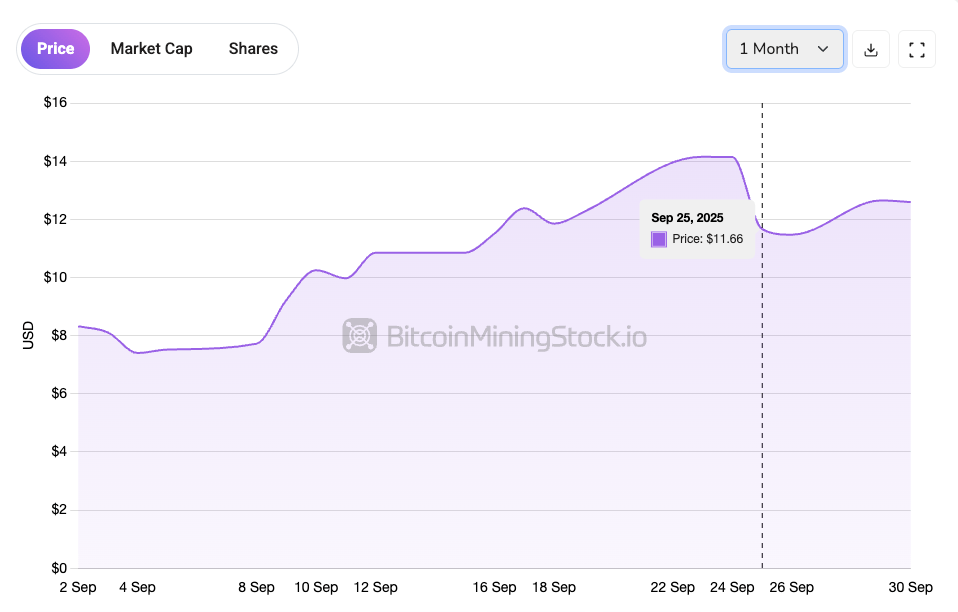

Such bulletins normally trigger sustained gatherings. This time, Cipher’s inventory was first checked, however shortly fell after saying a large personal finance. Inside 24 hours, $800 Million Personal Convertible Observe Provide Up dimension $1.1 billion On overwhelming institutional demand. On social media, traders have denounced the convertible for killing momentum. This notion is comprehensible, but it surely additionally reminds us that giant upfront prices are required to make the advantages of HPC/AI a actuality.

Let’s unlock this mechanism of funding contracts. As a result of the establishment unexpectedly finds why shareholders responded cautiously.

HPC Economics and Funding Hyperlinks

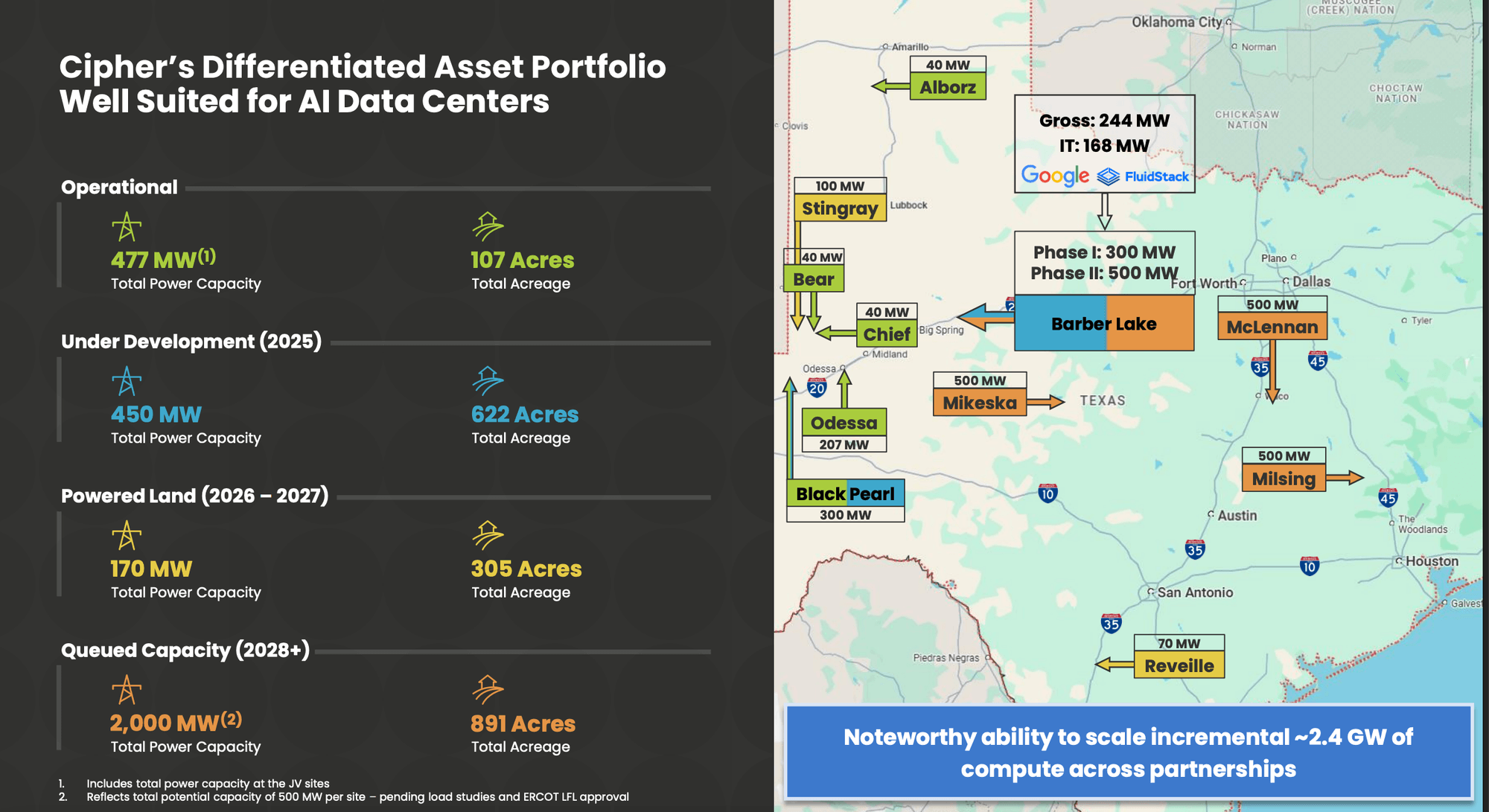

The Barber Lake web site and Cipher’s wider 2.4 GW pipeline are the spine of HPC methods. You want Hyperscalers Massive pay as you go spending Land, energy interconnections, and information heart build-outs. Fluidstack examined demand, however capital was a bottleneck.

*Barber Lake’s 168MW construct alone is anticipated to require a capital funding of round $1.5 billion to $1.8 billion, even earlier than bearing in mind the extra prices required to completely make the most of Cipher’s wider vitality pipeline.

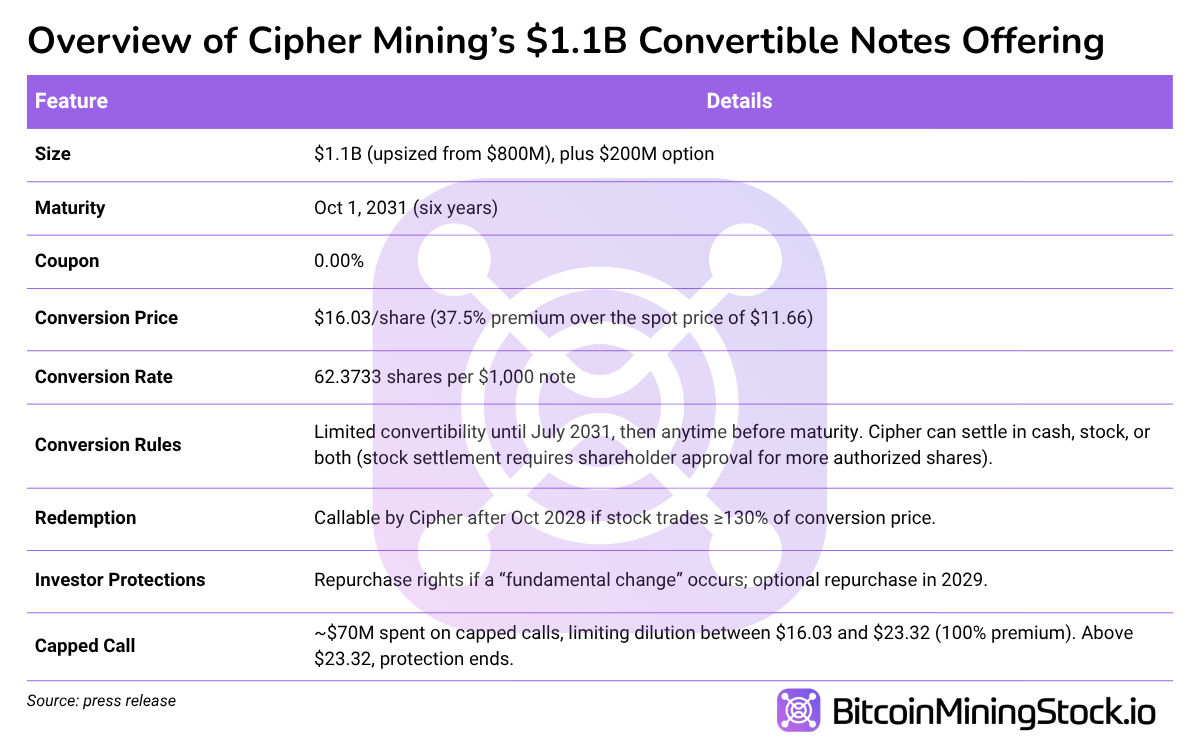

That is the place the convertible is available in. A $1.1 billion wage improve shouldn’t be an afterthought to HPC tales, however a needed step. By securing years of capital with zero curiosity, Cipher bought the time and sources to run. However in doing so, administration shifted danger from administration to fairness construction.

Disassemble the convertible notice

Worth of worth 0.00% Convertible Senior Notes Till October 1, 2031It’s scheduled to be resolved on September thirtieth, 2025. The deal shortly rose from $800 million to $1.11.1, with a further $200 million possibility*, reflecting overwhelming institutional demand.

*$200 million buy choices exercised per cipher Kind 8-Okayconvey within the whole convertor payments issued to $1.3 billion.

In comparison with peer miners, the transaction (6-year funds at 0% rate of interest) seems to be cheaper. Some folks both paid an rate of interest of 10% or extra on their debt or depend on issuing cereal fairness. As well as, Cipher spent $700,000,000, Cap name transactionwhich helps scale back dilution when inventory rises. In different phrases, shareholders are shielded from dilutions of as much as $23.32 per share (nearly twice the promoting worth reported on September 25, 2025).

Why did the establishment run in?

At first look, this personal product would not pay curiosity till 2031 and would not appear engaging to be locked. Nonetheless, convertible notes should not easy bonds, however basically Mortgage and Inventory Name Choices. Traders will obtain compensation in 2031 if crypto is struggling, but when the inventory exceeds $16.03, they will convert pretty and seize it the other way up.

For hedge funds, enchantment goes past easy long-term publicity. Many runs Transformable arbitrage methodsthey purchase notebooks and shorten the inventory proportionally to conversion price. After that, the quick hedge is like that It is dynamically adjusted As inventory costs transfer. The objective is to not wager on the fundamentals of an organization, however to make earnings from options-like buildings and inventory volatility.

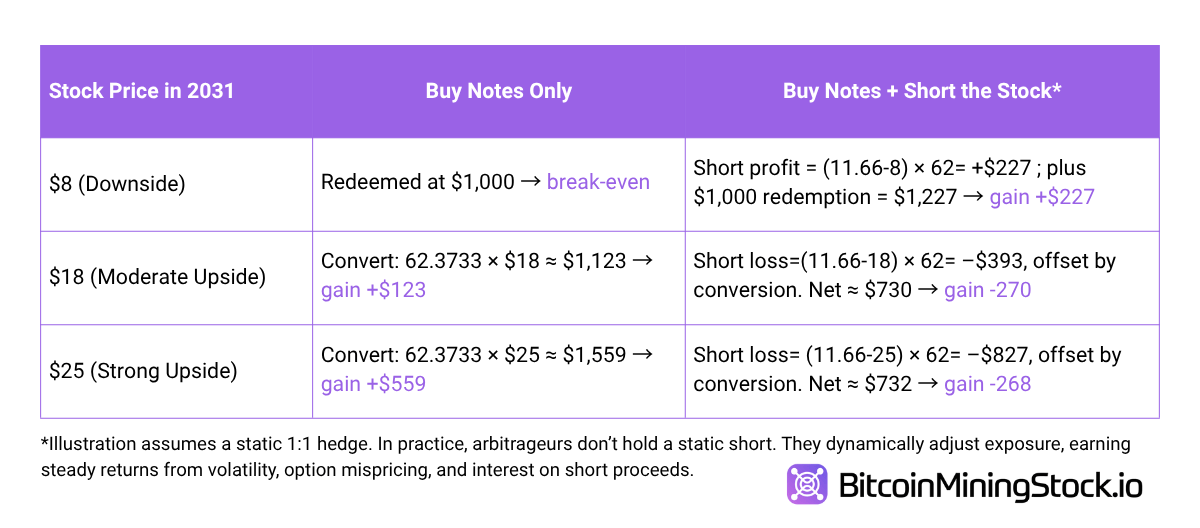

To elucidate, we assume that the investor will purchase $1,000 face worth Notes (62.3733 shares if transformed). Cipher’s inventory was $11.66. The conversion is $16.03.

in Static setupthe result’s as follows:

So, what does this imply? Static arithmetic could appear unattractive to arbitrators at larger costs, however dynamic hedging makes the technique worthwhile throughout the result. That is why the establishments stack up: they get the construction they supply Safety like the other way up bond like choices,Then again, strange shareholders solely profit if Cipher is efficiently executed. This explains why this transaction took impact inside hours.

Dilution mechanism for shareholders

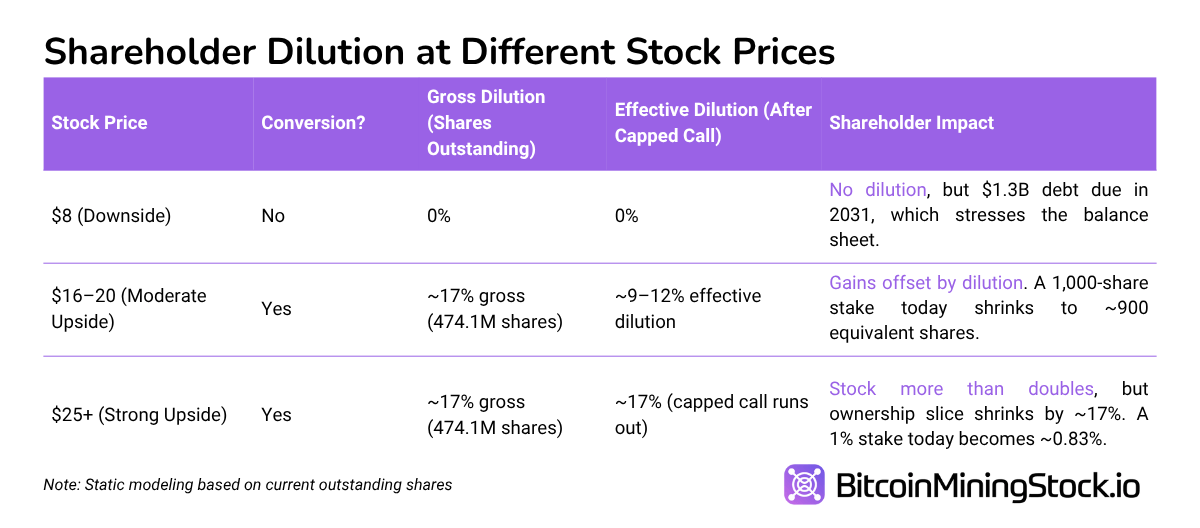

For a standard stockholder, the impression is easy and it’s a lot much less versatile than an establishment. Cipher at present has ~393m shares are unpaid. If all notes are transformed, a brand new inventory of ~81.1m might be issued and the full might be lifted to ~474.1m. Capped calls trim this 9-12% If the shares land between $16.03 and $23.32, however exceed that (>$23.32), there isn’t any safety and the shareholders will take up the complete dilution.

Asymmetry Right here: Establishments can fine-tune dangers by means of hedging and lock in to return, however shareholders can not. Inventory traders have binary outcomes. The code is working and the inventory has been valued properly sufficient to exceed a 9-17% dilution, or not, with the corporate being responsible for shares and $1.3 billion in debt.

Last Ideas

Cipher’s Fluidstack contract I will confirm it A strategic shift in the direction of HPC and AI internet hosting. Like Core Scientific, Utilized Digital, and Terawulf, the corporate is leveraging vitality and infrastructure to draw hyperscale purchasers, aiming for a way more predictable income stream than pure Bitcoin mining.

However muted inventory reactions present how Funding Even probably the most constructive headlines could be solid a shadow. The $1.3 billion convertible notice has well structured, capped name safety with out instant money drainage, and nonetheless represents a considerable future declare for equity. Shareholders face a dilution of 9-17% when the cipher is executed, however that is true Dilution solely causes a considerably larger inventory worth.

This rigidity explains the divergence HPC buying and selling is a transparent strategic victorynonetheless, fundraising restructuring traders deal with danger. Cipher is the front-load capital to construct Barber Lake and activate the two.4 GW pipeline. It is a needed step if you wish to monetize HPC demand at a big scale. If the execution takes place inside the deadline and Barber Lake’s 168 MW comes on-line by September 2026 as deliberate, the ensuing income may exceed the dilution.

For now, convertibles give establishments an entry level like low-risk choices, with shareholders taking execution danger. The HPC storyline stays partaking, however till concrete revenues come true, the market may have fewer cryptos on account of its Fluidstack offers, and the $1.3 billion funding it has been used to fund it.