Digital asset shares are cut up this week, with spot costs flattening, and sharper alerts emerge from public firms holding digital property.

A research by analysis agency 10x stated the sector is cut up between constrained incumbents and new winners. The premium that after promoted progress is compressed and creates a danger of stress as a change in liquidity.

Ministry of Finance, firms rebound

Bitcoin’s flat efficiency contrasts with the growth of splits, warning that 10x analysis might precede a extra dramatic spin.

“What seems as integration may very well be light earlier than a pointy flip.”

As soon as Bitcoin’s most aggressive purchaser, MicroStrategy is at present going through restrictions. Its internet asset worth (NAV) a number of fell from 1.75 occasions in June to 1.24 occasions in September, suppressing new purchases. The inventory value slides from $400 to $326 and the way Monetary Mannequin It turns into weak with out premium assist.

Skepticism is mirrored exterior the analysis desk.

“My finest monetary recommendation is that you simply simply want to purchase Bitcoin and keep as far-off as potential from $MSTR.

Feedback from traders and podcaster Jason highlighted the issues Monetary shares It could add complexity fairly than direct publicity.

Metaplanet, sometimes called “Japan’s micro-strategy,” has surpassed 66% amid issues over tax coverage this summer season. Regardless of buying and selling near 1.5 occasions extra NAV, volatility stays excessive and retail movement stays risky.

In distinction, the circle has recovered 19.6% since September ninth, after USDC adoption expanded by the Finastra partnership. Ten occasions extra analysis reaffirmed the bullish angle, calling Circle extra engaging as a liquidity beneficiary than Coinbase.

Choices reset, places strain on finance firms

Along with these fairness shifts, the derivatives market has signaled reasonably. Ten occasions reported a 6% drop in volatility implied BTC, and a 12% drop in ETH on September 12, after a 12% drop in ETH and softened producer costs and inline CPI. Merchants actively offered volatility and dealt with circumstances regular. Nonetheless, 10x warned that pricing for compressed premiums and decrease choices might set a sharper squeeze stage if the movement was reversed.

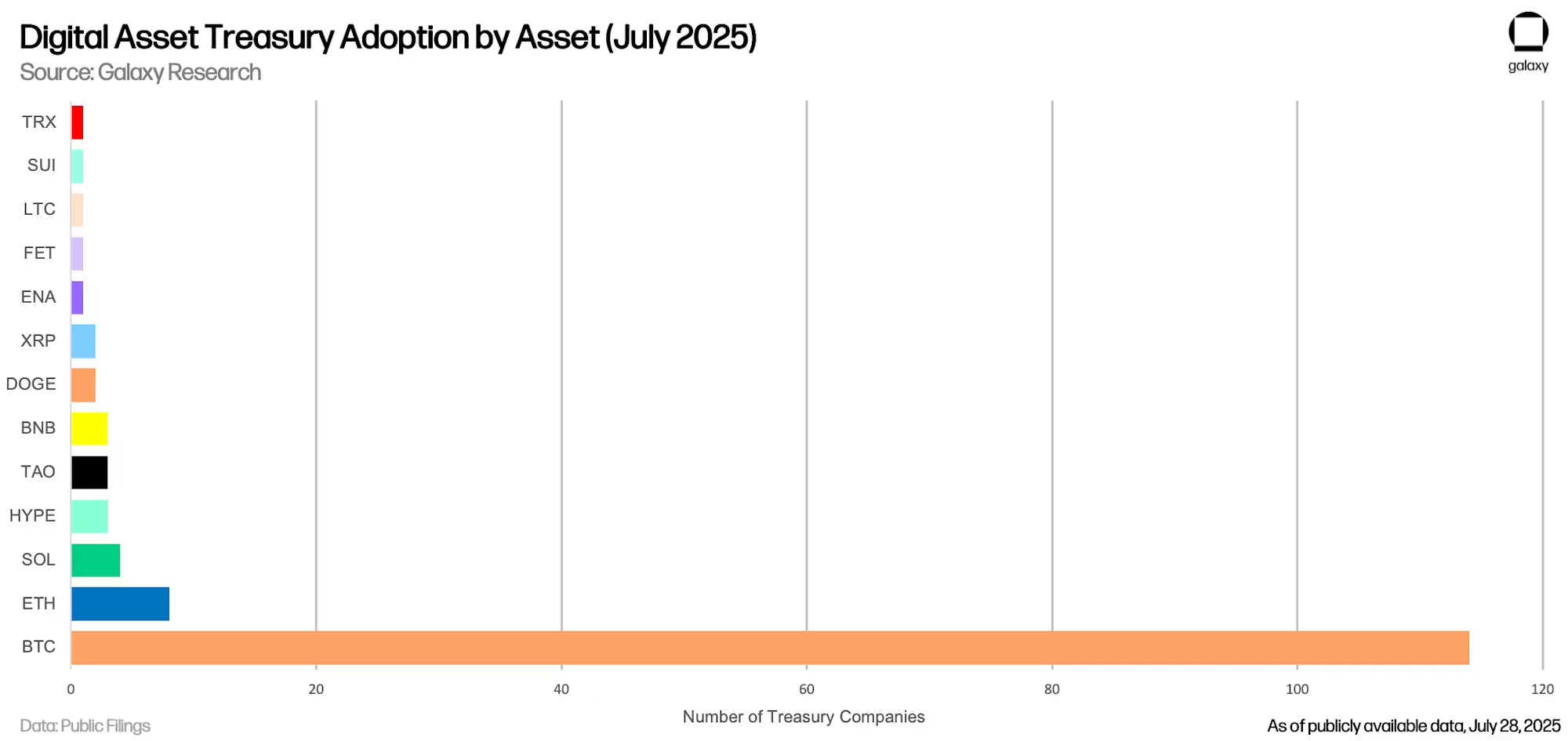

Digital Belongings by Belongings Ministry of Finance (July 2025) :Galaxy Analysis

Galaxy Analysis estimated that Digital Asset Finance Firm (datcos) at present owns greater than $100 billion in crypto, led by Technique (previously MicroStrategy), Metaplanet and others. This mannequin thrives on inventory insurance coverage premiums, however collapsed valuations threaten capital entry. Galaxy warned that gas progress in merchandise and pipes out there and pipes can backfire right into a recession.

Coinbase Institutional’s month-to-month outlook defined that the sector will enter the “PVP stage” the place success relies on execution fairly than imitation. DAT Circulation nonetheless helps Bitcoin, however claimed that the straightforward premium period is over Within the second half of 2025.

Beincrypto reported it Finance Firm“Purchases are slower, and several other ethnic targeted firms are at present buying and selling under MNAV, poses the danger of funding and compelled gross sales. He additionally stated a small variety of gamers counting on money owed are growing vulnerability, and liquidation is an imminent risk.

The result of Bitcoin might rely upon whether or not circle rebounds construct confidence or whether or not NAV compression throughout incumbents causes stress. For now, the choices counsel gentle, however there are variations between Monetary shares Signifies the cycle below pressure.

Submit-digital asset inventory branches: Circle Rises and MicroStrategy Stalls first appeared in Beincrypto.