Bitcoin Mining Firm CleanSpark secured a second $100 million credit score line this week with out issuing new shares, highlighting the rising position of digital property as collateral for mainstream finance.

The most recent facility, disclosed on Thursday, will function two Prime, the establishment’s Bitcoin (BTC) yield platform, totally supported by CleanSpark’s Bitcoin Treasury. Beneath the settlement, CleanSpark’s whole collateral mortgage capability is presently $400 million.

The non-dilution of funding is especially noteworthy. Public firms usually increase progress capital by inventory presents that may dilute the inventory of current shareholders. Through the use of almost 13,000 BTC holdings as collateral as an alternative, CleanSpark positive factors entry to liquidity whereas sustaining shareholder worth.

The deal is protected towards Bitcoin Reserve, following a further $100 million credit score facility introduced earlier within the week at Coinbase Prime. The corporate’s representatives revealed to Cointelegraph that the 2 Prime and Coinbase main services are separate preparations, each of which contribute to the elevated monetary flexibility of the corporate.

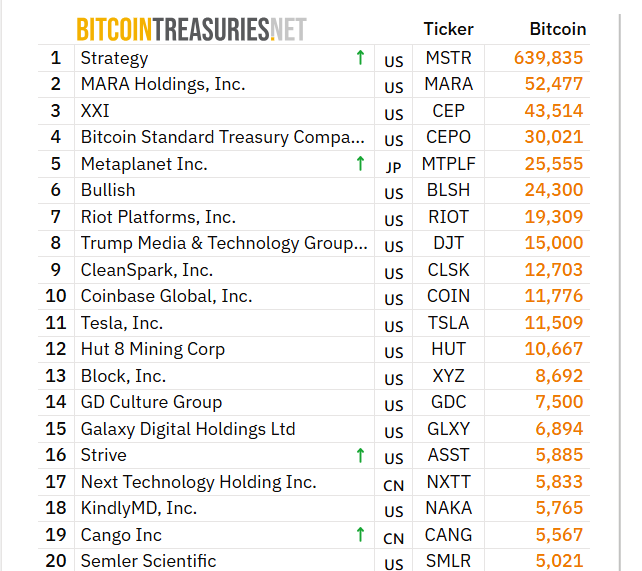

CleanSpark is the ninth largest public Bitcoin holder with almost 13,000 BTC on its stability sheet. sauce: bitcointreasuries.web

This funding will give Clear Spark extra flexibility to shortly deploy capital, whereas avoiding extreme leverage. The corporate plans to make use of credit score to increase its knowledge facilities, enhance its Bitcoin hashrate capability and increase its high-performance computing infrastructure.

CleanSpark would not simply faucet on Bitcoin Reserves to boost funds. Riot Platforms, which owns greater than 19,300 BTC, secured a $100 million credit score facility from Coinbase Prime earlier this yr.

Associated: Twenty One Capital Eyes Bitcoin Supported USD Mortgage: Report

Development in Bitcoin help funding

The worth of Bitcoin and the wealth it generates drives demand for Bitcoin-backed loans, that are created by each companies and people. Some buyers use them to purchase actual property with out promoting BTC, however it’s a technique that helps keep away from the set off for capital positive factors tax.

For Bitcoin Miners, this pattern has modified monetary administration. As a substitute of promoting mined BTC shortly to cowl operational prices, extra miners are holding Bitcoin on their stability sheets. Because of this, secured lending has grow to be a gorgeous possibility.

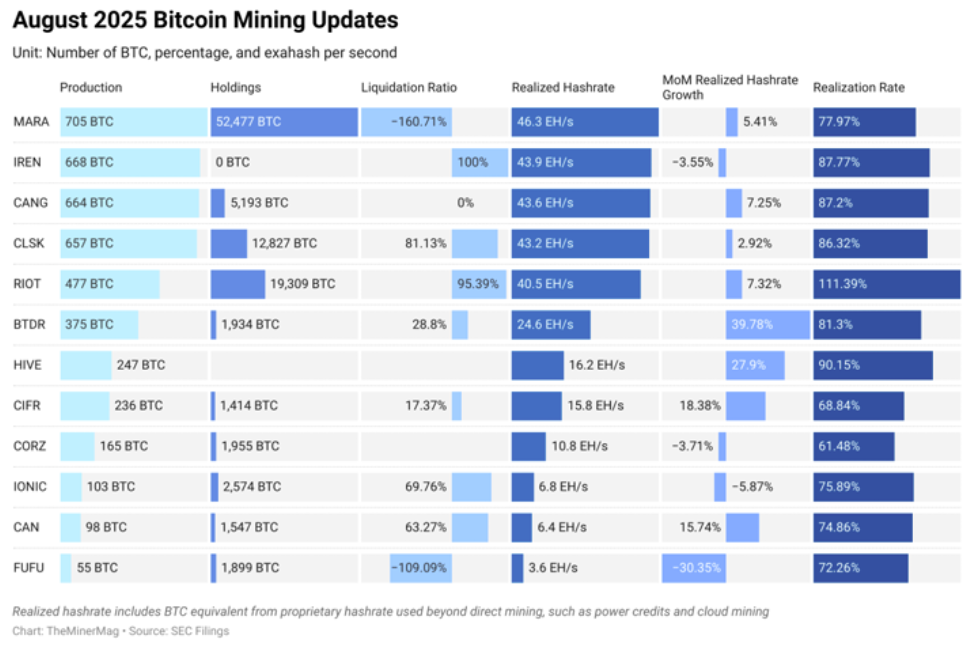

The largest bitcoin miners, reminiscent of Marathon Digital, CleanSpark, Riot Platforms, and Cango, maintain a considerable quantity of BTC on their stability sheets. sauce: Minor mug

Such funding gives a non-dilutive strategy to increase capital for miners whereas sustaining publicity to the potential advantages of Bitcoin. For miners with a substantial BTC Treasury, opposition to their holdings might be cheaper than conventional debt financing.

Journal: 7 Causes Why Bitcoin Mining is a Worrisome Enterprise Concepts