Institutional demand for regulated altcoin derivatives is exploding, with new XRP and SOL futures accelerating liquidity, sharpening worth discovery, and poised to redefine the following stage within the evolution of digital asset markets, driving a brand new wave of sturdy product development.

XRP and SOL Futures Develop Regulated Crypto Entry

Rising demand for regulated digital asset derivatives is fueling product enlargement. CME Group launched a particular government report on November 14th, asserting that it’s going to listing spot inventory worth XRP futures and spot inventory worth SOL futures on December 14th, with a buying and selling day of December fifteenth, pending regulatory overview.

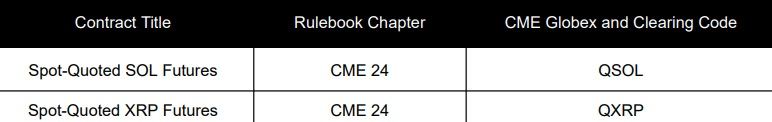

The particular government report outlines that each contracts are money settled and incorporate every day money changes to account for the idea between the futures worth and the underlying spot index. Spot-quoted XRP futures discuss with the CME CF XRP greenback reference price and commerce below the code QXRP. The contract measurement is 250 tokens, the minimal tick is $0.0004, and the tick worth is $0.10. Spot quoted SOL futures discuss with the CME CF SOL greenback reference price and are listed with the code QSOL, utilizing a contract measurement of 5 tokens, a minimal tick of $0.02, and a tick worth of $0.10.

CME spot quoted SOL futures and spot quoted XRP futures. Supply: CME Group

Every product might be launched with a single maturity of June 2026 (QXRPM6 for XRP and QSOLM6 for SOL) and traded on CME Globex with clearing by way of CME ClearPort. Until adjusted for U.S. holidays, buying and selling for each contracts will finish at 4:00 p.m. Jap time on the second Friday of the contract month, in accordance with the report.

learn extra: CME highlights XRP futures surging as institutional buying and selling momentum will increase

The report additionally particulars charge constructions, together with quarterly upkeep charges of $0.15 for XRP and SOL contracts, and CME Globex transaction charges starting from $0.10 for sure membership classes to $0.20 for non-members.

Market strategists see the simultaneous introduction of XRP and SOL as an enlargement of hedging choices for institutional buyers throughout two extremely liquid altcoins. Whereas skeptics warn of altcoin volatility and evolving regulatory concerns, proponents argue that regulated XRP and SOL futures will improve transparency, enhance worth discovery, and broaden institutional threat administration instruments in digital belongings.

FAQ ⏰

- What are the primary traits of the brand new spot quotes XRP and SOL futures?

These are cash-settled contracts with every day money changes and are due June 2026, traded on CME Globex. - How do contract sizes differ between XRP and SOL?

XRP makes use of a contract measurement of 250 tokens, whereas SOL makes use of a contract measurement of 5 tokens with the same $0.10 tick worth. - What charges apply to new altcoin futures?

Each merchandise have a quarterly upkeep charge of $0.15, and CME Globex’s buying and selling charges vary from $0.10 to $0.20. - Why are monetary establishments desirous about regulated XRP and SOL futures?

These present clear, regulated publicity that enhances hedging, worth discovery, and threat administration for extremely liquid altcoins.