Coinbase expects the crypto market to enter a restoration part in December as liquidity improves and promoting strain from long-time Bitcoin holders eases.

On December 5, the US-based crypto buying and selling platform mentioned market situations have modified in latest weeks, pointing to new capital inflows, tightening spreads, and elevated macro assist.

Liquidity state of affairs improves as odds of Fed price lower rise

The commerce highlighted rising expectations for a Fed price lower, with CME FedWatch exhibiting the chance of a Dec. 10 assembly near 90%.

It added that the restoration in liquidity marks a pointy change from the sustained capital outflows that characterised October and November.

Certainly, broader cash provide knowledge seems to assist this speculation. After an uncommon multi-year contraction, M2 reached a file excessive of $22.3 trillion, surpassing its peak in early 2022, in accordance with Fed statistics.

US M2 cash provide hits a brand new all-time excessive of $22.3 trillion 🤑📈🥳 pic.twitter.com/nYryFFj3Vk

— Barchart (@Barchart) December 5, 2025

Analysts usually monitor M2 to grasp adjustments in liquidity and inflation expectations. Moreover, provided that the asset has a set provide of 21 million cash, elevated liquidity has traditionally coincided with improved Bitcoin efficiency.

On the similar time, Coinbase mentioned that quick greenback positioning seems to be enticing at present ranges, which might draw buyers looking for extra threat again into cryptocurrencies.

The corporate additionally argued that the so-called AI commerce stays sturdy and continues to draw capital to digital asset sectors associated to automation and computing calls for.

Lengthy-term Bitcoin holders withdraw from sale

Particularly, the on-chain indicators are pointing in the identical path.

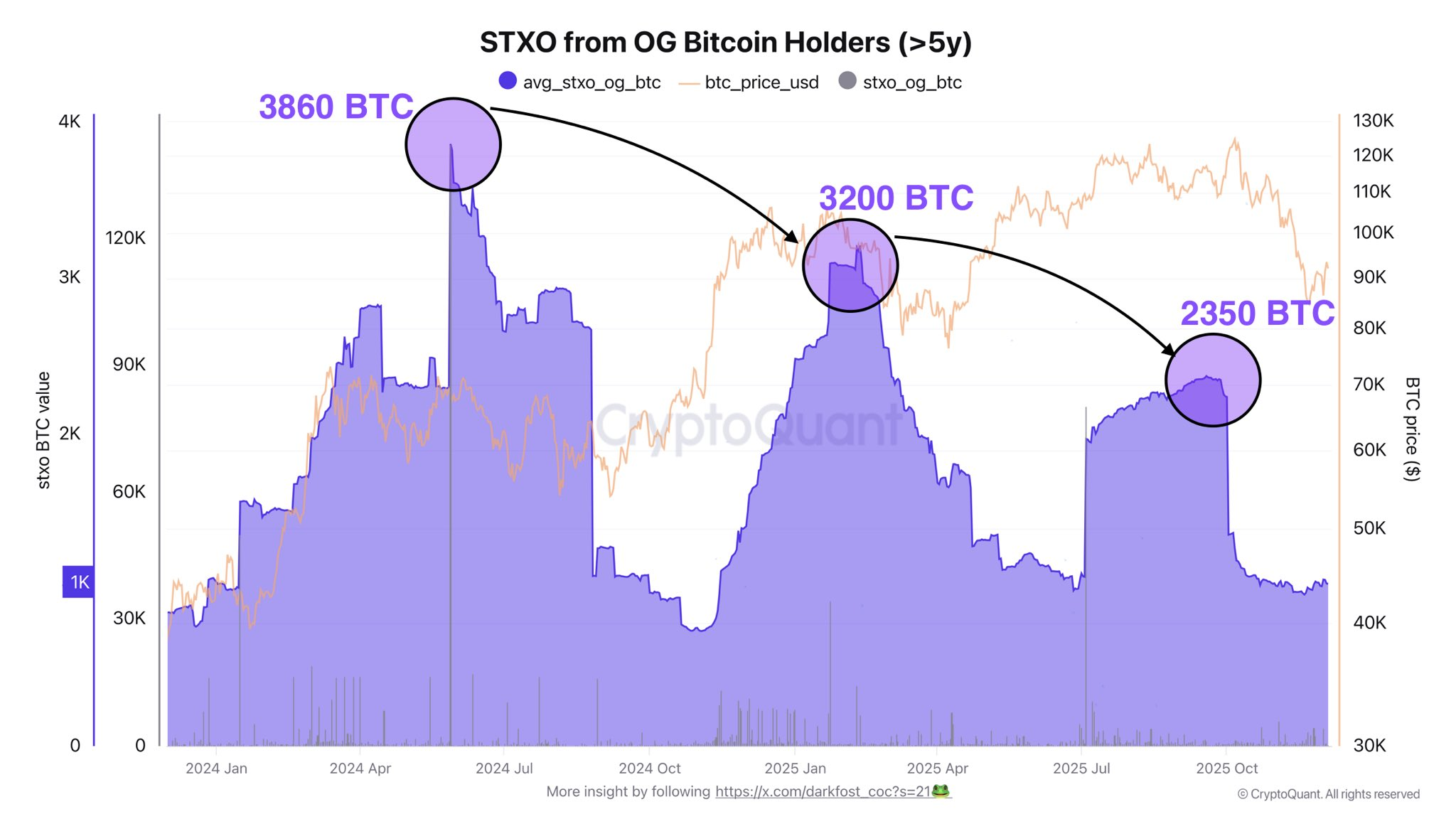

Dirkforst, an on-chain researcher at CryptoQuant, mentioned that after a number of months of elevated exercise on this cohort, there was a pointy decline in spending from Bitcoin wallets that had been greater than 5 years outdated.

Bought by long-term Bitcoin holders. Supply: CryptoQuant

He famous that the common day by day turnover of those long-term holders has decreased from about 2,350 BTC to about 1,000 BTC on a 90-day rolling foundation. This indicator usually signifies strain from buyers who’ve amassed the coin at traditionally low worth factors, corresponding to round $30,000.

Dirkforst added that the decline in UTXO and spent manufacturing exercise signifies that tensions are easing because the market cycle progresses. Subsequently, the decreased promoting from “OG” holders has given Bitcoin extra room to stabilize after a risky fall.

“This knowledge means that the promoting strain from the OGs is easing, giving the market a bit extra room. It’s noteworthy that the STXO peaks (90dma) from these OGs are getting decrease and decrease, and the promoting strain seems to be reducing because the cycle progresses,” the analyst defined.

Total, improved liquidity, supportive macro indicators and easing provide pressures set the stage for a powerful December. If this momentum continues, Bitcoin might file its first constructive closing worth in December since 2023.

The put up Coinbase makes daring predictions for Bitcoin in December regardless of market downturn appeared first on BeInCrypto.