Financial institution of America, in collaboration with Goldman Sachs, upgraded Coinbase from “impartial” to “purchase” this week, citing Coinbase’s main function in bringing the monetary system on-chain and changing into “every part change.”

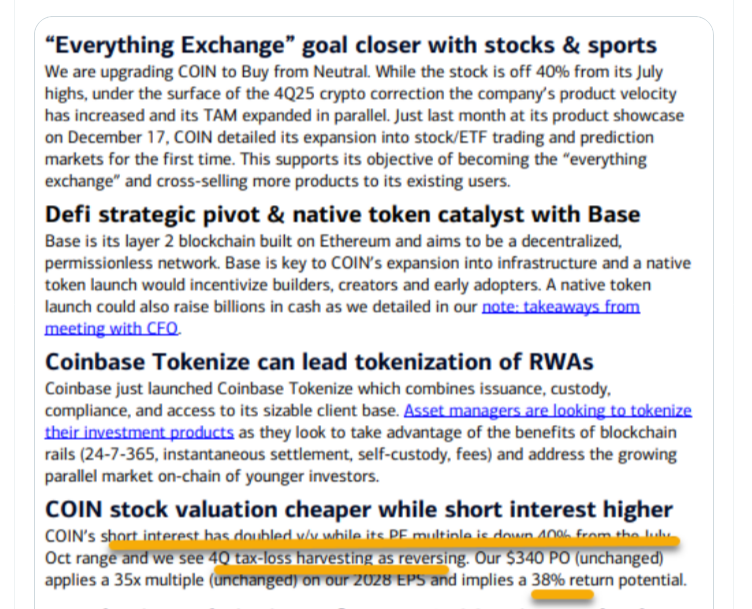

In a analysis be aware revealed Thursday, BofA mentioned Coinbase’s enlargement from buying and selling to tokenization of real-world property, together with shares and exchange-traded funds, and its transfer into prediction markets positions it to cross-sell extra merchandise to new and potential customers and lead a “new monetary system.”

“The inventory is down 40% from July highs, however beneath the floor of the crypto correction in This autumn 2025, the corporate’s product velocity is growing, and in parallel, the[total addressable market]is increasing.”

BofA mentioned Coinbase (COIN) inventory may rise about 38% from its present worth to $340 as COIN quick curiosity reverses whereas loss restoration pressures seen late within the fourth quarter ease.

Excerpt from BofA’s analysis be aware on Coinbase. sauce: Matthew Siegel

On Monday, funding financial institution Goldman Sachs additionally gave Coinbase a “purchase” ranking, explaining that the latest market pullback has left crypto shares buying and selling at a reduction and will set the stage for a rebound in early 2026.

COIN inventory was unstable all through 2025

Coinbase has fallen 5.6% over the previous 12 months to $245.6, however has traded as little as $151.8 and as excessive as $419.8 for the yr, a worth distinction of 176.6%.

Modifications in COIN inventory worth final month. sauce: Google Finance

Base token, Trump may also push COIN this yr

BofA can be bullish on Coinbase’s potential to launch a token for its Ethereum Layer 2 community, Base, which it says will elevate billions of {dollars} and encourage builders and early adopters to construct and use extra decentralized monetary purposes on-chain.

One other impetus for Coinbase is that US President Donald Trump has three years left in workplace to advance his imaginative and prescient of constructing the US the crypto capital of the world, BofA famous.

“Whereas the world remains to be within the early phases of cryptocurrency adoption, we imagine Coinbase is a trusted platform with the primary market share within the U.S. and the right TradFi accomplice.”

Nonetheless, the financial institution warned that Binance’s attainable return to the US market and additional crypto worth correction are two obstacles that might restrict COIN’s upside in 2026.