Coinbase CEO Brian Armstrong has outlined bold plans to maneuver each step of a startup’s journey to blockchain, from inception to fundraising to public buying and selling.

On the TBPN podcast, Armstrong defined his imaginative and prescient for an on-chain lifecycle the place founders can incorporate startups, elevate a seed spherical, obtain instantaneous funding in USDC, and finally go public by way of tokenized shares.

“You may think about this complete lifecycle being on-chain,” he stated, including that such a change “may improve the variety of corporations elevating capital and beginning operations around the globe.”

Armstrong stated that by having the ability to elevate funds immediately by way of on-chain good contracts, startups will not want banks or attorneys to course of international cash transfers. As soon as capital arrives, founders can begin producing income, settle for cryptocurrency funds, entry funding, and even take their firm public instantly on-chain.

Associated: Coinbase CEO reveals that “personal transactions” shall be launched to Base

Understand on-chain funding

Coinbase’s CEO stated the fundraising course of is at the moment “fairly cumbersome.” He proposed on-chain funding to leverage Coinbase’s just lately acquired funding platform Echo to make capital formation “extra environment friendly, fairer, and extra clear.”

Echo, now a part of Coinbase, has already helped greater than 200 initiatives elevate greater than $200 million. Armstrong stated the corporate will initially function independently however will regularly combine with the Coinbase ecosystem, giving founders entry to $5 trillion in belongings below custody and a world investor base.

“If we will get good builders who need to elevate cash to return in and join them with traders who’ve the cash, we have now the proper platform to speed up this,” he stated.

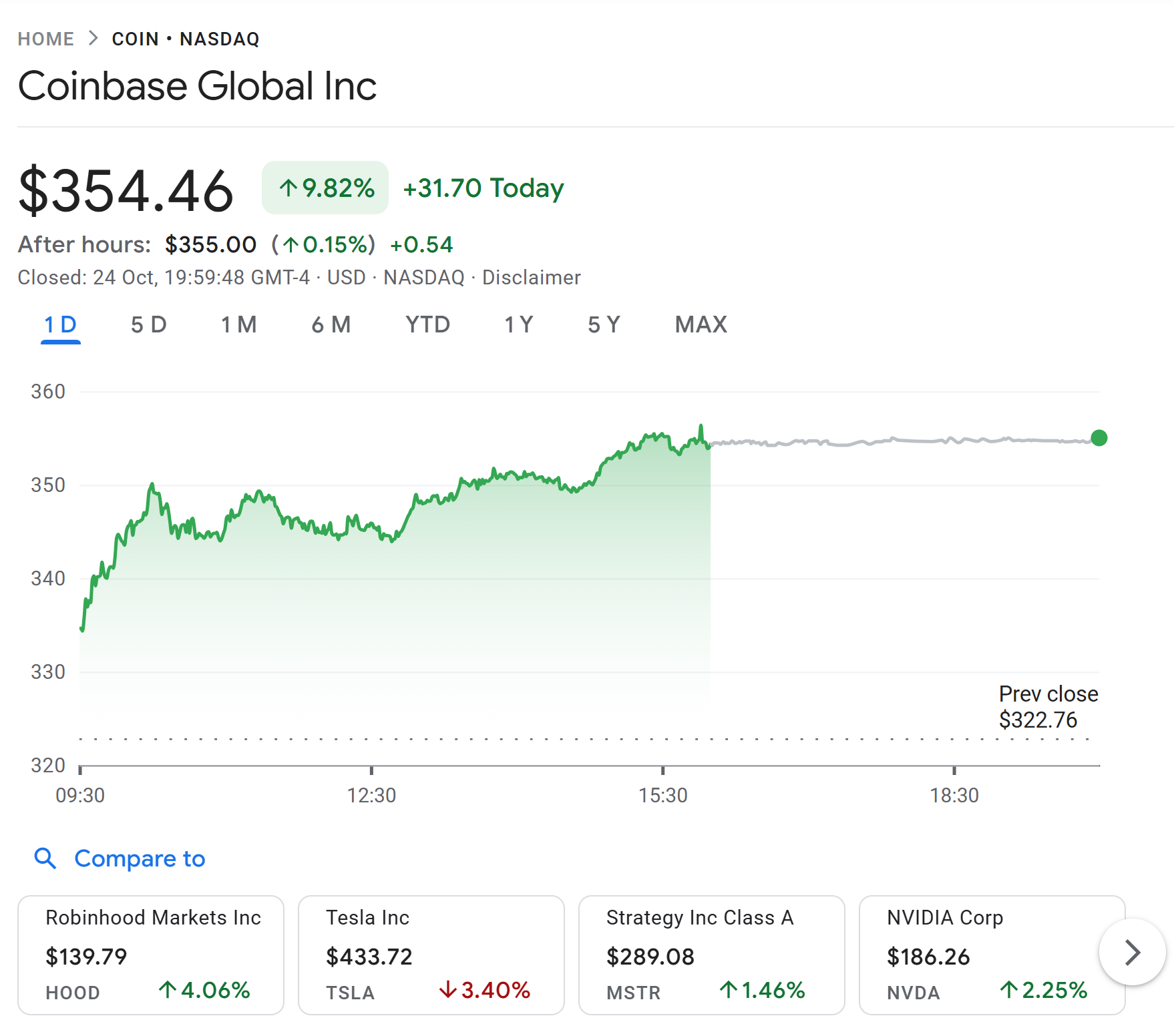

Coinbase inventory ended Friday up about 10%. Supply: Google Finance

Coinbase can be working with US regulators to allow broader entry to on-chain funding. Armstrong argued that present accredited investor guidelines exclude many people from early-stage alternatives.

“In some ways, the accredited investor guidelines are sort of unfair,” he says. “We expect to find the suitable stability of shopper protections and delivering these to retailers as properly.”

Associated: Coinbase spends $25 million to revive Final Bull Market podcast

JP Morgan sees $34 billion alternative in Coinbase base

Final week, JPMorgan Chase upgraded Coinbase to “obese”, citing sturdy progress potential from the Base community and revised USDC rewards technique.

Analysts stated Coinbase is “leaning” towards base layer 2 blockchain to seize extra worth from platform expansions. They estimate {that a} potential Base token launch may create a market alternative of $12 billion to $34 billion, with Coinbase’s share price $4 billion to $12 billion.

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom