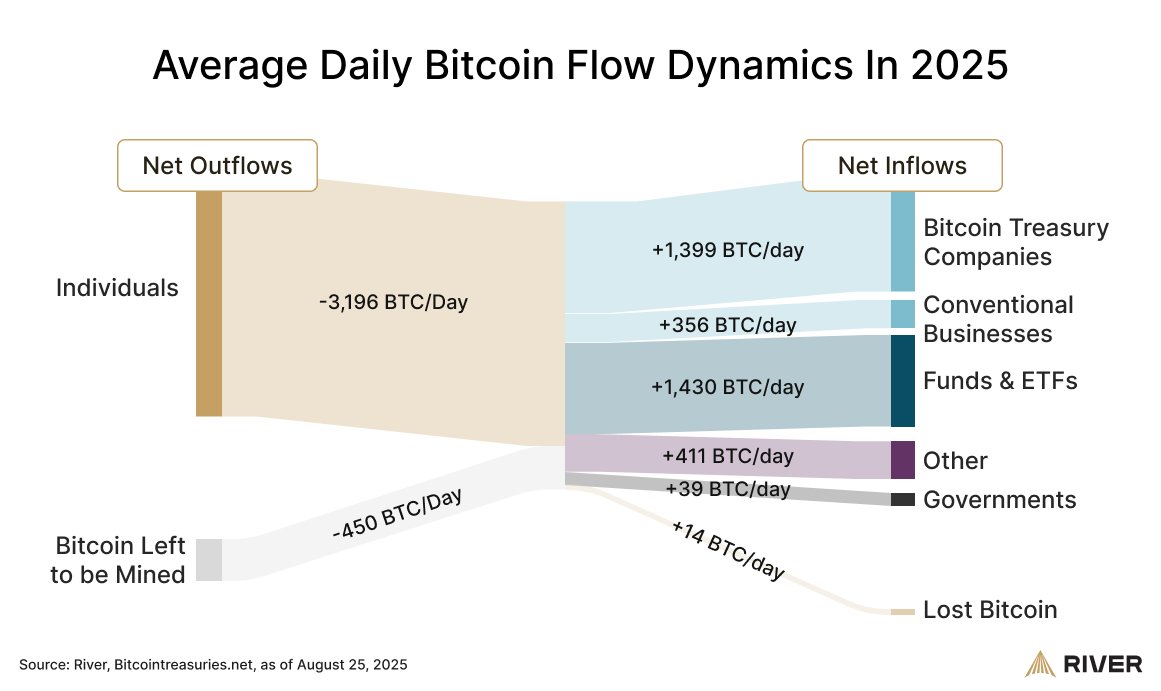

Based on Bitcoin Monetary Providers Firm River, personal and public corporations are absorbing Bitcoin (BTC), 4 occasions quicker than miners are producing new cash.

These corporations are publicly referred to as the Bitcoin Treasury and conventional or personal corporations that bought a mean of 1,755 BTC per day in 2025, in line with River.

Change-Traded Funds (ETFs) and different funding automobiles additionally bought a further 1,430 BTC per day in 2025, with the federal government buying round 39 BTC per day, River information reveals.

Companies, governments, and ETFs that collectively bought 1000’s of BTC per day in 2025 on common. Supply: Supply: river

Bitcoin miners generate a mean of round 450 new BTC per day, inflicting potential provide shocks if alternative reserves proceed to shrink and establishments proceed to take care of the coin.

Analysts proceed to take a position concerning the potential and potential affect of such a provide shock, and a few predict that it’ll change into a bullish catalyst for Bitcoin costs.

The Bitcoin change reserve, the whole quantity of BTC held on the change, continues to say no and is presently at a multi-year low. sauce: Encryption

Bitcoin finance firm that generates large demand for BTC

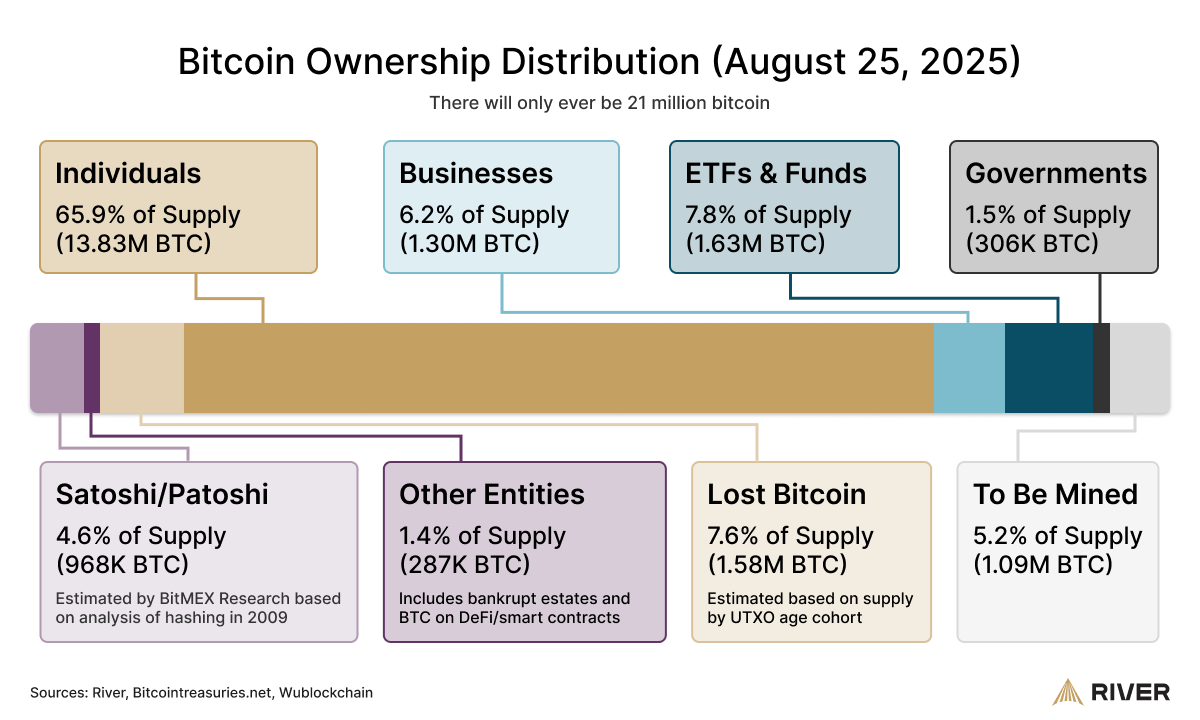

Bitcoin Treasury Firms acquired 159,107 BTC within the second quarter of 2025, bringing the whole quantity of Bitcoin held by the corporate to roughly 1.3 million BTC.

The holders are led by the technique of Michael Saylor, the world’s largest Bitcoin holder, and have a whopping 632,457 BTC in company reserves, in line with Bitcoin Treasuries.

Adam Livingston, creator of “Bitcoin Age and the Nice Harvest,” beforehand mentioned that the technique has been halving Bitcoin by itself by fast accumulation.

Breakdown of the company’s BTC possession. sauce: river

Regardless of the technique’s loopy BTC buy, Silish Jajodia, the corporate’s company finance officer, says the technique won’t have an effect on the short-term Bitcoin worth by purchases.

Jajodia mentioned the corporate will unfold purchases by off-the-shelf buying and selling (OTC) transactions that happen on exchanges and don’t have an effect on spot markets or transfer costs.

“Bitcoin buying and selling quantity exceeds $50 billion in 24 hours. That is an enormous quantity. So for those who’re shopping for $1 billion in just a few days, you are probably not shifting the market that a lot,” he mentioned.