Ethereum continues to point out energy, transferring nearer to the midline of the ascending channel and presently buying and selling round $4,670. Though the market has maintained a gentle restoration since late September, indicators of localized depletion are starting to look, suggesting the opportunity of a short-term pullback earlier than additional features.

technical evaluation

Written by Shayan

every day chart

On the every day time-frame, ETH stays firmly inside an ascending channel construction, supported by the 100-day transferring common close to $3,900 and the 200-day transferring common close to $3,000. The value is approaching the $4,800 resistance zone, a key stage that has repeatedly capped features over the previous few months.

The RSI has additionally risen to 62, reflecting wholesome momentum, though it has not but overheated. Whereas a breakout above $4,800 might pave the best way for a check of the psychological stage above $5,000, failure to maintain present ranges might result in a retest of the decrease finish of the ascending channel and even the crucial $4,000 demand zone, which is essential for traders to carry to maintain the bull market.

4 hour chart

The 4-hour chart reveals an early bearish divergence between value and RSI, indicating momentum is weakening as ETH checks the important thing $4,700-$4,800 resistance zone. Nevertheless, a small bullish truthful worth hole (FVG) has fashioned round $4,600, which might appeal to near-term retracement or help earlier than a continuation.

If patrons defend this hole and regain management, the subsequent upside value goal stays $4,800. Nevertheless, a lack of this stage might set off a deeper correction in the direction of $4,200, the place the neckline of the sturdy demand zone and up to date inverted head-and-shoulders sample lies.

On-chain evaluation

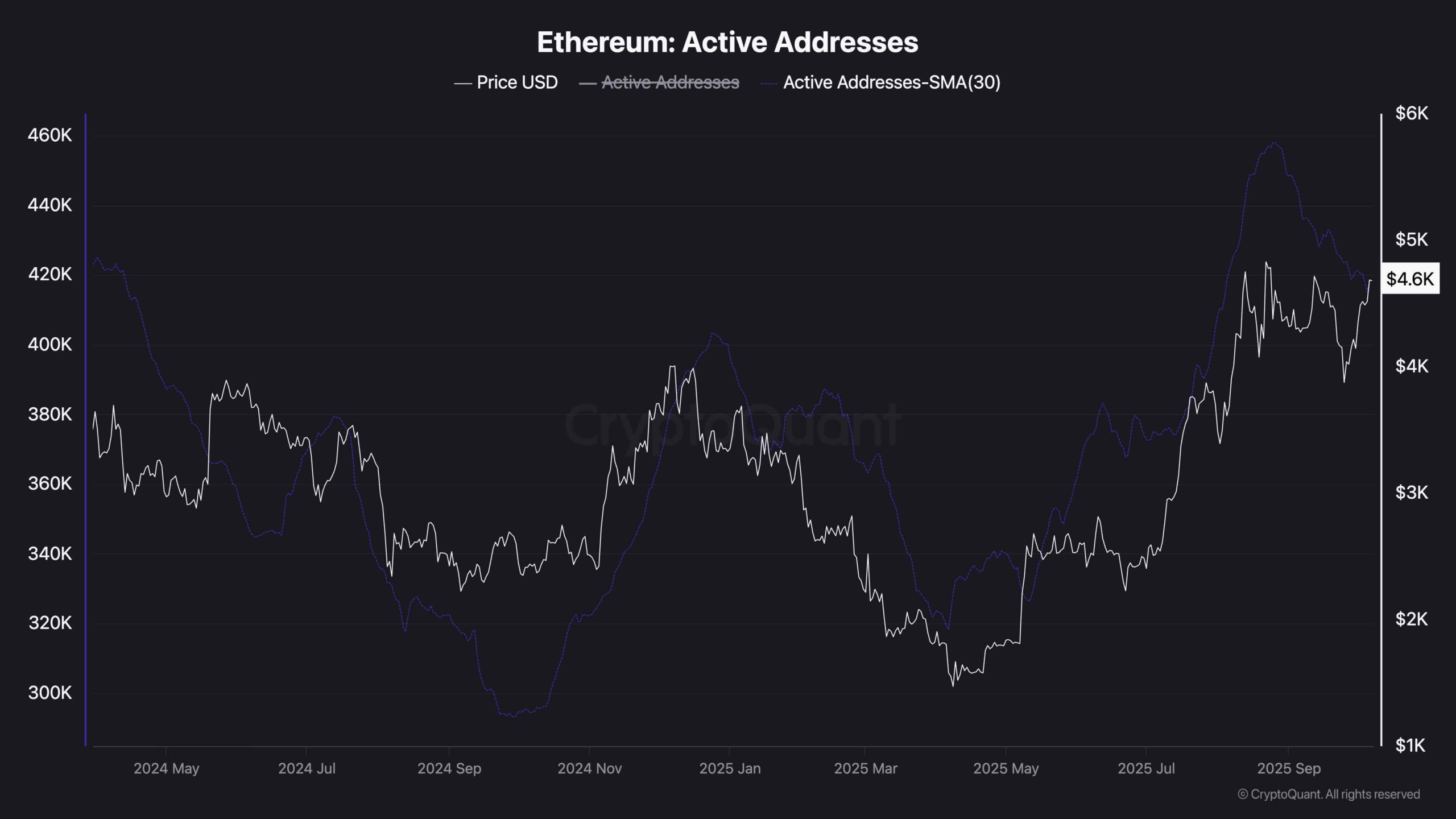

Whereas Ethereum value has rebounded strongly and appears poised to rise additional, on-chain exercise tells a barely completely different story. Regardless of rising costs, the variety of energetic addresses has decreased barely not too long ago. This means that there’s a short-term disconnect between community participation and market efficiency.

For this upward development to proceed, energetic addresses should rise together with value, supporting true person engagement and on-chain demand. The continued decline in exercise suggests weakening fundamentals and will make it troublesome for ETH to maintain momentum above the $4,700-$4,800 resistance zone.