The cryptocurrency market fell practically 4% on Monday, escalating issues over a surge in Ethereum (ETH) uncertainty. On-chain information reveals 1.18 million ETHs are queued for his or her withdrawal, the largest backlog in months.

The delay highlights the strain on the Ethereum Community. Staking normally takes 3-5 days. Present candidates can last as long as 40 days.

ETH stake surge ≠ gross sales strain

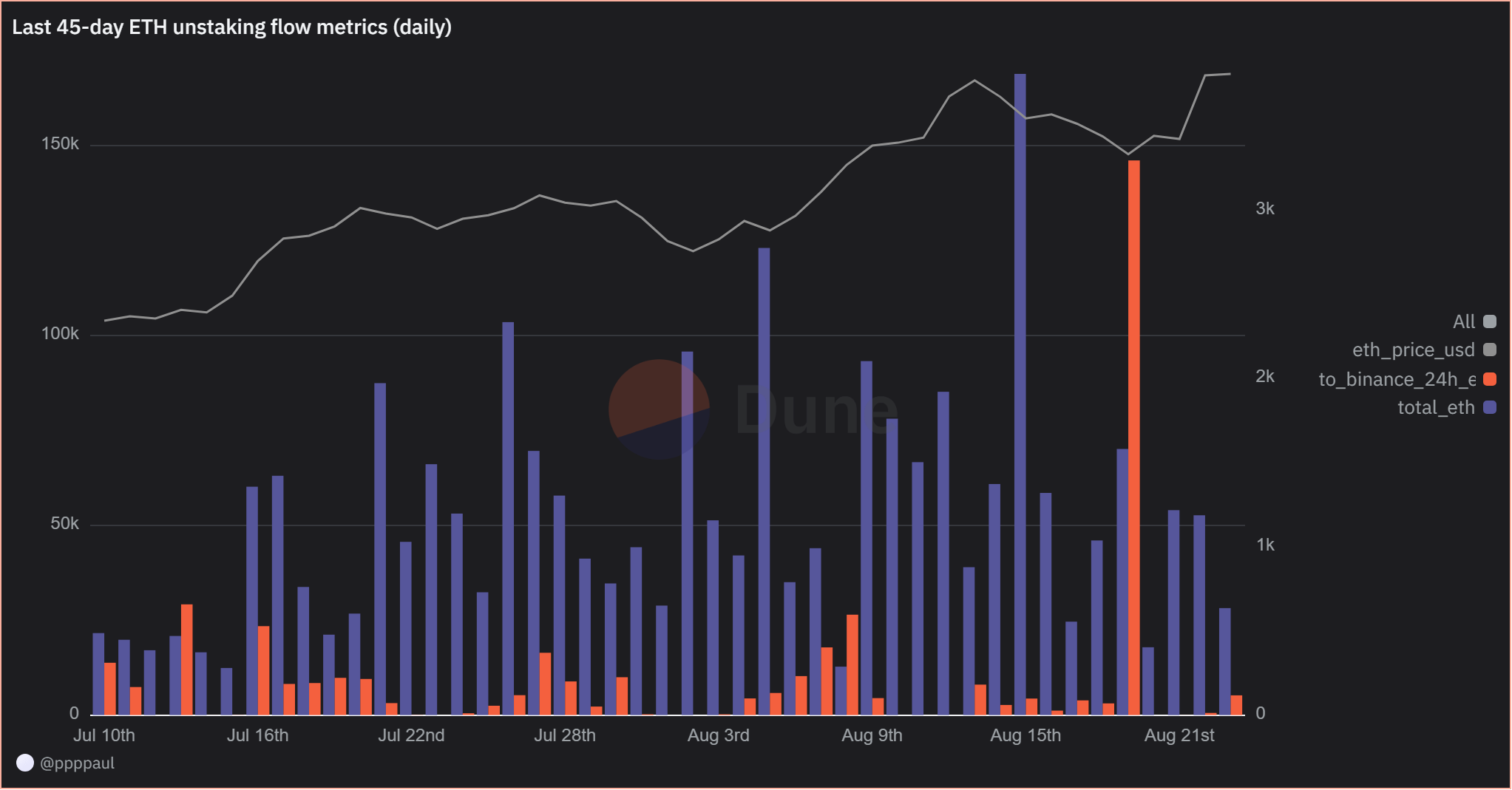

Staking doesn’t mechanically imply promoting. Many holders can preserve their ETH, ready for greater costs and debt alternatives. Information from Dune Analytics reveals that there isn’t a sturdy hyperlink between staking quantity and ETH value over the past 45 days.

Nonetheless, if withdrawn, ETH will transfer to exchanges and costs will usually proceed to say no.

(ETH staking circulate metrics for the final 45 days. Supply: Dune Analytics)

On August nineteenth, a big inflow into Binance coincided with a 5% ETH drop. That very same day, the Nasdaq fell 1.46% in worry of delays within the Federal Reserve cuts.

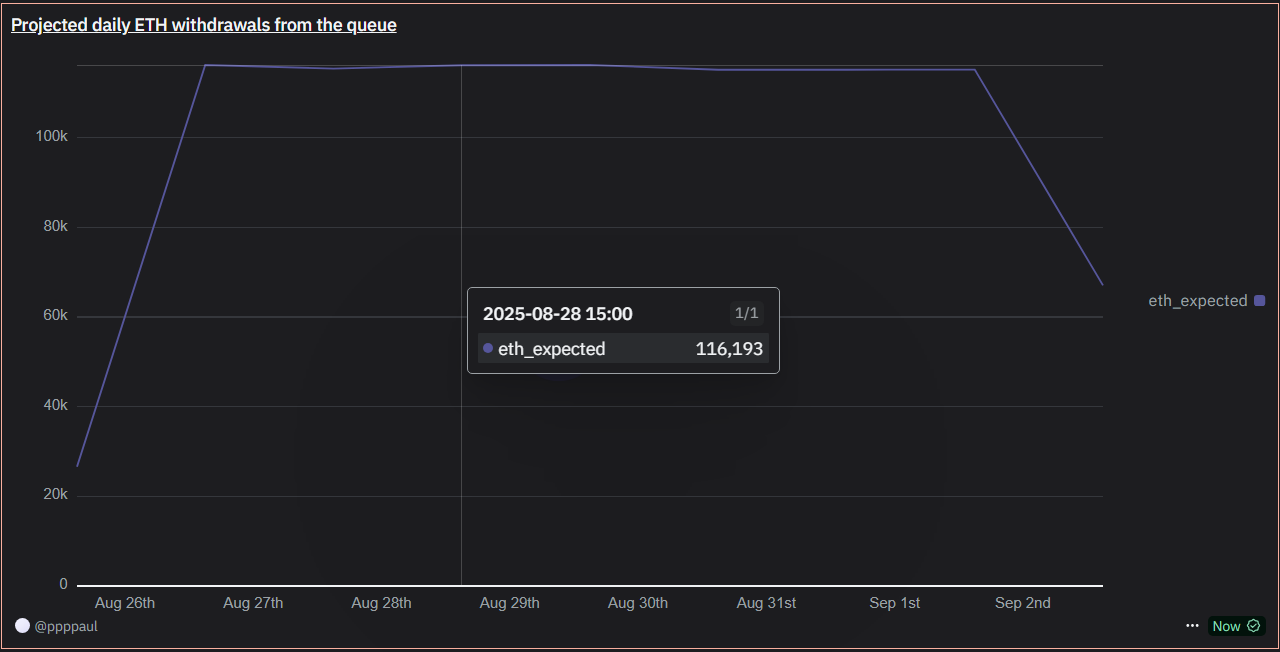

About 115,000 ETH will finish their staking each day this week, in accordance with on-chain information. At present costs it’s nearly $4,600, which is equal to $529 million a day.

This quantity provides uncertainty because the market stays delicate to macroeconomic modifications. Mixed with unfavorable information that’s not too heavy can drive sharp value fluctuations.

(Every day ETH withdrawal from queue is predicted

. Supply: Dune Analytics)

Some market voices declare that worry is exaggerated. Some buyers in contrast this case with Solana. Solana confronted related fears after her FTX-related uncertainty.

In the meantime, the encrypted information highlighted that the centralized trade ETH provide has fallen to a low worth. Solely the remaining 18.3 million ETH stays, decreasing instant gross sales strain.

The quantity of $eth on the trade is the bottom ever.

$18.3 million in ETH stays on the trade.

You need not full your diploma to grasp what’s going to occur. pic.twitter.com/ehscrrww5h

– Lark Davis (@thecryptolark) August 23, 2025

Whereas the circulate with out staking stays massive, its affect relies on the switch of exchanges and the broader financial state of affairs. Analysts warn that ETH withdrawals alone are unlikely to trigger sustained divestment with out exterior market shocks.

General, the document Ethereum staking backlog highlights a rise in investor exercise, however its affect available on the market stays unsure.

Though billions of ETH are set to launch, the trade circulate and international financial traits decide whether or not surges will in the end be transformed into gross sales strain or just replicate a mature community.

This publish does not spotlight Ethereum staking as Crypto’s market capitalization first appeared on Beincrypto.