CoreWeave’s transformation from a crypto miner to a large-scale AI infrastructure supplier highlights a broader shift in the best way computing assets are reused throughout know-how cycles.

In our newest e-newsletter, The Miner Magazine outlined how Ethereum’s transfer away from proof-of-work decreased the demand for GPU-based mining and began rising demand for computing, main corporations like CoreWeave to redeploy {hardware} in the direction of AI coaching and different high-performance computing workloads.

As beforehand reported by Cointelegraph, CoreWeave started its exit from crypto mining in 2019, first transferring to the cloud and high-performance computing, after which fully repositioning itself as a GPU infrastructure supplier for AI workloads.

Since then, this axis has been gaining momentum. Chipmaker Nvidia lately agreed to a $2 billion fairness funding in CoreWeave, a transfer that strengthens the corporate’s place as one of many largest impartial GPU infrastructure operators outdoors of main cloud suppliers, Miner Magazine mentioned.

CoreWeave’s development has additionally created vital liquidity for the corporate’s executives, who’ve made about $1.6 billion from inventory gross sales for the reason that firm’s preliminary public providing final March, Minor Magazine mentioned.

Coreweave (CRWV) inventory. Supply: Google Finance

Associated: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Stress, and Battle for Survival

From digital forex mining to AI knowledge facilities

The shift to AI workloads has confirmed worthwhile for a number of crypto miners, together with HIVE Digital, TeraWulf, Hut 8, and MARA Holdings.

Like CoreWeave, these corporations are repurposing vitality infrastructure and computing energy initially constructed for mining into knowledge facilities that assist AI and high-performance computing.

Nevertheless, AI knowledge facilities are beginning to face a number of the similar challenges that Bitcoin (BTC) miners encountered early on. As Cointelegraph lately reported, a number of areas with giant AI amenities are experiencing native opposition associated to energy consumption, grid pressure, and land use.

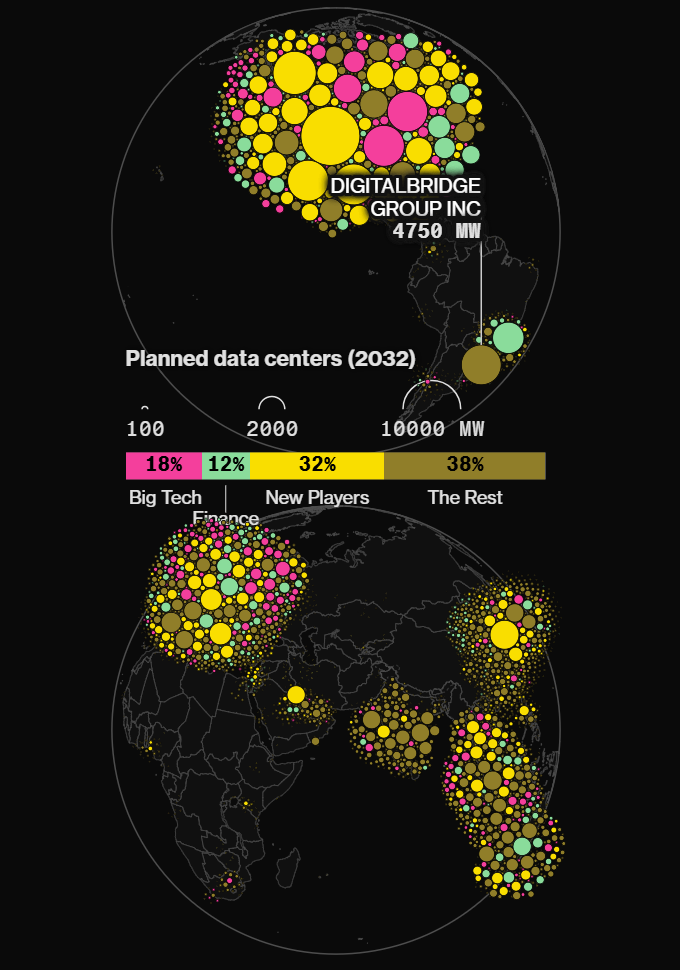

Nonetheless, the market stays fluid. Information cited by Bloomberg based mostly on analysis by DC Byte reveals that 1000’s of latest entrants are getting into the information middle enterprise. By 2032, Large Tech corporations may have lower than 18% of the world’s computing energy, suggesting a extra fragmented and aggressive market.

If this development holds, AI knowledge facilities may more and more function outdoors of the direct management of enormous know-how corporations, much like cryptocurrency mining earlier than them.

As new operators enter the market, AI knowledge facilities might grow to be much less concentrated amongst Large Tech corporations. sauce: bloomberg

Associated: What position stays for distributed GPU networks in AI?