Bitcoin (BTC) and the Cryptocurrency pose related dangers to secured debt obligations (CDOs), securitized baskets of mortgages, and different sorts of debt that brought about the 2007-2008 monetary disaster.

Crypto Treasury Corporations purchase Bearer Belongings with out threat of counterparty and introduces a number of dangers, together with firm administration capabilities, cybersecurity, and enterprise capacity to generate money stream. He added:

“For instance, there’s this side of individuals reclaiming fairly wholesome merchandise, mortgages from that point, and Bitcoin and different digital belongings at the moment.

Lupena advised CointeLegraph that whereas he would not count on cryptocurrency corporations to be answerable for the following bear market, the rise in corporations can “enhance” the market droop by means of compelled gross sales, it is too early to know what the precise impression will probably be.

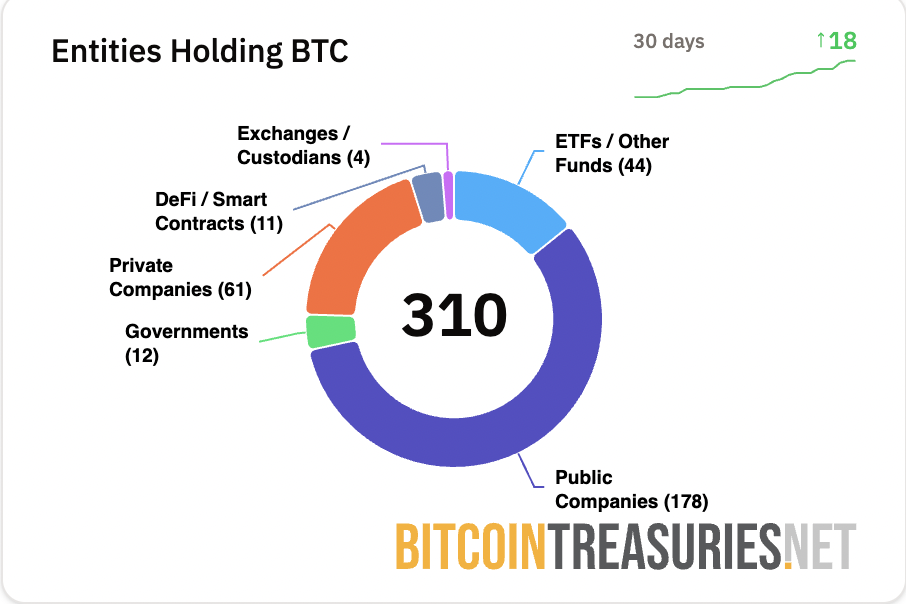

There are 178 public corporations with BTC on their steadiness sheets. sauce: Bitcoin Tray

A number of market analysts have issued warnings about the potential for being compelled to promote and inflicting contagion all through the market to shortly cowl the debt by dashing crypto costs.

Associated: Peter Tiall vs. Michael Saylor: Crypto Treasury bets or bubbles?

Corporations diversified into Altcoin Holdings, market traders cut up

Conventional monetary corporations have surpassed the Bitcoin monetary technique that has been popularized by BTC advocate Michael Saylor and diversified into Altcoin Treasuries.

In July and August, a number of corporations introduced Toncoin (TON), XRP (XRP), Dogecoin (Doge), and Solana (Sol) Company Treasury Methods.

Corporations that make use of cryptocurrency methods have a fancy impression on inventory costs as they reply to the expansion of corporations whose markets pivot in direction of digital belongings.

Well being and wellness drink maker Security Shot introduced in August it will undertake Bonk (Bonk) Memecoin as its principal reserve asset, sending out a stake within the firm that fell 50% within the information.

Equally, inventory costs of many Bitcoin finance corporations collapsed within the second half of 2025 as the sector grew to become more and more crowded.

journal: Koreans abandon Tesla for Ethereum Treasury Bit Mine: Asia Categorical