Though the cryptocurrency market struggled all through December, a small variety of institutional traders managed to finish the 12 months within the black.

New on-chain knowledge from analytics platform Nansen reveals that whereas costs stay below stress, a number of massive cryptocurrency funds generated thousands and thousands of {dollars} in realized positive aspects however turned to aggressive promoting because the month progressed.

Elite fund secures highest earnings even in market downturn

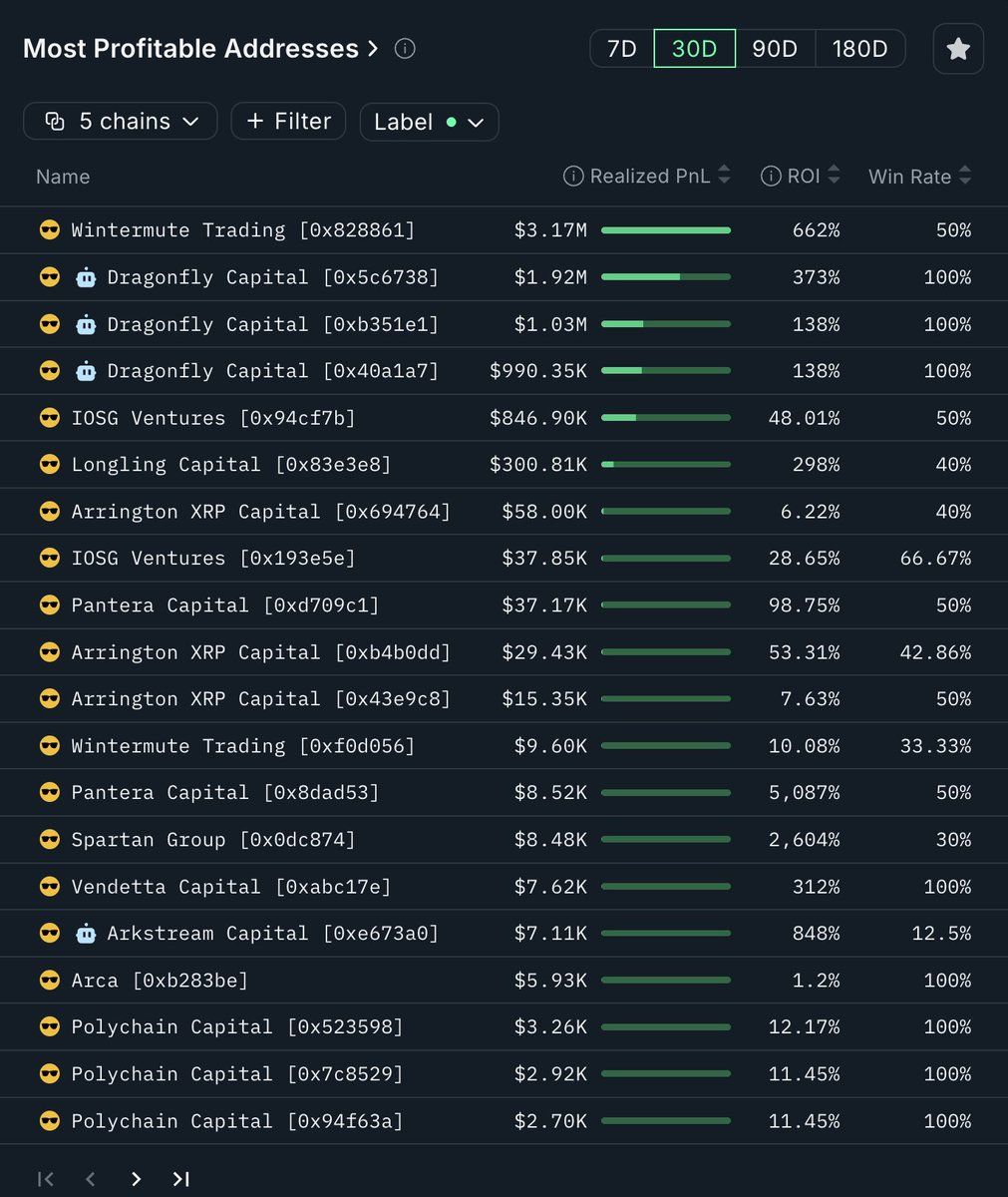

Market maker Wintermute emerged as probably the most worthwhile fund in December, posting realized positive aspects of about $3.17 million, Nansen mentioned.

Dragonfly Capital adopted swimsuit, with earnings unfold throughout a number of wallets totaling $1.9 million, $1 million, and $990,000.

IOSG and Longling Capital additionally ranked extremely. Taken collectively, these tendencies recommend that the positive aspects had been concentrated in a repeat group of extremely lively institutional merchants slightly than remoted one-off wallets.

“Income are concentrated in a small variety of repeat funds slightly than one-time wallets,” Nansen famous, highlighting how constant execution and lively commerce administration have remoted institutional winners from broader market downturns.

Arrington, Pantera, and Polychain are additionally included in Nansen’s 30-day dataset from 5 blockchain networks, every with various profitability.

In December 2025 revenue rating, Wintermute tops the record with $3.17 million, adopted by a number of Dragonfly Capital wallets. Nansen

December was a troublesome month for many crypto individuals as volatility elevated and sentiment weakened in the direction of the top of the 12 months.

Regardless of this background, Wintermute and Dragonfly Capital capitalized on the alternatives offered by short-term disruption and liquidity.

Their efficiency highlights the advantages of scale, refined buying and selling infrastructure, and multi-chain monitoring throughout instances of market stress.

Dragonfly’s technique is distinguished by its diversification throughout wallets, permitting the fund to seize upside in quite a lot of positions whereas diversifying threat.

Then again, Wintermute’s dominance displays its position as a serious liquidity supplier that may revenue from volatility slightly than undergo from it.

IOSG and Longling Capital additionally posted notable positive aspects, making them among the many most worthwhile funds of the month. Taken collectively, these knowledge spotlight the group’s resilience at a time when retail merchants had been barely struggling to remain afloat.

Aggressive profiteering shapes on-chain habits

However Nansen’s on-chain monitoring reveals that these similar worthwhile funds are actually leaning towards promoting slightly than accumulating.

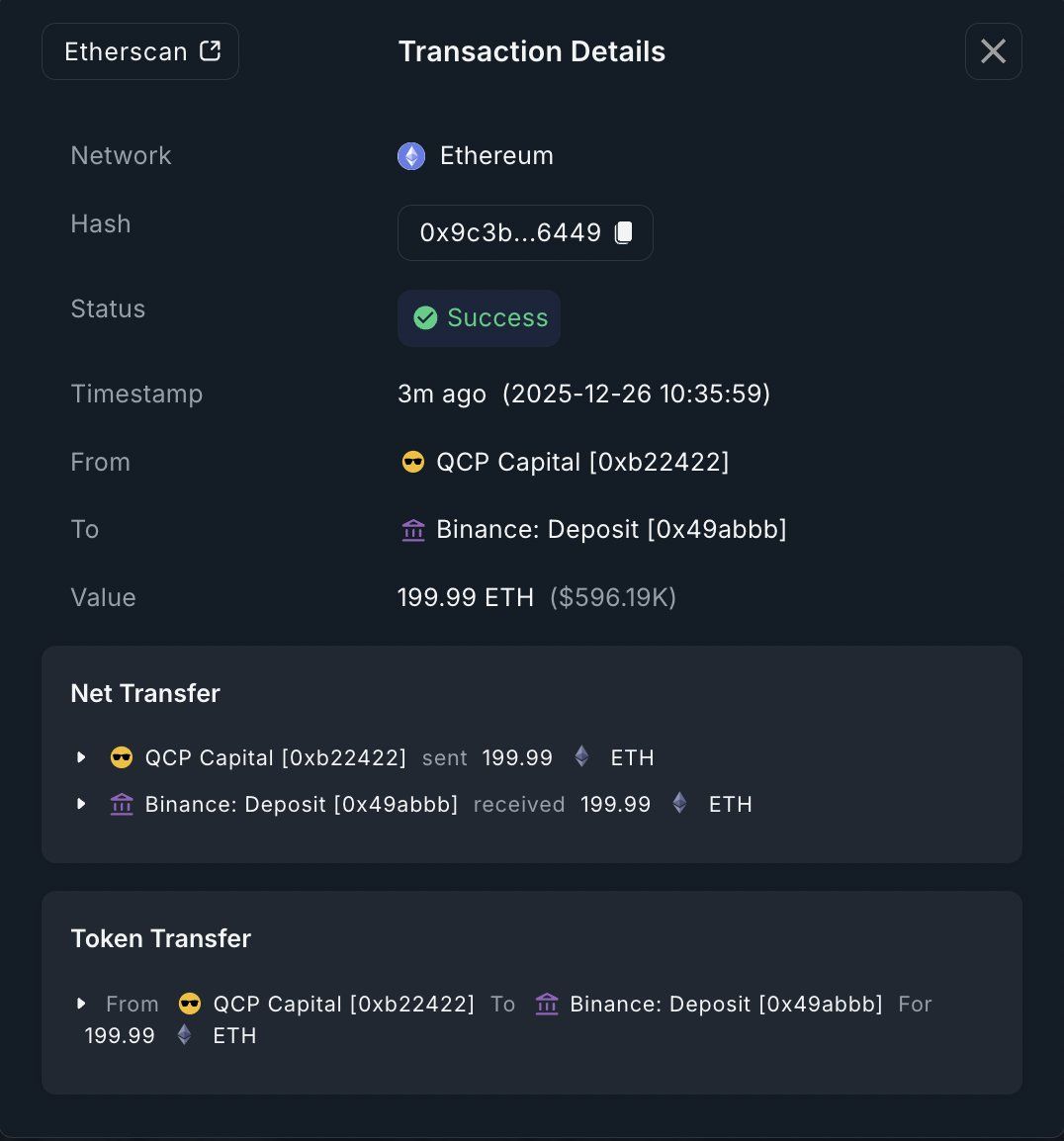

On December 26, QCP Capital deposited 199.99 ETH, price roughly $595,929, onto the Binance alternate, a transfer usually related to making ready property on the market.

QCP Capital transferred 199.99 ETH price $595,929 to Binance on December 26, 2025. Nansen

Wintermute can also be aggressive on the gross sales entrance. Social media commentary has accused the corporate of aggressively promoting Bitcoin and Ethereum throughout December’s volatility, however on-chain knowledge confirms that Wintermute diminished its publicity after constructing positions in the beginning of the month.

🚨 Breaking information:

WinterMute accumulates $BTC and $ETH price of property simply earlier than Christmas

They dumped over $125 million in BTC in a single minute, lowering it to $24,000.

That is pure Christmas manipulation!! https://t.co/hSbWI1Bl2R pic.twitter.com/MmQv1nBZql

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) December 25, 2025

This exercise is extra according to revenue taking and threat administration slightly than passive holding.

Dragonfly Capital equally diminished its place in Mantle (MNT). In seven days in December, the fund deposited 6 million MNT tokens price roughly $6.95 million into Bybit.

.@dragonfly_xyz (Dragonfly Capital) continues to deposit MNT to @Bybit_Official.

Prior to now 7 days, $6,000,000 (roughly $6.95 million) has already been transferred.

They nonetheless maintain 9.15 million tokens unfold throughout a number of wallets, price roughly $10.76 million. pic.twitter.com/3M2s5se9l6

— Nansen🧭 (@nansen_ai) December 21, 2025

Regardless of these gross sales, Dragonfly nonetheless holds 9.15 million MNT tokens (price roughly $10.76 million), suggesting a partial exit slightly than a whole exit.

The distinction between December’s stable positive aspects and rising promoting stress factors to a twin organizational technique.

- Reap the benefits of volatility when alternatives come up,

- Rapidly keep away from dangers in response to altering circumstances.

For skilled funds, year-end promoting might additionally replicate portfolio rebalancing, capital preservation, or preparation for brand new allocations in early 2026.

Continued promoting by top-performing funds might weigh on short-term markets, but it surely is also an indication of self-discipline slightly than bearish perception.

The article Crypto Funding Funds Achieve in December Regardless of General Market Weak point was first revealed on BeInCrypto.